Energy-as-a-Service: A Business Model for Expanding Deployment of Low-Carbon Technologies

An exploration of how the Energy-as-a-Service model has benefited consumers by promoting advanced technology and its potential for expanding the deployment of low-carbon technologies.

Summary

Energy-as-a-service (EaaS) is a business model whereby customers pay for an energy service without having to make any upfront capital investment. EaaS models usually take the form of a subscription for electrical devices owned by a service company or management of energy usage to deliver the desired energy service. This issue brief explores how the EaaS model has benefited consumers by promoting advanced technology and its potential for expanding the deployment of low-carbon technologies.

The Low-Carbon Technology Deployment Challenge

Energy is used across many sectors, including for electricity generation, transportation, and for various needs in residential and commercial buildings. Most existing energy technologies burn fossil fuels and emit carbon dioxide. To meet the emissions targets necessary to avoid the most severe impacts of climate change, low and zero-carbon technologies must replace current methods of energy production and use by consumers.

Low-carbon energy technologies exist but have faced barriers to widespread adoption. Policies that address the environmental externalities of energy use, such as a carbon tax or a cap-and-trade program for carbon emissions, can help encourage the deployment of low-carbon technologies. However, even with a climate policy in place, other market barriers—high upfront technology costs, capital constraints for consumers, information barriers, and uncertainty about a technology’s performance—can still prevent widespread adoption (Iyer et al. 2015). Consequently, additional measures may be necessary to increase market adoption of low-carbon technologies. One possible solution is the energy-as-a-service model.

What Is Energy-as-a-Service?

In recent decades, service-based business models have gained popularity across a wide variety of traditionally product-based industries, ranging from video streaming to regular wardrobe updates. The model typically involves a subscription-based service: the customer can enjoy the benefits of a product without purchasing it outright or directly managing its use. Service-based business models can provide producers with steady revenue streams (McCarthy and Fader 2017) while benefiting customers through increased product value and accessibility through financing (Tauqeer and Bang 2019).

In the electricity sector, service business models, typically referred to as energy-as-a-service, provide the customer with energy services, such as lighting, in exchange for a recurring fee. The customer benefits from avoiding direct electricity payments, expensive upgrades for electrical equipment or software, or device management while still benefiting from the use of the device. Similar to service models in other sectors, EaaS can make better technology (such as energy devices and software) more accessible and benefit consumers, service companies, the electrical grid, and potentially society overall.

Although the term energy-as-a-service has been used primarily to describe energy efficiency–related business models in the past, it can be used to describe other business models used in the energy space unrelated to energy efficiency, such as a subscription for solar energy. EaaS has provided value for customers and arguably society in the past, and it could be helpful for expanding the use of new technologies in the future.

Using EaaS to Address the Energy Efficiency Gap

The EaaS model arose as a method of capturing the value associated with energy efficiency improvements. Consumers can save money by upgrading to more energy efficient technologies, but they often fail to do so due to a combination of market and behavioral behavioral failures, which prevent them from acting in their own self-interest. The resulting apparent underinvestment in energy efficiency, compared with what would be expected from a financial standpoint, is a phenomenon known as the energy efficiency gap. In addition to a private efficiency gap, a societal gap exists as well when electricity production has adverse environmental effects.

Incentives to reduce energy consumption have been misaligned among utilities, consumers, and society at large. Electric utilities are financially motivated to expand electricity sales to increase revenues and therefore have little reason to encourage energy efficiency (unless required to do so by government policy), even though customers and society can often benefit from reduced energy consumption.

The energy efficiency gap inspired the creation of the energy services company (ESCO) model, which allows service companies to profit from energy savings. Early ESCOs provided energy efficiency upgrades (typically lighting retrofits) under a performance-based contract (Goldman et al. 2002). This contract would include repayment for the upgrades through the energy savings: customers paid for lighting services but the ESCO paid for the electricity to power the new efficient lights, and therefore the ESCO would share the risk of performance (Palmer et al. 2012). The ESCO model is largely considered successful at promoting the adoption of energy-efficient technologies (Goldman et al. 2002).

One business model that emerged from the ESCO approach is the energy service agreement (ESA): the service company makes energy efficiency upgrades with financing provided through the customer’s energy savings. Companies that offer ESAs provide the efficiency upgrade equipment (while retaining ownership) and charge customers for their services for typically five to 15 years (with an option at the end to purchase the equipment). During the contract period, the customer pays a reduced utility bill and an ESA payment that together are less than the customer’s original utility bill attributable to the particular energy service, allowing savings on energy expenses. Metrus is a self-described pioneer of the ESA model.

