Resource Nationalism and the Resilience of Critical Mineral Supply Chains

This report addresses challenges for the United States in securing supply chains for critical minerals, focusing especially on those most important for batteries.

Abstract

As trade policies and other US federal actions attempt to reshape global critical mineral markets, concerns about the resilience of supply chains for strategic civilian and military technologies will continue to assume a large role in policymaking. This report addresses the supply chain for lithium-ion batteries and evaluates the limits of resource nationalism, an approach to policymaking that entails greater government intervention in the resource economy, to bolster US mineral production and processing capacity. We first discuss recent executive actions, tariffs, and defense-led partnerships and then assess US lithium, cobalt, and nickel resources, as well as processing costs, considering potential electric vehicle demand through 2050. We conclude that the national interest is best served by structured international cooperation with selective domestic expansion, given fundamental resource availability constraints, long lead times for new mines, and the high costs of geographically diversifying processing capacity. This report presents cost estimations and weighs policy options for decisionmakers seeking to address Chinese market power in the material foundations of battery technology.

1. Concerns About Supply Chain Resilience

As policies affecting trade between the United States and China continue to be unpredictable, concerns abound about the resilience of supply chains for critical minerals. These raw material inputs are widely used in civilian and military technologies, and it is difficult to substitute other materials in the short to medium term. Fundamentally, a resilient supply chain implies a stable and affordable supply of these materials.

China holds a dominant position in the extraction or processing of many critical minerals, currently accounting for over 60 percent of global processing of cobalt, lithium, and manganese—three minerals that play a major role in batteries. China accounts for over 70 percent of global extraction of natural graphite, another important battery mineral (Spiller et al. 2023). For other critical minerals, the rare earths that play key roles in electromagnets, guidance systems, and other civilian and military technologies, China’s market share of extraction and refining is even more substantial.

One concern is that China could restrict physical availability of mineral supplies to the United States, as with the December 2024 announcement of restrictions on exports of several rare earths. Actions by other major producing nations also have impacted world markets. The Democratic Republic of Congo responded to a global cobalt oversupply by banning exports in February 2025 (Bedder 2025). As of April 2022, to grow its domestic processing industry, Indonesia prohibited nickel ore exports (Home 2024). However, Toman and Kannan (2025) argue that this is easier said than done in many cases, since it would require China to control the entire market allocation of a mineral to prevent US access through intermediaries. At present, intermediaries are selling restricted Chinese-origin antimony oxides into US markets from Thailand and Mexico (Parodi et al. 2025).

Another concern is that China could restrict exports of some critical minerals to all foreign buyers, as it has done in the past. Whether states intervene for geopolitical reasons or to exercise market power to increase economic returns, the result is higher costs that are difficult to avoid because substitution possibilities are limited. One consequence of such higher costs is a drag on the expansion of advanced manufacturing.

This report addresses challenges for the United States in securing supply chains for critical minerals, focusing especially on those most important for batteries. It reaches four main conclusions:

- Resources in the Unites States appear to be insufficient for the nation to meet the demands for several battery critical minerals related to electric vehicle production, let alone other demands. Identification of currently undiscovered resources could change that picture, and the effort being led by the United States Geological Survey (USGS) to improve knowledge of the mineral resource base is extremely valuable.

- Even if additional resources in the United States are discovered and domestic production is expanded, the national interest in resilient mineral supply chains is best served by also cultivating mineral supply contracts with other friendly and reliable countries.

- Concentration of critical mineral processing in China is the result of decades-long industrial policy. The risk of disruptively high prices for processed minerals could be reduced by geographic diversification of processing capacity as global demands for the minerals grow. However, the costs associated with such diversification would be substantial—implying a need for careful balancing of benefits and costs.

- Diversifying supplies of processed critical minerals depends on more than geographically diversifying processing capacities. The cost-competitiveness of alternative supply sources and the impacts of mineral price volatility also matter. Various policies, with associated costs, may be needed for new investments in processing capacities to be financially sustainable.

The paper proceeds as follows. Section 2 summarizes recent US policy developments affecting the resilience of supply chains for critical minerals. Section 3 evaluates the feasibility from a resource-availability perspective of onshoring sufficient battery mineral extraction to meet potential demands associated with domestic electric vehicle production for three key battery minerals deemed critical or near critical in the short term by the Department of Energy’s 2023 Critical Materials Assessment: lithium, cobalt, and nickel (Bauer et al. 2023).

In Section 4, we discuss the potential costs associated with the build-out of a US domestic processing sector for these key battery minerals. Section 5 concludes with a discussion of the advantages and limitations of policies that might be needed to maintain the resilience of the sector. Throughout this paper, we abstract from important environmental and social considerations related to mineral extraction and processing that would necessarily arise in connection with expanding domestic critical mineral production capacity.

2. Emerging Policies in the United States

The issue of supply chain resilience has been tackled by successive US presidential administrations dating back to the 2000s, when a global commodity boom put upward pressure on the prices of raw materials, and US officials, alarmed by the nation’s dependence on Chinese mining and processing capacity, began to investigate supply chains underpinning key technologies (Riofrancos 2023). Through recent policy announcements and direct federal investment, the Trump administration has detailed its own commitment to diversifying how the civilian and military sectors satisfy their mineral demands. The administration began its current term with executive orders aimed at increasing the domestic production and processing of critical minerals and even centered foreign mineral access on war diplomacy (Baskaran and Schwartz 2025; Dizolele 2025).

