The Fate of Coal: Determining Missouri’s Path to a Clean Grid

The first in a series about how state electricity plans compare to a net-zero electricity sector goal, this issue brief examines the integrated resource plans of Missouri utilities.

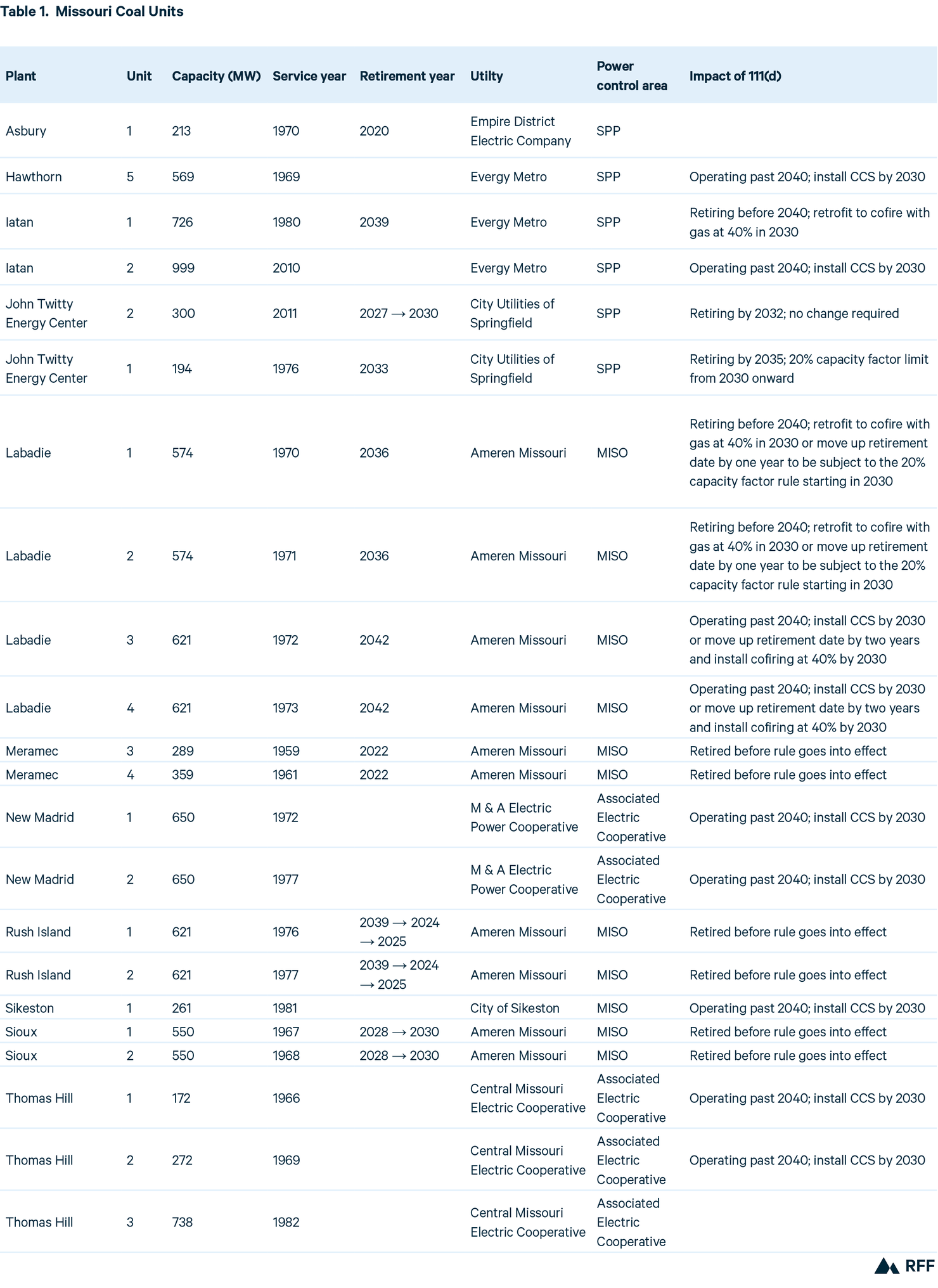

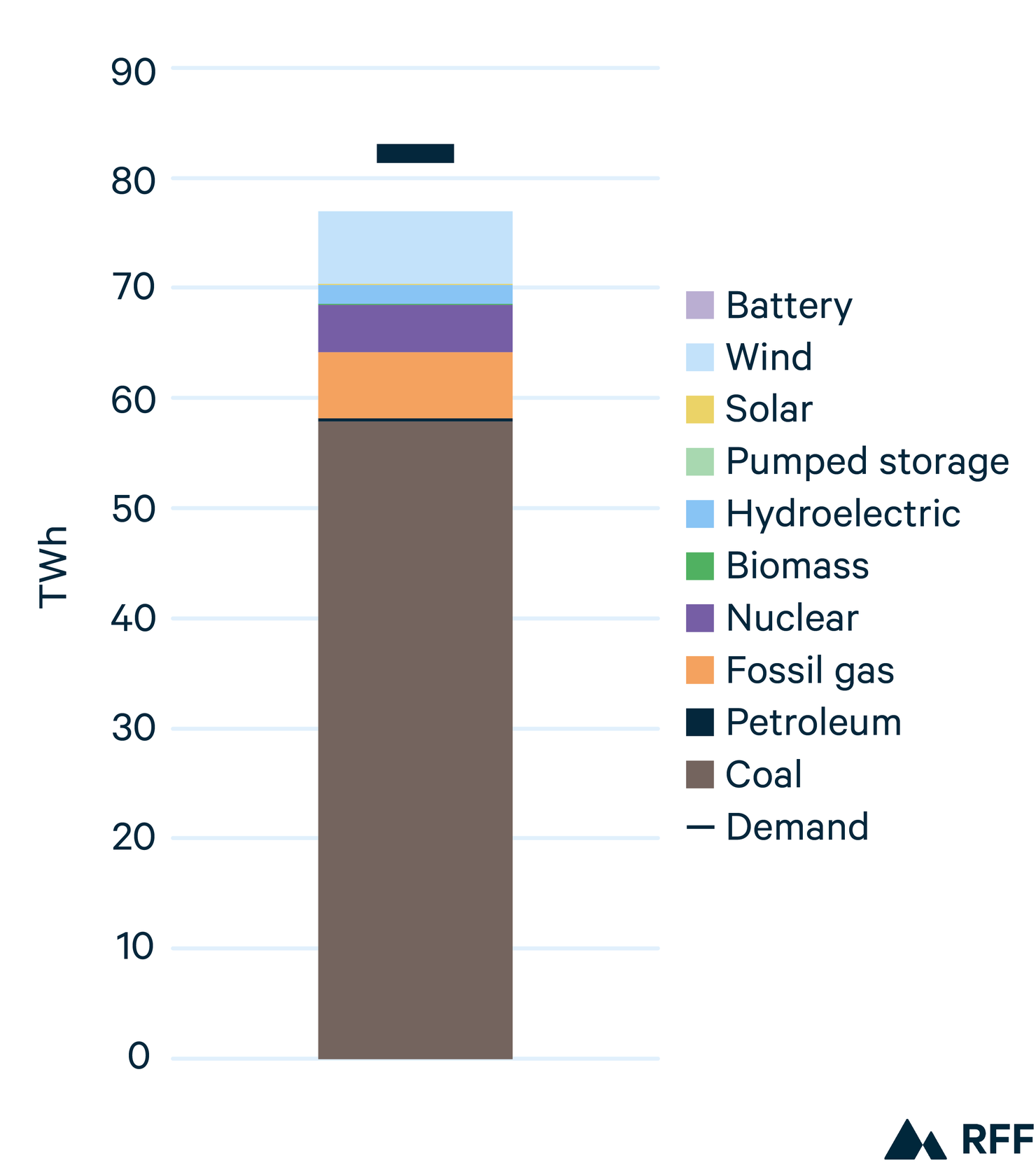

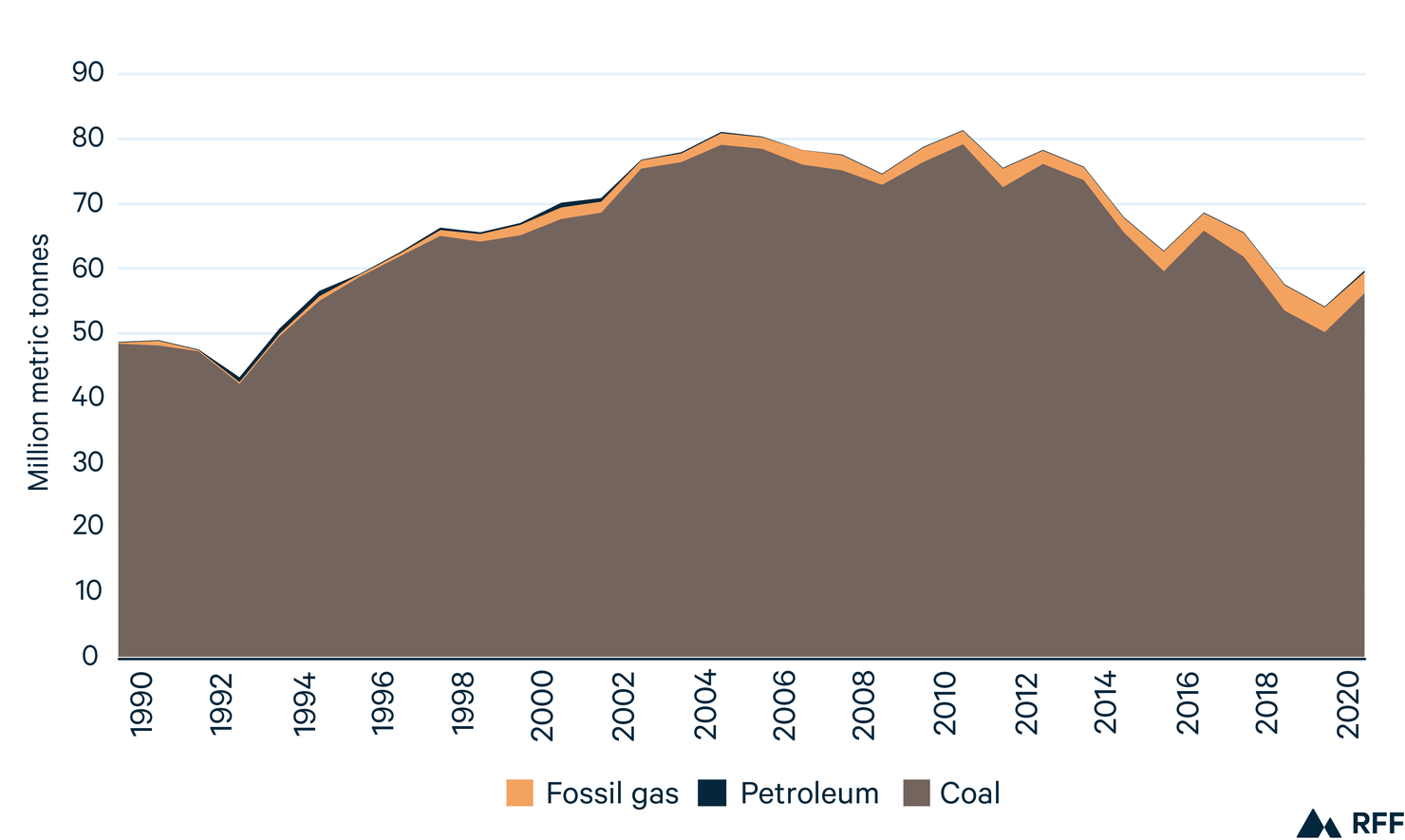

As Missouri is a state with no formal climate goals and an electricity sector that is three-quarters coal generation (Figure 1a), the decarbonization of its electricity grid will depend in large part on decisions by utilities to retire or retrofit coal capacity (Figure 1b; Table 1). Utilities covering a majority of electricity sales in Missouri have net-zero targets—Empire District, 2050; Ameren, 2045; Evergy, 2045; and City Utilities of Springfield, 2050—accounting for 71 percent of sales (Figure 1d). Most of the remaining electricity sales are covered by cooperatives (co-ops), none of which have climate targets. But these private net-zero targets are not enforceable, and they may not have direct impacts on coal generation in Missouri, given that the utilities serve customers in multiple states. On the other hand, the US Environmental Protection Agency’s (EPA’s) recent proposed regulation of existing fossil generators under section 111(d) of the Clean Air Act sets firm dates before which coal plants must either retire or retrofit in a way that reduces their greenhouse gas emissions. “New Source Performance Standards for GHG Emissions from New and Reconstructed EGUs; Emission Guidelines for GHG Emissions from Existing EGUs; and Repeal of the Affordable Clean Energy Rule,” Item No. 1, Docket ID EPA-HQ-OAR-2023-0072. https://www.regulations.gov/document/EPA-HQ-OAR-2023-0072-0001. In addition, advocacy groups within Missouri—most notably the Sierra Club, through its Beyond Coal Campaign—have been pushing for coal plant retirements through litigation and rate cases because of the climate and public health harms.