Other companies manage a facility’s energy use more broadly in the form of a managed energy services agreement (MESA). A MESA is structured similarly to an ESA but typically includes the management of the facility’s utility bills in exchange for a series of payments based on prior bills. Unlike an ESA, contracts of this nature do not necessarily include capital investments but rather provide a more general management of overall electricity use. The MESA model is beneficial for customers who lack energy management expertise and can realize efficiency gains by outsourcing this task to a services company.

Companies like Flywheel and Carbon Lighthouse provide managed energy services mainly through software-based solutions. Flywheel provides software services that monitor energy use and identify opportunities for reduction. The company reports that most customers see energy savings of 10 to 40 percent in their first contract year. Carbon Lighthouse similarly uses sensors and data to discover areas of inefficiency, make energy-saving changes, and monitor energy use. Carbon Lighthouse also uses technology that can adjust the usage of devices to save energy during certain times, but its contracts do not offer customers shared savings. Instead, customers pay a fixed fee for a guaranteed baseline level of savings relative to previous usage. If the realized savings exceed the baseline, the customer keeps the savings, and if they do not reach the baseline, then Carbon Lighthouse pays the customer for the difference.

Those service models have helped improve energy efficiency by aligning incentives between consumers and energy service companies to reduce energy consumption since the companies’ profitability depends directly on the level of energy savings they can deliver to their customers. Recent advances in energy-monitoring technologies and data analytics software have also enabled savings beyond those resulting from upgrading older equipment with more efficient models.

Expanding Access to Renewable Energy with Solar-as-a-Service

The application of the service model for residential and community solar systems is another example of how EaaS has been used to overcome barriers to the use of low-carbon technologies.

Residential solar panels provide residents with clean, renewable energy at virtually no cost after purchase. Though relatively more expensive[1] than community or grid-scale solar, residential solar panels do provide community benefits by reducing the need for electricity from the power grid (energy that is typically produced using carbon-emitting resources), for transmission and distribution line upgrades, and for additional generation capacity. Residential rooftop solar installations can also reduce customers’ electric bills for many years, but the upfront costs are high (on average, more than $12,000 after tax credits for a 6 kW system for a single-family home). Such costs, as well as uncertainty about future energy prices and thus the payback period, can deter customers from making the purchase, even if future energy savings would deliver a positive net present value for the project.[2]

The EaaS model for solar can overcome those barriers while providing two advantages that many homeowners want—electricity cost savings and environmental benefits—without requiring them to purchase or maintain the system. Under a solar lease or power purchase agreement (PPA),[3] a solar services company installs and maintains a solar system on a homeowner’s roof, at no upfront cost, that supplies the household with electricity for the duration of the contract, typically 15 or more years. The solar provider retains ownership of the system and charges the customer for the service, through either a monthly lease for the system or a PPA for the power the system produces. These rates typically offer either cost savings or cost certainty for the consumer relative to retail electricity rates. The solar provider receives monthly revenue and also benefits from policy incentives like the federal investment tax credit (ITC) and state renewable energy credits for the system’s generations. Because its revenue depends on system performance, the provider has an incentive to design and install the best possible system for each customer, and thus incentives between the customer and the provider align.

SolarCity (now a Tesla subsidiary), SunRun, and Vivint Solar are prominent examples of companies that offer these models. Vivint Solar, for example, offers both a solar lease option and a solar PPA for residential customers. The solar lease involves a fixed monthly payment for use of the panels, and the solar PPA is payment for the electricity that the system generates at a predetermined price per kWh, which is lower than the utility’s retail rate and thus provides savings for the customer. In both plans, Vivint retains ownership and has the responsibility of installing, maintaining, and monitoring the solar system throughout the 20-year contract, while the customer enjoys energy savings and the benefits of solar without purchasing the system outright.