An executive order issued March 20, 2025, states, “It is imperative for our national security that the United States take immediate action to facilitate domestic mineral production to the maximum possible extent” by reducing regulatory barriers. See https://www.whitehouse.gov/presidential-actions/2025/03/immediate-measures-to-increase-american-mineral-production. An April 14 executive order asserts, “The dependence of the United States on imports [of critical minerals] and the vulnerability of our supply chains raises the potential for risks to national security, defense readiness, price stability, and economic prosperity and resilience.” See https://www.federalregister.gov/documents/2025/04/18/2025-06836/ensuring-national-security-and-economic-resilience-through-section-232-actions-on-processed-critical. In calling for a Section 232 investigation by the commerce secretary of those risks, the president has taken another step toward enacting future tariffs or other import restrictions on critical minerals.

In mid-July 2025, the US Department of Commerce intervened in the natural graphite market, imposing a tariff of 160 percent on Chinese graphite anode active material (Benchmark Source 2025). On July 30, the administration announced a 50 percent tariff on imports of copper products and copper-intensive products, with additional actions forthcoming (in 2027) to require that 25 percent of copper ores, scrap, and concentrates produced in the United States be sold domestically.

Also in July, the Department of Defense (DOD) entered into a partnership agreement with MP Materials for a vertically integrated operation from rare earth extraction to the production of magnets (MP Materials 2025). On September 5, 2025, the Trump administration issued an executive order initiating a process to rename the Department of Defense as the Department of War. In this text, we continue to refer to the agency as the Department of Defense, as an act of Congress has not yet codified this change. The arrangement includes equity investment by DOD; a guaranteed offtake agreement of 7,000 MT of rare earth magnets per year, just over 40 percent of the US demand for these materials in 2020 (Kannan et al. 2025); and a guaranteed price roughly twice the 2025 market price.

In August 2025, the US Department of Energy (DOE) announced nearly $1 billion in funding across four new initiatives focused on domestic production, improved by-product recovery, and commercialization of late-stage critical mineral processing technologies (McDonald et al. 2025). The Advanced Research Projects Agency–Energy, the DOE’s funding agency for high-risk, high-reward new research and development, is actively supporting new projects focused on enhancing the potential value of critical minerals from industrial and mining wastewaters (ARPA-E 2024). New research from Holley et al. (2025a) has underscored the potential of the United States to meet considerable mineral demands with by-product recovery, but the authors find that progress toward this end requires more process research before commercial adoption.

3. The US Lithium, Cobalt, and Nickel Resource Base

In 2024, the United States extracted roughly 2 percent of the world’s lithium and a mere 0.22 percent and 0.10 percent of nickel and cobalt, respectively (USGS 2025b; Conness 2024). Table 1 shows that the fraction of US economic reserves produced in 2024 was quite small. Current estimates of the US resource base for cobalt and nickel are too small for the country to rely on its own extraction for an extended period. Furthermore, Manalo (2025) finds that bringing new mines online in the United States can take roughly two decades, which tempers the prospect of rapidly increasing production—even if this timeline were shortened.

Table 1. 2025 US Mineral Economic Reserves and Percentage of Reserves in 2024 Domestic Production

Sources: Economic reserve and 2024 domestic production figures for selected minerals are from USGS (2025b) when available. Domestic 2024 production of lithium is from Conness (2024).