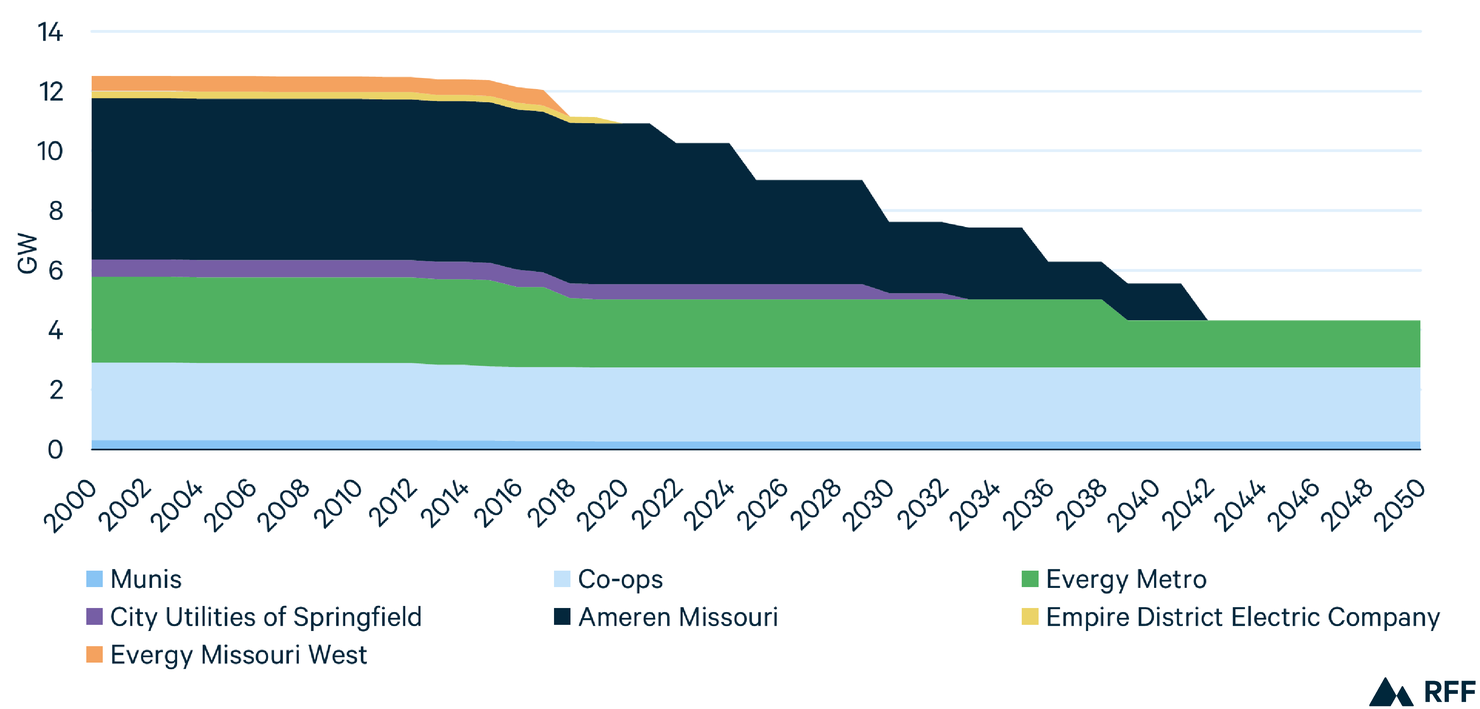

So what plans have Missouri utilities made for their coal plants, and are they following through on those plans? A brief accounting indicates that Missouri utilities plan to retire 6.0 gigawatts (GW) of coal capacity between now and 2050, leaving 4.3 GW still online after that date and making no plans for carbon capture and storage (CCS) retrofits (Figure 2). Moreover, there have been noticeable shifts in successive integrated resource plans (IRPs) about which plants are to be retired and when. This issue brief explores three factors influencing whether Missouri coal plants retire as planned: (1) whether the plants are in conflict with environmental regulation and would require expensive upgrades to continue operating, (2) whether financial barriers to retirement exist, and (3) whether generators are available to replace the coal plants.