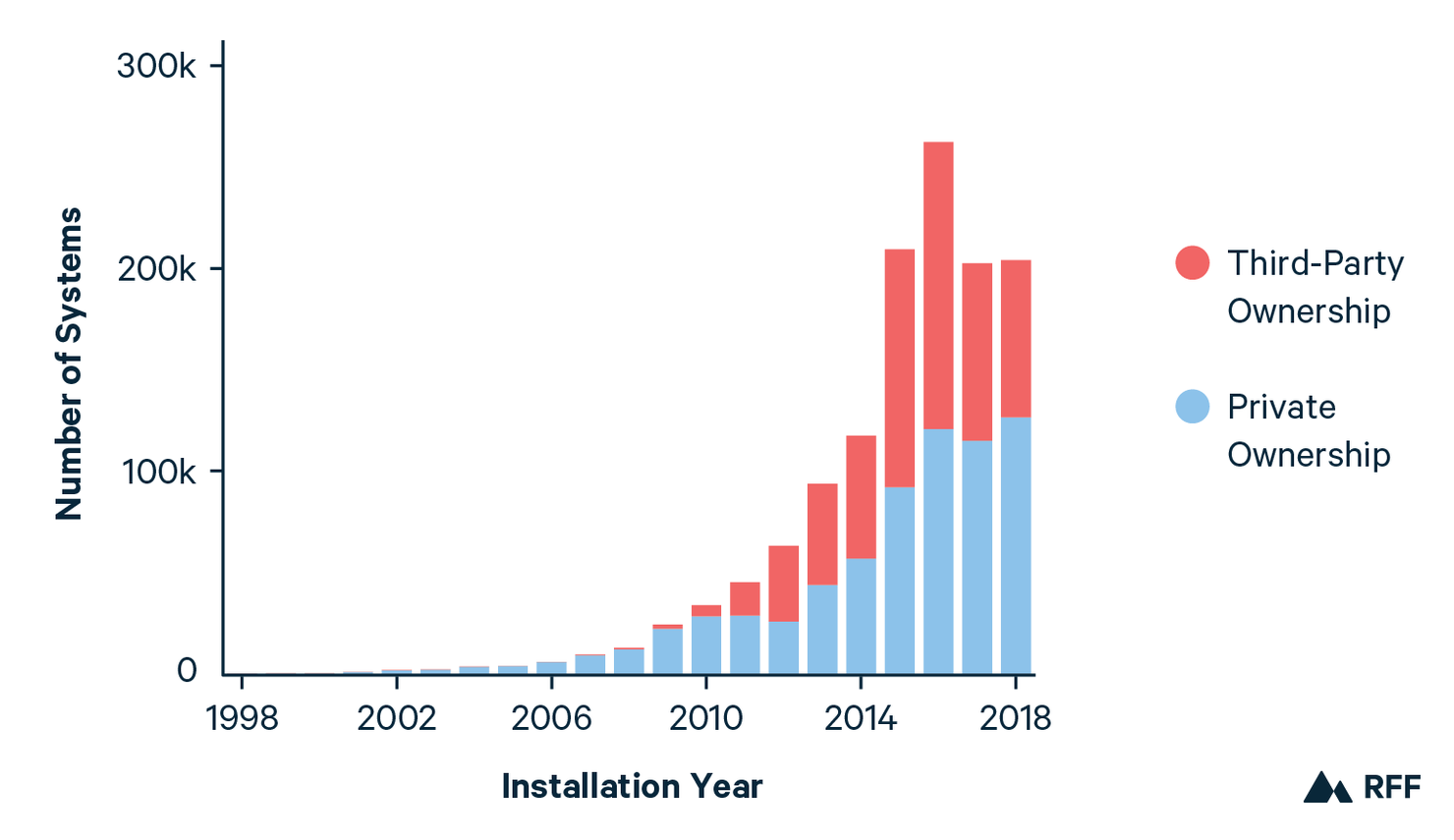

By removing market barriers to entry like upfront capital costs and maintenance, companies offering solar services, typically referred to as third-party ownership (TPO) firms, have transformed and significantly expanded the market for residential solar (Rai and Sigrin 2013). By 2015, more than half of all residential solar systems installed in the United States were done through a TPO model (O’Shaughnessy 2018) (see Figure 1). Drury et al. (2012) estimate that the TPO model has expanded the market and broadened the demand for solar to more demographic groups, in particular younger and less affluent populations in California, the state with the highest number of solar installations in the country. Rai et al. (2016) find that customers who are more concerned about upfront costs and/or operations and maintenance expenses are more likely to enter a TPO arrangement instead of purchasing the system.