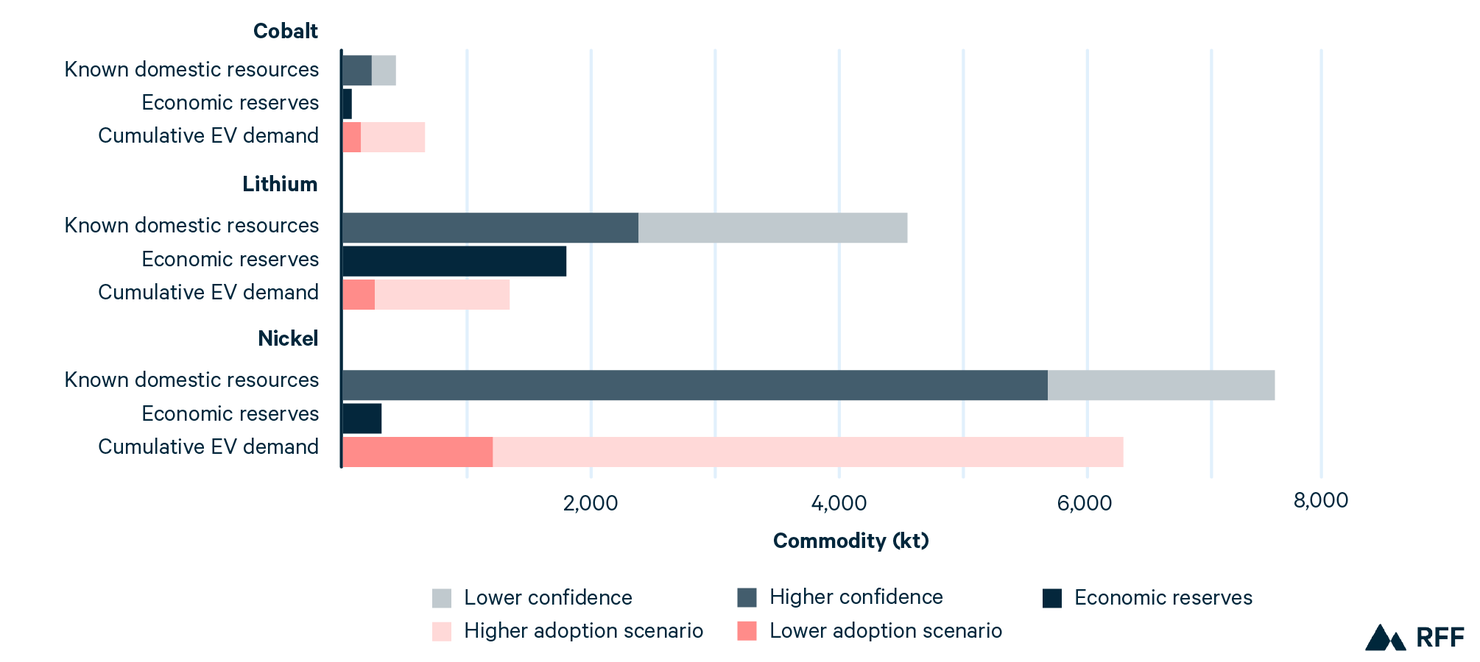

Figure 1 brings together recently published data on lithium, cobalt, and nickel resources in the United States with two projections of future demands for these minerals based solely on projections of electric vehicle production in the country. Manganese is another important mineral for battery production, but the USGS (2025a) maintains that the United States has essentially no known manganese resources of suitable extraction grade. We also exclude natural graphite, the remaining major battery mineral deemed critical in the short term by the DOE’s 2023 Critical Materials Assessment. The last updated USGS reserve base figures for graphite stood at a mere 1,000 megatons (MT) (USGS 2009). However, recent USGS data releases underscore the potential of the Alaskan Graphite Creek deposit, where production feasibility studies are ongoing and a new project entered the federal permitting process in July 2025 (USGS 2022; Elliott 2025). A recent prefeasibility study for Alaska’s Graphite Creek project projected roughly 50,000 MT of production per year (Alaska DNR, n.d.). This is still only part of total graphite demand for EV batteries in our high-demand scenario.

Figure 1. Domestic Mineral Resources and 2050 Cumulative Electric Vehicle (EV) Battery Mineral Demand

Sources: For data on the mineral deposits, Karl et al. (2019) for lithium; Burger et al. (2018) for cobalt; and Hammarstrom et al. (2024) with secondary data cleaning and analysis for nickel. For economic reserves, USGS (2025b). For stylized EV forecasts, Cox Automotive (2025), BEA (2025), and EIA (2025) for vehicle sales; and Shen et al. (2024), Li et al. (2024), Kresse et al. (2025), and Topsoe (n.d.) for vehicle mineral content. See Appendix A for more information.

Resources are classified based on geologists’ confidence in the existence and size of deposits. They become reserves when economic extraction is possible under current technical and market conditions. The boundary between the two is fluid, as it is subject to a complex of factors, including commodity prices, infrastructure, regulatory frameworks, political arrangements, and technological innovation. This is perhaps best demonstrated in recent American history by the “shale revolution,” when the combination of hydraulic fracturing and directional drilling transformed vast uneconomic hydrocarbon resources into commercially viable reserves.

For the purposes of this analysis, we focus on lithium, cobalt, and nickel resources at two confidence levels, distinguishing resources classified with mineral reporting codes, which have higher confidence, from those that are not so classified. We report resources in addition to economic reserves to allow for the possibility of some current resources to become reserves. We exclude inferred resources because they require continued exploration to upgrade to indicated or measured mineral resources. Only indicated and measured mineral resources may be converted to probable or proven reserves in a qualifying technical analysis of modifying factors such as mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental compliance, and community negotiation factors (17 CFR § 229.1302). We compare our figures for resources and reserves to two levels of cumulative mineral demands for electric vehicle production by 2050. The lower mineral demand scenario assumes that the market share of electric vehicles remains at the 2024 level, whereas the higher demand scenario assumes market share growth as projected by the US Energy Information Administration (EIA) in its Annual Energy Outlook 2025.

This exercise indicates that it is likely infeasible for onshore nickel and cobalt extraction to meet demands from EV battery production. Moreover, this comparison makes no allowance for other (non-EV) mineral requirements. To illustrate, Alonso et al. (2023) estimate that the 2018 total cobalt requirement by the United States, including both raw material consumption and the materials embedded in other products, was 29 metric kilotons (kt). The USGS reports that the nation imported 100 kt of primary nickel in 2024 (2025b). As we estimate the 2024 cobalt and nickel demand from electric vehicles alone to have been roughly 13 and 59 kt, respectively, onshoring primary extraction of these minerals to meet all demands is infeasible, at least in the absence of substantial new resource discoveries. That such discoveries are possible is illustrated by the experience of the oil industry, in which reserve replacement has kept pace with or exceeded domestic extraction. Nonetheless, at present, the potential for new mineral discoveries is unknown.

Figure 1 indicates that onshoring extraction to meet EV-related lithium demands, and potentially even other demands, could be more feasible. This depends in part on how much these demands grow over time. It also depends on the extent to which known lithium resources can be economically recoverable reserves.

