Progress and Potential for Electric Vehicles to Reduce Carbon Emissions

Electric vehicles (EVs) represent a promising step toward lowering greenhouse gas emissions from the transportation sector—but this report finds that EVs will continue to play a small part in emissions reductions over the next five years, with larger contributions in the decade after.

Key Findings

- Despite exponential growth, EVs still represent only 2 to 3% of the annual new-vehicle market share.

- Passenger vehicle fleets take approximately 20 years to turn over, and truck fleets 25 years. Even under optimistic forecasts, the transition to EVs will be gradual.

- New EV sales will have a limited impact on overall emissions by 2025 but will be increasingly important in the following decades. Continued improvements in gasoline vehicle fuel economy are critical to reduce GHG emissions during this long-term transition.

- There are still barriers to more widespread adoption of EVs, including vehicle cost—especially for larger vehicles—and public charging technology and availability.

- Government policies and continued innovation will be important for accelerating the transition to EVs.

1. Introduction

By emitting no tailpipe emissions, electric vehicles (EVs) have the potential to completely decarbonize the US transportation sector. But the US transportation sector currently remains far from zero emissions, as the composition of the current on road vehicle fleet is mostly gasoline vehicles. EVs represent a growing yet small share of all vehicles on the road today.

This report details the current role that EVs play in reducing greenhouse gas emissions (GHG) in the US transportation sector. It also looks forward to 2025 and beyond to assess the potential for EVs to reduce future GHG emissions. We summarize our most important findings here.

First, EVs represent about one percent of all passenger vehicles on the road today, and though some truck EVs are in development, they have not yet entered the market in significant numbers. Thus, to date, EVs have had little impact on overall GHG emissions in the US. However, EV sales have grown rapidly in recent years, and there is the potential for continued exponential growth in the future.

Second, even with accelerating growth in the next few years as more EV models enter the market, they will continue to have only a modest effect on transportation sector GHG emissions. This is because the passenger vehicle fleet takes several decades to turnover, and truck fleets take even longer. Therefore, most gasoline vehicles on the road today will still be on the road in 2025, which limits the increase in the share of the fleet that will be electric by that time. Even optimistic forecasts of new EV sales will have only a limited impact on overall GHG emissions. Even if 15% of new vehicle sales are EVs in 2025, 85% of sales will still be gasoline vehicles and those will remain on the road for many years.

Third, in the longer term, as many EVs reach cost parity with gasoline vehicles some time after 2025, we expect sales volumes to increase significantly especially for passenger vehicles. However, for most larger vehicles, such as large passenger trucks and heavy-duty trucks, continuing technological progress will be essential for lowering costs to achieve competitiveness with vehicles powered by gasoline and diesel. By then trucks will contribute a larger share of GHG emissions than passenger vehicles, making them a major focus of efforts to decarbonize the transportation sector.

We present a range of forecasts about how quickly light-duty (car and light truck) EVs will enter the market in the longer term. To attain even the mid probability forecasts, government policies to promote EV demand and supply will be essential at least until full parity between EVs and gasoline vehicles is reached. Even then fleet GHG emissions do not go zero because of heterogeneity among vehicle sizes and EV buyers, and the slow turnover of the fleet.

We find that a barrier to high levels of EV penetration of the fleet in the medium to longer term is uncertainty over the cost of high-speed widely available charging capability. Fast charging availability outside the home appears critical for widespread adoption of EVs. Yet, there remain uncertainties about how to bring costs down enough for widespread commercial fast-charging in the long-run.

Finally, we review government policies that will play a critical role in accelerating the transition of the fleet, with the associated gradual reduction in GHG emissions. We discuss existing policies including state sales mandates, which target increasing the supply of EVs, and subsidies and rebates, which increase demand. We highlight the role of continual improvements in fuel economy for gasoline and diesel vehicles throughout the transition to EVs. And, we identify additional policies and ways to improve current policies to spur demand, hasten fleet turnover, and ensure sufficient charging capability.

In the discussions below, we refer to all electrified vehicles as EVs, and these include full plug-in battery electric vehicles and fuel cell vehicles powered by hydrogen. Both of these vehicle technologies have zero tailpipe emissions, but full lifecycle emissions that include producing the fuel and the vehicle are not zero. Our focus in this paper is on EV fleet penetration and tailpipe GHG, so we touch only briefly on fuel and battery emissions.

2. Current Role of Electric Vehicles in Decarbonizing the US Transportation Sector

In this section, we summarize the role that EVs are currently playing in reducing carbon emissions from the transportation sector in the United States. We first show the shares of different sources of greenhouse gas emissions in the transportation sector. We then look at the current state of electrification of passenger vehicles, and heavy-duty trucks, which are the two major sources of emissions from transportation.