Figure 1. Ownership Structure of Solar Installations under 20 kW, by Year

Residential solar as a service is expanding the deployment of rooftop solar for homeowners, but it requires a viable roof, which can restrict participation more broadly. An emerging and more widely applicable model is community solar, which allows ratepayers to subscribe for solar energy without putting solar panels on their own roofs. A community solar project is typically developed, owned, and operated by a solar company, which then sells subscriptions to customers for a portion of the energy that the system generates. These larger projects are less expensive per kilowatt to develop than individual rooftop solar installations, and thus solar companies benefit from economies of scale. Consumers can benefit from energy cost savings and clean energy without purchasing a solar system or using their own rooftop. This model has advantages over the TPO residential system model as it expands the adoption of solar energy beyond homeowners by requiring even less risk and involvement from the customer.

Successes and Limitations of EaaS Models

Early successes of energy-as-a-service models for energy efficiency were mainly limited to municipal buildings, universities, schools, and hospitals, commonly known as the MUSH market. Lawrence Berkeley National Laboratory researchers estimated that the MUSH sector accounted for 58 percent of the ESCO industry in 2006, equivalent to $2 billion, and as much as 69 percent of revenues in 2008. This success was largely attributed to the large scale of these institutions and the streamlined procedures for entering contracts of this nature (Hinkle and Schiller 2009). Additionally, the low default risk of government-backed contracts encouraged ESCOs to seek out business in this market (Palmer et al. 2012).

Newer ESCO models that provide financing, such as companies offering ESAs or MESAs, have been geared more toward the private sector, particularly commercial and industrial customers (Srivastava 2019). This market is expected to grow substantially, and Navigant (2017) research estimates that the global market for energy-as-a-service agreements for the commercial and industrial sectors will reach as much as $221.1 billion by 2026.

On the other hand, the EaaS model for efficiency improvements has not had much success historically in the residential sector. Residential customers are more likely than large commercial customers to default on a contract, which can discourage companies from seeking out residential customers (Palmer et al. 2012).

Other potential roadblocks to residential market penetration may have included greater difficulty in application. For example, tracking residential customer behavior, especially in the past, may have been complicated by technological constraints on data availability and access, or by the high effort (and therefore low payback) associated with procuring individual customers. ESCOs can benefit from economies of scale in transaction costs when pursing business deals with large customers that use the same amount of electricity as hundreds or even thousands of individual households.

That situation is starting to change, however, and at least one company is working in the residential efficiency service space. Sealed, a home improvement energy service company doing business in New York State, follows a similar model to Metrus, which offers energy efficiency as a service primarily to large customers—industrial and manufacturing plants, higher education, healthcare, and aerospace facilities. Sealed’s “Comfort Plan” contract provides efficient equipment for residential customers in exchange for service payments equal to their energy savings (so Sealed earns all the savings benefits). This company’s model could suggest that residential customers may not necessarily demand energy savings if a company provides another service that they value—in this case, improved home comfort and more consistent heating and cooling through the elimination of air leaks.

Solar service plans have also demonstrated that the energy service industry can succeed in the residential sector. Whereas some ESCOs targeted the MUSH market and avoided the residential sector to reduce risk, companies like Sunrun have successful business models that focus on selling energy services to residential customers. In 2018 alone, Sunrun grew its customer base by 29 percent and generated $63 million.

Possibilities for the Future

The ESCO and solar cases highlighted above show how the EaaS model can help overcome barriers to technology adoption by reducing consumers’ capital expenditure and their responsibility for managing energy devices, thus leading in many cases to better outcomes for users and society overall. These successes can serve as a framework for addressing other challenges caused by misaligned incentives or ownership structure in the electricity sector.

Decarbonization of the electricity sector will likely create new challenges for meeting consumers’ energy needs. The rise of intermittent renewable generation, like wind and solar, will require extensive forecasting, an increased need for flexible demand, and likely greater use of energy storage to balance grid operations. Electrification of transportation and buildings could help provide grid flexibility and battery storage, but car and building owners may not have incentives or the expertise to provide these services.

The energy-as-a-service model could be used to better align customer incentives with operational constraints of the grid at large. EaaS could help activate demand-side management, assist with the integration of renewables, and encourage electrification. One example would be a services company that owns and operates grid-connected water heaters in residences and commercial buildings. This company could schedule the water heaters to heat the tank during times of high renewable production and low energy cost, and then store the water for later use. This type of service for building occupants provides grid services through time shifting of electricity demand and can also save customers money.