There are some important caveats to this analysis. First, we do not account for potential by-product recovery or the discovery of new resources. Beyond improving the efficiency of primary extraction or expanding the resource base, battery material recycling has the potential to reduce primary mineral demand over the medium to longer term (see Nurdiawati and Agrawal 2022). As mentioned in Section 2, Holley et al. (2025a) find that a considerable share of US electric vehicle mineral demand could be met with improved by-product recovery, and research and development efforts are focused on this process. Additionally, increasing domestic mining to meet even a fraction of domestic demands would have environmental and social consequences, consideration of which is beyond the scope of this analysis. (For a discussion of the social dimensions of mining projects, see Spiller et al. 2025; for a review of impacts to ecosystem services, see Boldy et al. 2021).

Environmental and social trade-offs vary by different means of mineral extraction. Our analysis of USGS data shows that 1,250 kt, or almost 30 percent, of total reported lithium resources are contained within brines. This substantial base points toward the possibility of more production using the still-nascent method of direct lithium extraction (DLE), which avoids the environmental impacts that accompany large-scale evaporation pools or hard-rock mining operations (Stower 2023). However, important questions remain regarding the water intensity of DLE methods, a common concern among affected communities, with policy dimensions detailed in McBride et al. (2025).

4. Costs of Geographically Diversifying Mineral Processing Capacity

As of 2024, the United States produces less than 3 percent of globally refined lithium and does not have capacity to produce refined cobalt or nickel from primary ores (USGS 2025b; Conness 2024). China is currently responsible for high percentages of global processing of battery minerals, including cobalt, lithium, and nickel, in Indonesia. A recent estimate tallies Chinese overseas investment in battery materials at $62 billion by the first half of 2025, with most of the new investment having occurred since 2022 (Xue and Larsen 2025). Concerns about market stability and the threat of market power point to a need for geographic diversification of mineral processing as the markets for minerals expand. However, such diversification involves significant investment costs.

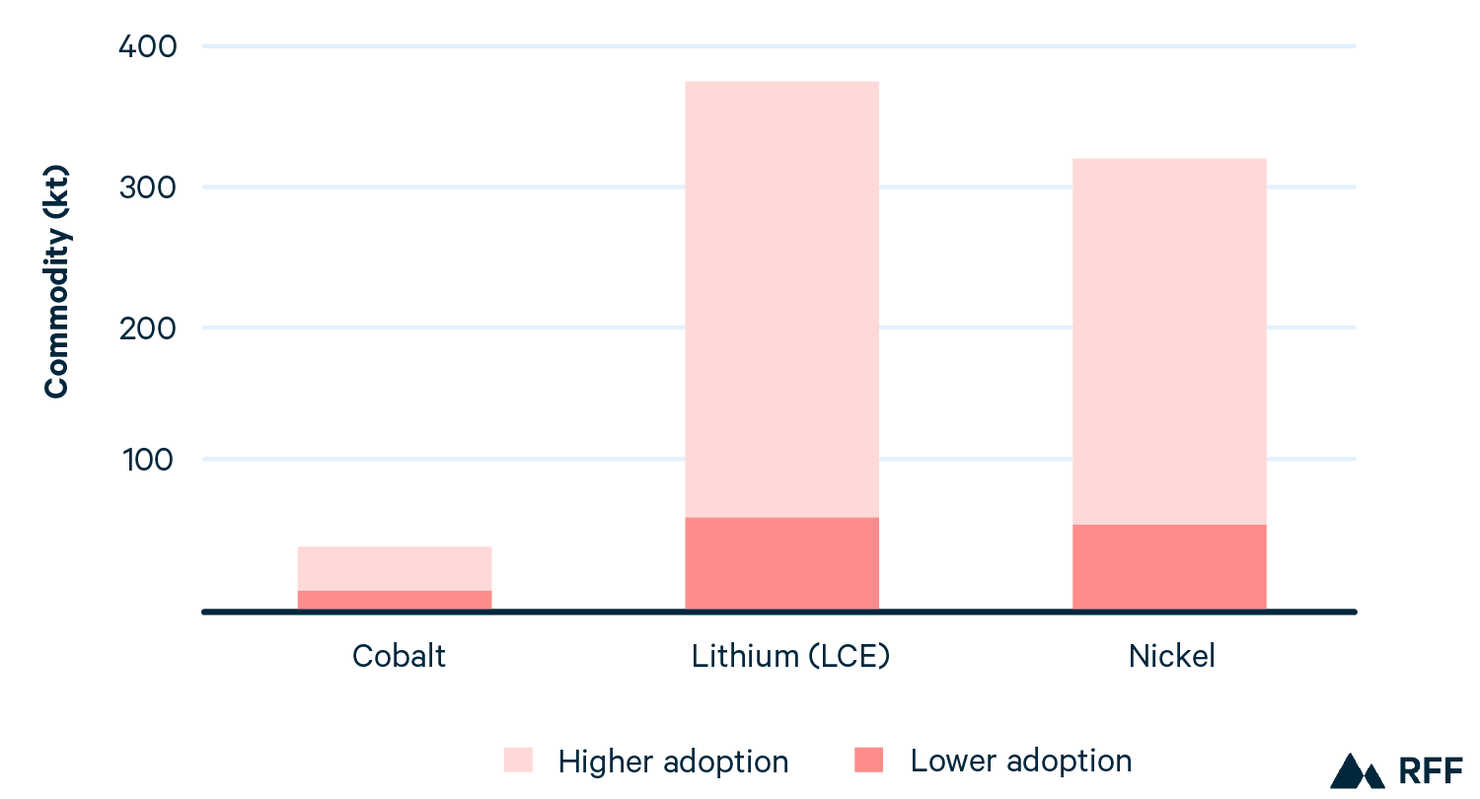

To illustrate the magnitude of these costs, we provide rough estimates of investments necessary to process in the United States all the cobalt, nickel, and lithium needed to meet the projections of demands for those minerals in EV batteries, as shown in Figure 1. For each mineral, we break down the cumulative demand forecast and report the cost of processing the peak demand per annum over the 2024–2050 period. Because our forecast accounts for changing battery chemistries and electric vehicle sales, peak demand estimations represented in Figure 2 do not automatically correspond to 2050 levels of EV adoption. We also provide rough estimates of unit operating costs for processing minerals.