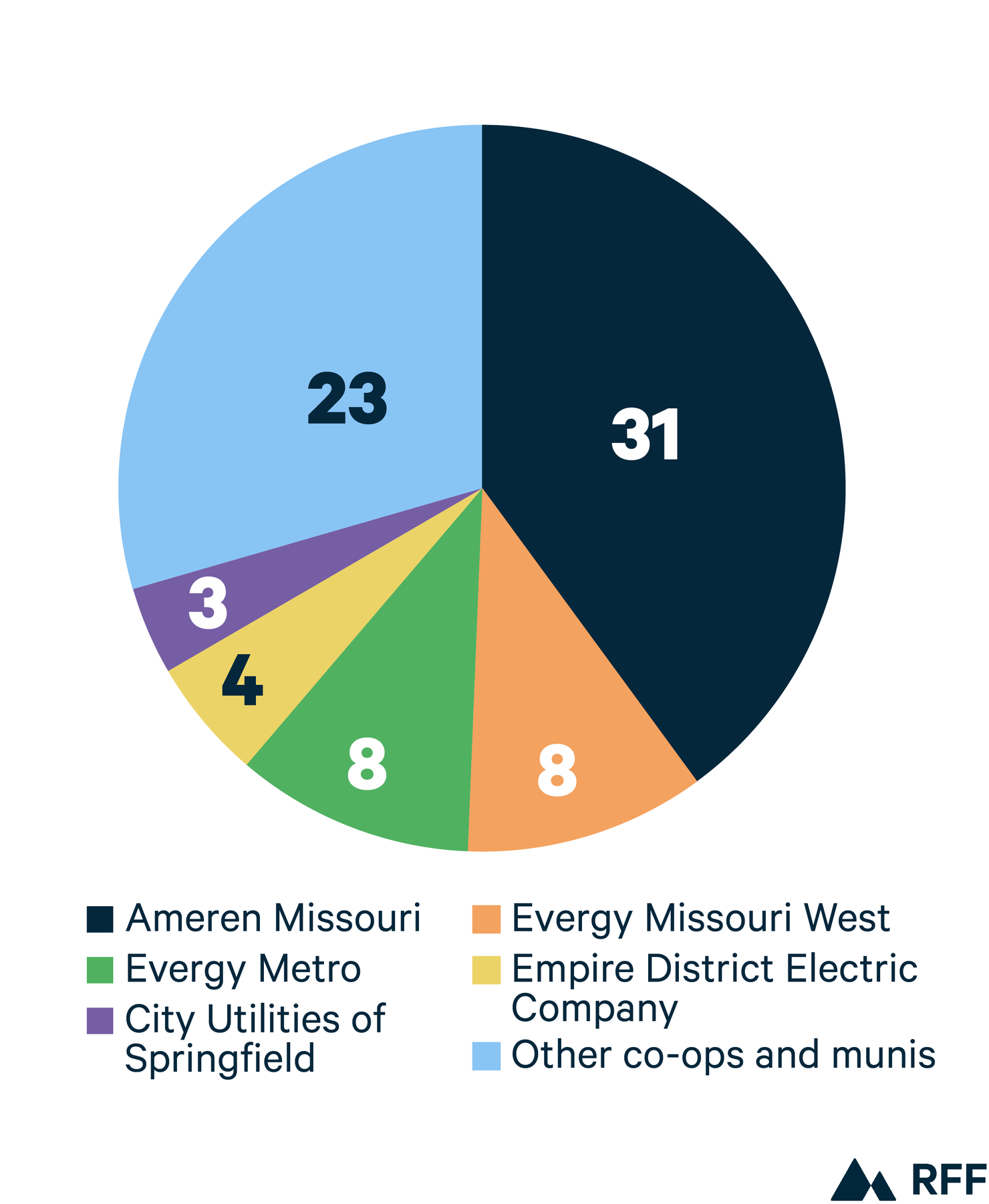

The main (enforceable) driver of coal retirements is environmental regulation. For example, when the Department of Justice sued Ameren’s Rush Island plant for violating the Clean Air Act’s New Source Review requirements, the plant was ordered to install flue gas desulfurization (Sierra Club 2021). Rather than do so, Ameren elected to move the plant’s retirement date from 2039 to 2024 (Skipworth 2022). The recent coal combustion residual rule required that wet coal ash be stored in lined ponds. After making investments to close the final ash ponds at its Meramec plant, Ameren made plans to close the plant in 2022 (Ameren Missouri 2021). Perhaps most impactfully, the EPA’s proposed 111(d) regulation will require coal plants that want to exist beyond 2035 but retire by 2040 to retrofit to cofire with fossil gas by 2030 and plants that want to exist after 2040 to retrofit with 90 percent carbon capture by 2030. Several plants have retirement dates just one or two years after one of these deadlines (Labadie 1&2 in 2036, Labadie 3&4 in 2042), so they may choose to retire earlier than planned rather than retrofit to run for only a short while longer. Others with no retirement date (Thomas Hill, Sikeston, New Madrid, Iatan, Hawthorne) will have to install CCS by 2030 or declare retirement dates before 2040 (Table 1).

Many coal plants cost more to operate than the expense of building and operating a new renewable resource, but remaining debt on the coal facilities deters utilities from retiring them (Bodnar et al. 2020). When a regulated utility retires a plant without recovering its costs, the utility’s shareholders lose money, and in some cases the utility’s credit rating falls, affecting its ability to borrow money in the future. This makes utilities reluctant to retire plants early, even when doing so would save ratepayers money. In 2021 Missouri passed a securitization law designed to address this problem (Kite 2021). Under the law, the utility establishes a special-purpose entity that issues ratepayer-backed bonds to pay off the remaining debt. The bonds are then paid off over a long period through a charge on electric bills. Because the ratepayer-backed bonds have a lower rate of interest than the utility’s rate of return, ratepayers save money on both operating expenses for the coal plant (since it’s no longer running) and the interest rate they would have paid on the utility’s coal plant debt. At the same time, the utility avoids an unpaid debt, and having cash on hand allows it to invest in new clean generation (Varadarajan 2018). Empire District Electric Company (Algonquin) used securitization when it closed its last coal unit, the Ashbury plant, in 2020 (Uhlenhuth 2019; Howland 2022c). And Ameren intends to use it to recover some of the costs associated with the Meramec and Rush Island plants (Ameren Missouri 2022b).