Numerous possibilities exist for future EaaS models, many of which are becoming more feasible through technological advancement. Almost half of all residential electricity customers now use smart meters that track electricity usage electronically, which allows for the collection of useful data regarding consumer demand and, if applicable, home generation. Data analytics and advances in software and technology provide new opportunities for service companies to help customers save money beyond those available when the EaaS model originally evolved.

Future EaaS business models could likely involve energy management through software or ownership of electric devices, like cars or water heaters. Such approaches could save consumers money while providing societal benefits by better matching of electricity demand with supply, integrating renewables, and reducing emissions.

Notes

[1] According to NREL, as of 2018, residential solar panels cost about $2.70 per watt DC versus $1.83 per watt for commercial systems and $1.06 per watt for utility-scale systems.

[2] The net present value to consumers of a given solar project under net metering of solar production will depend on the location and the retail electricity rate. In Los Angeles, for example, a 6 kW solar system that costs $12,000 has a nine-year payback period, given an average retail electricity rate of 13 cents per kWh, according to NREL’s PVWatts Calculator. The same system would require a payback time of over 24 years in Seattle, where the average retail price is 7.8 cents per kWh. Neither case accounts for future increases in the electricity rate, which could reduce the payback period.

[3] These models are possible because of solar net metering, a state policy that allows customers to sell power generated by solar back to the grid. The rate varies by state but is typically at the retail rate of electricity. Changes to net metering policies would alter the feasibility of these business models. Some states (recently Louisiana) are considering rolling back net metering policies, which would make these models not feasible in those locations.

[4] The Lawrence Berkeley National Lab’s Tracking the Sun (TTS) data set has information on solar projects in the United States that is compiled from state agencies and utilities and updated annually. Because of the many contributors to data collection, many systems have missing values. The data displayed here were filtered to show only systems that had information regarding ownership.

References

Drury, E., M. Miller, C. M. Macal, D. J. Graziano, D. Heimiller, J. Ozik, and T. D. Perry. 2012. The transformation of southern California's residential photovoltaics market through third-party ownership. Energy Policy 42: 681–90.

Goldman, C. A., J. G. Osborn, N.C. Hopper, and T. E. Singer. 2002. Market trends in the US ESCO industry: results from the NAESCO database project (No. LBNL-49601). Berkeley, CA: Lawrence Berkeley National Laboratory.

Hinkle, B., and S. Schiller. 2009. New business models for energy efficiency. San Francisco: CalCEF Innovations. Available at: https://docplayer.net/1822724-New-business-models-for-energy-efficiency.html.

Iyer, G., N. Hultman, J. Eom, H. McJeon, P. Patel, and L. Clarke. 2015. Diffusion of low-carbon technologies and the feasibility of long-term climate targets. Technological Forecasting and Social Change 90: 103–18.

Lawrence Berkeley National Laboratory. 2019. Tracking the sun. Data set. Berkeley, CA. Available at: https://emp.lbl.gov/tracking-the-sun

McCarthy, D., and P. Fader. 2017. Subscription businesses are booming; here’s how to value them. Harvard Business Review Digital Articles 1–6.

Navigant Consulting. 2017. Energy as a service. Report. Chicago. Available at: www.navigantresearch.com/reports/energy-as-a-service.

O’Shaughnessy, E. J. (2018). The Evolving Market Structure of the US Residential Solar PV Installation Industry, 2000-2016(No. NREL/TP-6A20-70545). National Renewable Energy Lab.(NREL), Golden, CO (United States).

Palmer, K., M. Walls, and T. Gerarden. 2012. Borrowing to save energy. Report. Washington, DC: Resources for the Future. April.

Rai, V., and B. Sigrin. 2013. Diffusion of environmentally-friendly energy technologies: buy versus lease differences in residential PV markets. Environmental Research Letters 8(1): 014022.

Rai, V., Reeves, D. C., & Margolis, R. (2016). Overcoming barriers and uncertainties in the adoption of residential solar PV. Renewable Energy, 89, 498-505.

Srivastava, S. 2019. Emerging opportunities: energy as a service. Washington, DC: American Council for an Energy-Efficient Economy. Available at: https://aceee.org/sites/default/files/eo-energy-as-service.pdf.

Tauqeer, M., and K. E. Bang. 2019. Integration of value adding services related to financing and ownership: a business model perspective. In Proceedings of the Design Society: International Conference on Engineering Design 1(1) (July): 2279–86.