Figure 2. Peak Demand per Annum from the US Electric Vehicle Market

Sources: Authors’ projection based on EV demand data from Cox Automotive (2025), BEA (2025), and EIA (2025) and vehicle mineral content from Shen et al. (2024), Li et al. (2024), Kresse et al. (2025), and Topsoe (n.d.). See Appendix A for more information.

Note: Lithium demands are converted from kt of metal into kt of lithium carbonate equivalent (LCE), the industry standard for expressing extraction and processing costs.

4.1. Nickel

The cost of processing nickel depends on several factors, including the type of ore deposit, technology deployed, and scale. Identified resources for nickel in the United States are dominated by magmatic sulfide occurrences. Sulfide concentrates recovered from such deposits are typically smelted and refined using hydrometallurgical processing, which is different from the high-pressure acid leach technique largely employed in Indonesia for nickel laterite ores. The United States does not have any operating nickel refineries, but based on typical nickel refineries using hydrometallurgical refining in countries such as Canada, we estimate an average unit processing cost of around $5,500 to $7,000 per metric ton of refined nickel net of by-product credits (Yao 2022; Ribeiro et al. 2021). These costs could vary depending on the grade of individual deposits.

A ballpark estimate of typical Capex costs associated with constructing a nickel refinery using the hydrometallurgical process with a capacity of 50 kt per annum is around $4.25 billion (CBC 2013). We project that nickel demand from US EV adoption peaks at 60 kt per annum in the lower adoption scenario and 320 kt in the higher adoption scenario (see Figure 2). This translates roughly to constructing one refinery with 60 kt per annum capacity with an associated Capex on the order of approximately $5 billion to $6 billion to meet the demand for the lower adoption scenario. The higher adoption scenario would necessitate the construction of seven refineries with 50 kt per annum capacity each, with Capex requirements on the order of $30 billion to $40 billion. Capex can be reduced by increasing the scale of each individual refinery to some degree; nevertheless, going from no nickel refineries to seven refineries is ambitious. It is important to note that the number of refineries required and their associated costs would be significantly higher if we considered other domestic demands for nickel in addition to EVs.

4.2. Cobalt

US cobalt resources are largely located in Idaho, Minnesota, and Michigan. The United States does not have the capability at present to refine cobalt from cobalt-copper-containing ores in Idaho, given the nature of the ore and its concentrations of arsenic and pyrite. In Minnesota and Michigan, cobalt occurs as a by-product in copper-nickel ores, requiring refinery facilities for copper and nickel with the ability to viably recover low grades of cobalt. Construction of refineries using the hydrometallurgical process may be needed to refine cobalt domestically. Such refineries are typically capital-intensive, as discussed in Section 4.1 (Holley et al. 2025b). Unit processing costs for cobalt are heavily dependent on various factors, such as the feed source and the process adopted for refining. Moreover, as cobalt is a by-product in copper and nickel refining, the cost of processing is dependent on copper and nickel refining costs. Unit operating costs for refining cobalt are estimated to be in the range of $1,500 to $6,000 per metric ton of cobalt, depending on coproduct credits for refining copper or nickel (Yao 2023; GCC 2020).

The Capex costs associated with refinery construction discussed for nickel would apply to cobalt as well, if the hydrometallurgical process is used. Common facilities to refine both cobalt and nickel to the extent possible based on cobalt-nickel ore availability can reduce overall Capex costs.

Our projection of US EV demand for cobalt peaks at 13 kt per annum in the lower adoption scenario and 44 kt in the higher adoption scenario (see Figure 2). This translates to constructing one refinery of 50 kt capacity using the hydrometallurgical process with around $4 billion to $5 billion investment to meet the higher adoption scenario demand. Again, it would be higher if meeting other domestic demands for refined cobalt were considered. In terms of supplies in the United States to meet cobalt demand, the constraint lies mainly in the lack of availability of domestic resources.

4.3. Lithium

The United States has resources of various types of lithium deposits, including brine, hard-rock, and unconventional deposits such as clay, geothermal brine, and oil-field brine. Including Capex, overall unit costs for producing refined lithium (as lithium carbonate) in the United States from domestic brine and hard-rock deposits, employing existing technologies, are estimated to be in the range of $4,500 to $7,500 per metric ton of lithium carbonate equivalent (LCE) (Fleming et al. 2024). The costs vary depending on the grade of individual deposits.

Our projection of annual US EV demand for lithium peaks at 65 kt LCE in the lower adoption scenario and 375 kt LCE in the higher adoption scenario (see Figure 2). Based on previous feasibility studies, we estimate that Capex needs to be in the $2 billion to $5 billion range to meet the lithium demand for the lower adoption scenario and in the $10 billion to $25 billion range for the higher adoption scenario (S&P 2022; Tharayil 2023). While EV batteries use both lithium carbonate and lithium hydroxide, producing refined lithium as lithium hydroxide is generally more capital-intensive than producing it as lithium carbonate.