While Missouri’s securitization law is aimed primarily at regulated utilities, the Inflation Reduction Act (IRA) contains two provisions that may address financial barriers faced by co-op–owned coal plants. The US Department of Energy Loan Program Office’s Energy Infrastructure Reinvestment program (funded at $5 billion) will provide low-interest loans to refinance and replace or reduce emissions at existing fossil generators (DOE n.d.). These funds are available to all power plants. The US Department of Agriculture’s Empowering Rural America program (funded at $9.7 billion) is limited to co-ops and is designed to help them replace existing fossil plants with low-interest, forgivable loans (USDA 2023). Given that 2.7 of the 4.3 GW of coal units left after 2050 are from co-ops or municipal utilities (munis) (Figure 2), these programs will do important work to ease the retirement of coal in Missouri.

Despite new environmental regulations and policies to overcome financial barriers to retirement, the utilities have repeatedly delayed coal retirements as the dates approach. And each time, the stated reason was a lack of adequate replacement capacity. For example, Ameren, which has retirement dates for all its remaining coal units, is planning to replace this coal mostly with fossil gas plants that have the ability to burn hydrogen or with unnamed “clean firm” facilities. The utility has already delayed two of these coal retirements. The Rush Island plant, which will be retiring with securitization in lieu of retrofitting with coal gas desulfurization, delayed its retirement beyond 2024 after the Midcontinent Independent System Operator (MISO) asked the Federal Energy Regulatory Commission to keep it online as a System Support Resource through 2025 (Howland 2022a). The Sioux Energy Center has pushed its retirement date from 2028 in the 2020 IRP to 2030 in the 2022 Change in Preferred Plan (Ameren Missouri 2022a), while Ameren waits for a fossil gas unit to come online in 2031. Evergy has repeatedly modified and delayed the quantity of renewables they planned to build in their 2020 IRP (Evergy 2021, 2022), before suggesting a significant fossil gas build-out in 2027 and 2028 (Evergy 2023). See also “In the Matter of Evergy Missouri West, Inc. d/b/a Evergy Missouri West’s 2023 Integrated Resource Plan Annual Update Filing,” Item No. 9, Docket Sheet EO-2023-0212; “In the Matter of Evergy Metro, Inc. d/b/a Evergy Missouri Metro’s 2023 Integrated Resource Plan Annual Update Filing,” Item No. 16, EO-2023-0213. Similarly, City Utilities of Springfield has delayed the retirement of the first unit at the John Twitty Energy Center from 2027 to 2030 in response to slower-than-anticipated renewable builds and new reliability rules from the Southwest Power Pool (SPP) (CU 2022). These examples suggest that even when utilities are planning to replace their coal plants, construction delays and reliability rules from Independent System Operators are keeping coal plants online longer. Additionally, current ways of measuring reliability may be pushing utilities to replace coal plants with fossil gas and hydrogen-enabled fossil gas rather than with renewables.

In summary, Missouri has a lot of coal generators and some unenforceable commitments from utilities to reach net-zero emissions. If the commitments are to be met, all these coal generators must be retired or retrofitted with CCS. An examination of IRPs reveals that as of now, utilities do not plan to do so, leaving 4.3 GW of coal with uncontrolled carbon emissions after 2050 (Figure 2). Regulations, specifically the coal combustion residuals and the 111(d) rule, may play an important role in pushing coal plants to retire or retrofit. Financial barriers to retirement related to paying off the debt on coal plants are surmountable for regulated utilities, given the state’s securitization law, and for co-ops, given the federal government’s new programs under the IRA. Nonetheless, planned coal plant retirements have been delayed because of slower-than-expected build-out of replacements and reliability concerns from grid operators.

Figure 1. Overview of Missouri’s Electricity Sector

Figure 1a. Generation (2021)

Data source: Missouri Electricity Profile 2021 (EIA 2022)

Figure 1b. Capacity (2021)

Data source: Missouri Electricity Profile 2021 (EIA 2022)

Figure 1c. CO2 Emissions

Data source: Missouri Electricity Profile 2021 (EIA 2022)

Figure 1d. Electricity Sales (2021, TWh)

Data source: Missouri Electricity Profile 2021 (EIA 2022)

Figure 2. Planned Coal Retirements in Missouri

Table 1. Missouri Coal Units