2.1. Current State and Trend of US Carbon Emissions in the Transportation Sector

As of 2018, the transportation sector accounted for 28 percent of total greenhouse gas emissions in the United States. Figure 1 shows that of the total transportation share, most are from vehicles - about 59 percent from passenger vehicles, and 23 percent from heavy-duty vehicles.

Figure 1. 2018 US Transportation Sector Emissions Breakdown

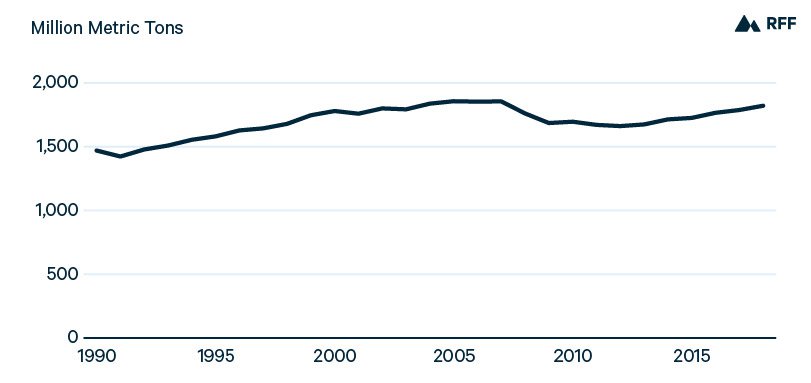

Carbon emissions from the transportation sector have grown by about 24 percent over the last 30 years. Transportation emissions grew between 1990 and 2007, then fell due to slowed economic activity caused by the Great Recession. Between 2012 and 2018, transportation sector emissions have grown every year. See Figure 2 below. Transportation now contributes the largest share of GHG emissions of any sector. Electricity generation is the now the second largest with 27% of GHG emissions. USEPA Greenhouse Gas Inventory, 2018.

Given the current state of the COVID pandemic, the future trajectory of transportation emissions remains uncertain. Prior to the pandemic, transportation sector emissions were expected to continue growing, primarily due to expected increases in vehicle travel. Even as the economy recovers from the current downturn, it is uncertain whether households and businesses will revert to past behavior. Anticipated innovation such as automated driving creates additional uncertainty about future transportation demand.

Figure 2. US Transportation Sector CO2 Emissions, 1990-2018

2.2. EVs in the Passenger Vehicle Fleet

In this section, we discuss how passenger vehicle EVs, which includes cars and light trucks, are playing a role in reducing carbon emissions in the transportation sector. We focus on the passenger vehicle fleet for a few reasons. First, passenger vehicles currently represent a majority of carbon emissions in the transportation sector. Second, EVs have begun to make an impact on passenger vehicle emissions due to their sales growth over the past decade. In contrast, EVs are only beginning to be introduced in the medium and heavy-duty truck segment, which is the second most important carbon emissions source in transportation (see Figure 1 above). We discuss this segment’s growing importance below.

For passenger vehicles, we differentiate between two types of EVs: plug-in hybrids and battery EVs. Plug-in hybrids have the capability of running on either electricity or gasoline, and generally have a relatively small electricity-only driving range. Battery EVs only have the capability of running on electricity, but have a much longer electricity driving range than plug-in hybrids.

Passenger vehicle EV sales—including plug-in hybrid and battery EVs—have increased dramatically since 2011. Figure 3 shows this growth through 2019.

Figure 3. New Plug-in Hybrid and Battery EV Sales in US, 2011- 2019

The figure shows an increase in annual new vehicle sales from several thousand in 2011 to about 350,000 in 2018 and 2019. Even with this massive growth, EVs represent a tiny fraction of the passenger vehicle fleet in operation. Annual new vehicle sales are typically on the order of 15 million vehicles per year, which implies that EVs have had an annual new vehicle market share of around 2% per year in recent years. Furthermore, vehicles remain on the road for many years after they are sold; the current passenger fleet stands at about 250 million vehicles (including those owned by rental car companies, businesses, and governments), or about two vehicles per US household.

Between 2011 and 2014, the split between new plug-in hybrid sales and battery EVs was about 50–50. Beginning in 2015, battery EVs began to sell in larger quantities, and by 2019, battery EVs represented three out of every four new EVs sold. This change is due to the entry of new battery EVs, including the Chevrolet Bolt and especially the Tesla Model 3, which together make up nearly two-thirds of all battery EVs sold in 2018 and 2019. Many of these sales occur in Zero Emissions Vehicle (ZEV) program states such as California.