5. Potential Policy Instruments

The key takeaway from the analysis in Section 3 is that from a resource availability perspective, the United States needs to shore up trade in extracted minerals with friendly and reliable foreign partners regardless of what is done to build up extractive capacity at home. The analysis also suggests a high social value of new information about mineral holdings from the current initiative of the USGS to maintain the “primary source of scientific information about the full life cycle and supply chains of minerals resources” (USGS, n.d.). The Energy Act of 2020 directed the USGS to revamp its national assessments of critical minerals to encourage domestic exploration and production where practicable (Rowan 2025).

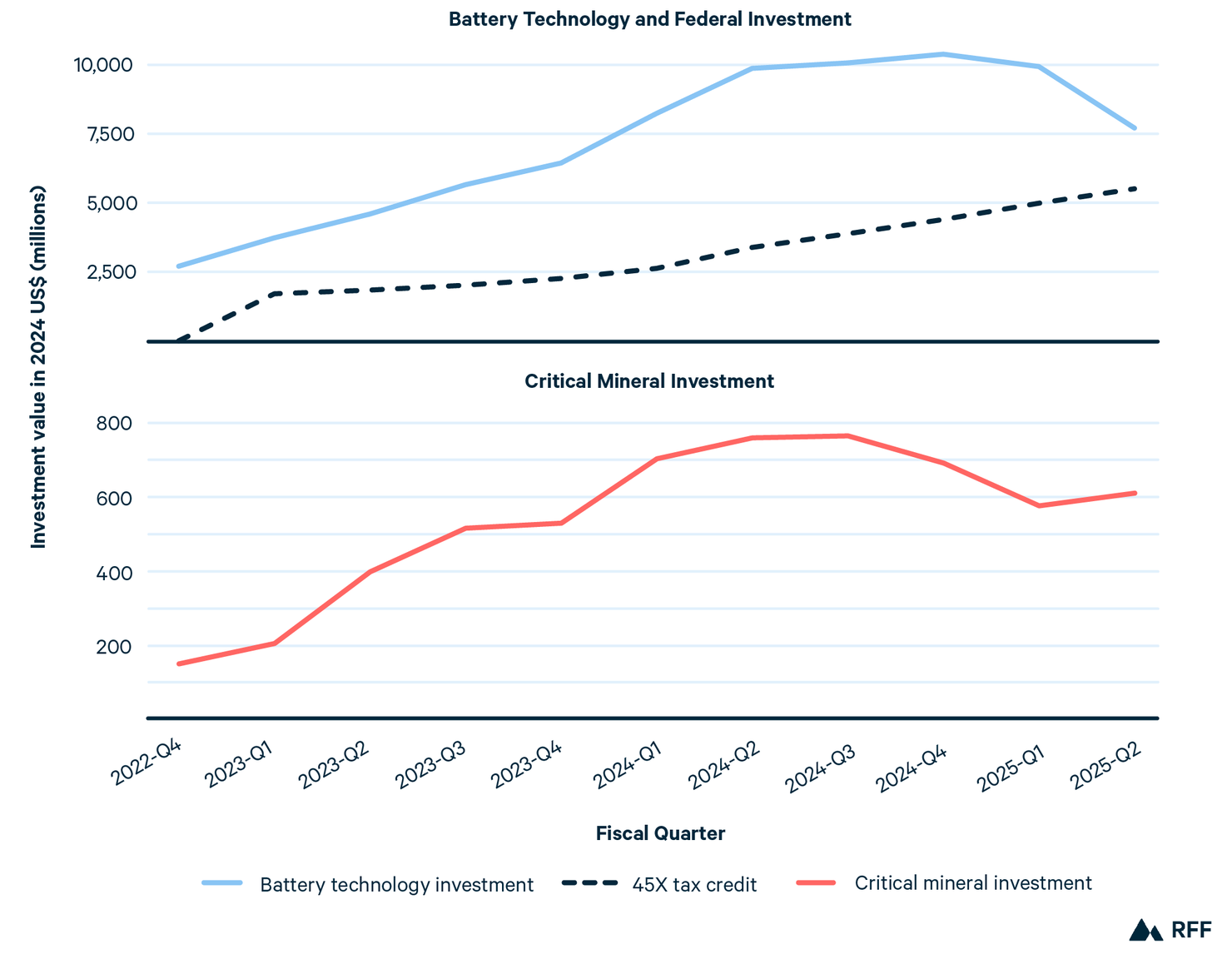

5.1. Revisiting Demand-pull Policy

Figure 3 shows the levels of total investment in the domestic critical minerals and battery production sectors, along with federal government investment in these industries through the Advanced Manufacturing Production Credit (45X) from late 2022 until the beginning of 2025. A notable part of this growth stemmed from tax incentives related to EV production and purchase. In recent years, new critical mineral projects were justified on the basis of offtake agreements between automotive manufacturers and domestic mineral extraction companies. General Motors (GM), for example, made a $650 million equity investment in Lithium Americas, receiving exclusive access to Phase 1 production from a new mine in Thacker Pass, Nevada (GM 2023). This deal would have supported GM’s eligibility for consumer tax incentives for domestically produced electric vehicles.

Figure 3. Recent Battery, Critical Mineral, and Advanced Manufacturing Investments

Source: Rhodium Group and CEEPR (2025).

Note: Investment figures for battery technology include companies involved in the fabrication of electrode active materials, cells, and modules. Critical mineral investments represented cover a range of minerals, including lithium carbonate, cobalt, nickel, graphite, and rare earth metals.

The Trump administration has canceled those policies and turned its attention to policies for augmenting mineral supplies, including import tariffs, deregulation, and direct federal investment through the DOD. However, one consequence of shifting policy away from the consumer market is that it undercuts the DOD’s strategy of diversifying its mineral demands, which are fragmented across an immense network of globalized supply chains (GAO 2024). Lithium-ion batteries are an integral component in a variety of defense technologies, from compact devices like those found in communications for dismounted soldiers and missile systems such as the Switchblade to large-scale energy storage systems for bases (Colthorpe 2018; Shields 2023; Amprius 2023). These batteries require nickel as well, which is also used in shipbuilding and in superalloys for aircraft (Bogdan and Radosław 2021). Khan et al. (2024) provide a list of 12 critical minerals of high priority for economic and defense purposes. The DOD saw that a low-cost approach to consolidating some of these supply chains would be to rely on domestically sourced minerals mined for battery components, adding the relatively limited quantities demanded by the military to rising domestic civilian demands (DOD 2022).

5.2. Striking Deals with Friendly Countries

Several options are available to shore up trade in extracted minerals with friendly and reliable foreign partners. The Mineral Security Partnership (MSP), started in 2022, is an international cooperation mechanism for expanding mineral supply diversification and trade (Soo Cho and Nakano 2025). Much of the focus of the MSP has been on promoting business and policy transparency in mineral-rich developing countries, including policies in support of environmentally and socially sound mining practices. However, the MSP Finance Network, established in 2024, incorporates multilateral development finance institutions and national-level institutions for trade finance with the aim of expanding financial resources available for sustainable mining (DOS 2024).

While these institutional developments resulted from actions taken during the Biden administration, the MSP remains a valuable framework for coordinating and enabling diversification of mineral extraction and more. In particular, Baskaran (2025) argues that MSP membership could provide a basis for multilateral efforts to respond to Chinese market power in mineral extraction and processing, as discussed further in Section 5.4.

Countries also can act unilaterally, though this entails a smaller scale of global diversification. For example, in 2010, prices of some rare earths increased significantly out of fear that China was restricting its supplies because of an unrelated dispute with Japan. Japan contracted with Australia for additional extraction of these materials, established an agreement with Malaysia for new processing capacity, promoted mineral recycling, and funded research into rare earth alternatives. Over the past decade, Japanese dependence on Chinese rare earths fell from 90 to 60 percent, providing both a case study of the rate at which diversification may be achieved and a cautionary example (Terazawa 2023).

5.3. Partnering with the Private Sector

Another option to shore up mineral extraction and processing arrangements involves public-private partnerships. Baskaran (2024) outlines how minority ownership by the US government in a US mineral extraction company provides diplomatic leverage for the company in establishing mineral extraction agreements with other countries. She also argues that government equity investment provides a pathway for needed capital and reduces offtake risks. This is illustrated by the partnership between the Defense Department and MP Materials (see Kannan et al. 2025). Moerenhout (2025) writes that the intervention may have been justified by the importance of rare earths for defense, Chinese export controls, and the small size of the market.

Great care is needed to establish objective performance criteria in such arrangements to ensure efficiency. This is especially difficult when the enterprise involves novel technologies that have a limited performance record (e.g., magnet fabrication vis-à-vis mineral extraction).

Achieving the level of market transformation envisaged in the deal with MP Materials for other minerals would be costly. The MP materials deal considers neodymium-praseodymium (NdPr) content right from raw material extracted to NdPr in magnet fabrication. The scale of the US annual cobalt requirement is nearly double that of rare earth magnets, and the DOD’s lithium requirements are met through a fractured set of supply chains owing to the many uses of lithium-ion batteries (Alonso et al. 2023; Kannan et al. 2025; Shields 2023). The scale of US nickel demand is roughly an order of magnitude larger (USGS 2025b). These observations underscore the inherent limitation of the government to make deals on a producer-by-producer basis to diversify all critical mineral supply chains consolidated by China.

5.4. Countering China’s Cost Advantage

Countering the risks of China exercising market power because of its large market shares in global mineral processing implies the need to geographically diversify processing capacity. For this purpose, new capacity does not have to be installed in the United States, if the capacity is installed in friendly and reliable foreign partners with whom the United States can establish secure trading relationships. In any event, a substantial investment flow must be channeled to that purpose, as shown in Section 4.

As detailed by Toman and Kannan (2025), the most relevant future risk is not that China might make materials unavailable selectively to some countries, but that it might restrict exports of materials such that prices rise to disruptively high levels. Moreover, it would have control over how long such restrictions exist, given its dominance in many critical mineral markets. However, if China were to restrict exports to keep prices too high for many processed minerals, and for too long, it would trigger significant investment in new processing capacity (and for graphite and rare earths, new extraction capacity) in other countries to counter its market power (Nguemgaing et al. 2025). The risk of disruptively high Chinese export prices for critical minerals is difficult to gauge quantitatively, but it must be compared with the significant investment cost for diversifying global processing capacity. Note that such diversification does not require that collaborating mineral-importing countries try to meet their requirements without any imports from China. It requires only enough diversification of available capacity to limit China’s potential exercise of market power.

Investment in global diversification of processing capacity also must confront the possibility that the new capacity initially will not be cost-competitive with Chinese mineral processing. If China has at least a temporary cost advantage, the United States and other countries investing in geographically diversified processing capacity will need to protect their new mineral processing capacities. This would need to be done in a coordinated fashion among those countries seeking to compete with China in mineral processing (Allan 2025; Baskaran 2025; Reuters 2025). Actions by most individual countries will have limited effects, given the scale of their mineral demands relative to the entire market.

Governments in countries hosting new processing capacity could, in principle, extend output subsidies. An alternative is investment subsidies, including those provided by the DOE Loan Program Office. However, that raises the question of a company’s incentives to efficiently configure its capital stock. With output subsidies pegged to a specific price, companies that more efficiently configure capital investments make more money, so there is an incentive to invest more efficiently. However, the populations of those countries then would be paying this “security premium,” while the benefits would accrue to all the customers of the new facilities. An alternative is a variable import tariff to directly protect fledgling mineral processors by establishing a floor price for their production, combined with agreements among other countries buying minerals to patronize allied capacity through, for example, content rules. The downside is that this protection would weaken incentives for minimizing costs among providers of the new capacity.

5.5. Acknowledging the Constraints

There are legal challenges to pursuing protectionist policies. In principle, a coalition of countries seeking to support their own mineral processing industries would face a burden of proof in terms of World Trade Organization (WTO) rules limiting discriminatory trade policies or preferential financing for domestic production capacity (see Wauters and Hertel 2024). However, the proliferation of US and other countries’ tariffs over the past decade highlights the weakness of the WTO.

An alternative approach is not to invest so extensively in geographically diversifying new processing capacity, but rather to use threats of nonmineral trade sanctions to deter the exercise of market power by China. Part of the challenge in this case is the difficulty in obtaining information that establishes discriminatory trade practices. The broader challenge in any application of this approach is to ensure that the harm to the United States and other mineral-importing countries’ economic interests from the trade sanctions is not larger than the harm from the exercise of market power in minerals processing.

Furthermore, US-led protectionist policies must confront the reality that the choice to align with the United States may not be in the interest of mineral producers, given that China has already consolidated leadership in many technologies that demand these minerals (Allan 2025; Reuters 2025). China’s edge in critical minerals cannot be explained exclusively by state support of the mineral extraction and processing sector; it also reflects a decades-long industrial policy that promoted electric vehicle adoption. Beijing extended subsidies to consumers, dramatically expanded the country’s charging network, and required foreign companies to enter into joint ventures with domestic automotive manufacturers, though these restrictions were lifted by 2022 (Boullenois et al. 2025).

Moreover, a resilient supply chain can depend on the scale of domestic demand as well as supply. For example, electric vehicles and wind turbines require the same specialized magnets as ship propulsion systems and guided missile actuators (Keeler 2022). The Department of Commerce has argued that securing the minerals used in these magnets for the long term necessitates a “substantial and consistent commercial demand [with] a broad customer base.” 88 Fed. Reg. 30 (Feb. 14, 2023). https://www.govinfo.gov/content/pkg/FR-2023-02-14/pdf/2023-03078.pdf. Finally, the necessary scale of processing capacity diversification depends on potential changes in future mineral demands due to innovation, such as the emergence of the lithium iron phosphate (LFP) battery, which requires no cobalt.

6. Conclusions

Supply chain resilience strategies will differ among critical minerals, given their unique geoeconomics and the urgency of their availability. One cross-cutting message, however, is that for geological and economic reasons, it is not in the national interest of the United States to go it alone. Beyond idiosyncratic deals, the United States needs a concerted strategy of international cooperation with friendly and stable partners—including buyers and suppliers of critical minerals—to strengthen and increase the resilience of its supply chains. The necessary cooperation will include support for diversification of mineral extraction and agreements for sharing the costs and risks of expanding processing capacity. The expansion of domestic extraction and processing would occur parallel to these efforts, sustained by policies that complement cooperation between friendly partners.

The concentration of critical mineral supply by China is a result of a decades-long industrial policy that coordinated investment across the entire supply chain of key consumer technologies. As demonstrated by our analysis, the costs of geographically diversifying processing capability will be high, and the current market is plagued by price volatility, oversupply, and demand uncertainty. Given these dynamics, the domestic mineral industry would benefit from government policies that signal a stable demand for their products. A policy that promotes the vertical integration of mineral producers with automotive manufacturers, for instance, would both onshore critical mineral capabilities and strengthen US automakers’ competitiveness in the European market, where regulations driving EV adoption are in effect.

Finally, any policy aimed at expanding domestic critical mineral extraction and processing capacity will give rise to significant environmental and social impacts, which complicated the revitalization of the sector during the Biden administration (Johnson 2023; Mohr 2022; Searcey 2023). Reducing demand for primary extraction through by-product recovery and material recycling warrants continued support for innovation, and to that end, it is encouraging that the DOE remains committed to investing in demonstration facilities. Meeting future demands while geographically diversifying production will undoubtably require new primary extraction and processing capabilities, however. The high costs of establishing such capabilities, even ignoring the fundamental resource availability constraints, indicates the United States is best served by a strategy of international cooperation.