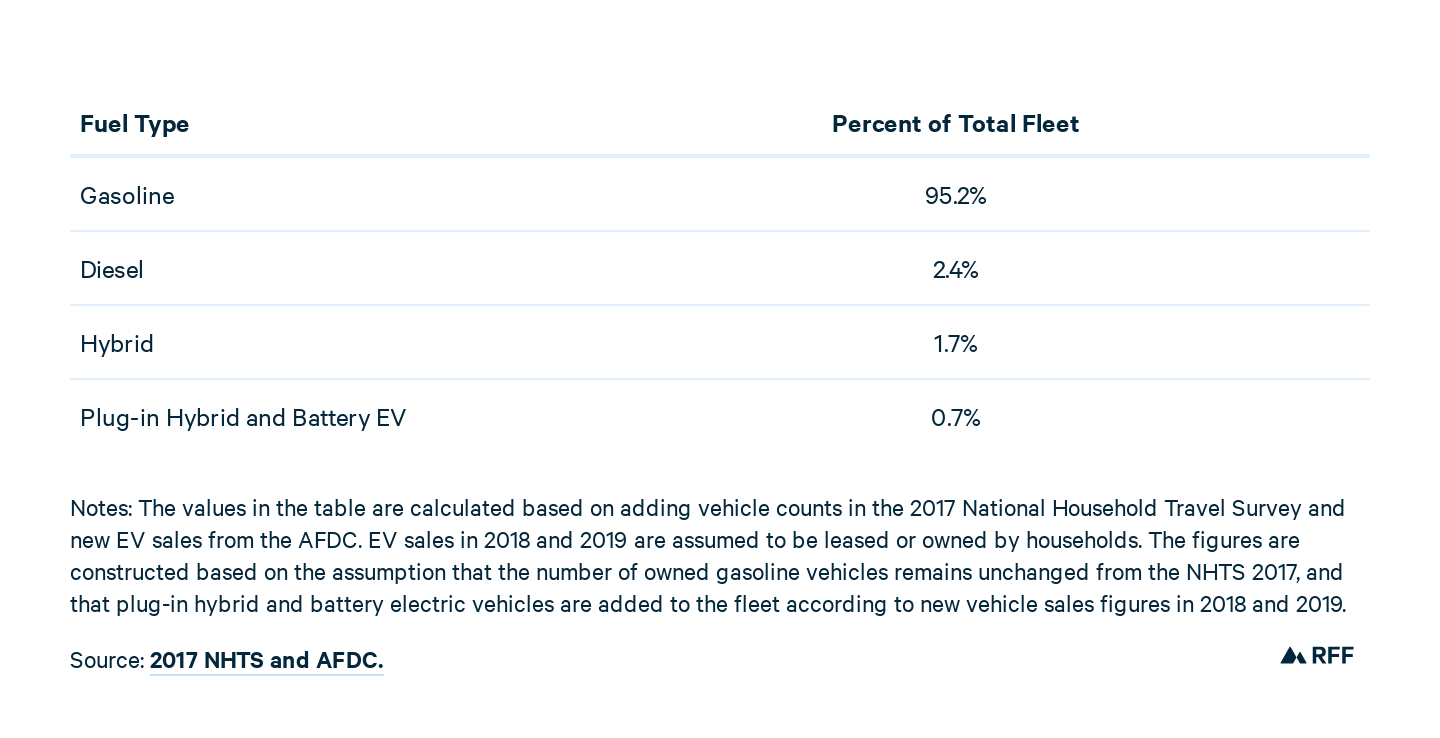

As of 2019, approximately 1.6 million plug-in hybrid vehicles and battery EVs were on US roads, representing just 0.7 percent of the on road fleet owned by households. Table 1 further breaks down the fleet by various fuel types.

Table 1. US Passenger Vehicle Fuel Type Distribution in 2019

2.2.1. Infrastructure

Battery powered electric vehicle fueling requires charging infrastructure which includes chargers, connections to the electricity grid, software and communications networks. Charging infrastructure is diverse in terms of cost and speed of recharging, reflecting both technology options and consumer preferences. There are currently over 1.2 million charging ports in the United States, ranging from residential plug-ins, to high-speed chargers in public areas. The forecasts are that millions more home chargers and fast charging stations will be needed in the future.

Most of the investment in infrastructure to date has been in urban areas where demand for and prevalence of EVs is the highest. M. Nicholas, D. Hall and N. Lutsey. Quantifying the Electric Vehicle Infrastructure Gap across US Markets. (2019). ICCT. Washington, DC. https://theicct.org/sites/default/files/publications/US_charging_Gap_20190124.pdf. Public high speed charging is essential for increasing the demand for EVs, but it is expensive especially when utilization levels are low. National Plug-in Electric Vehicle Infrastructure Analysis. US Department of Energy. (2017); also see Lee H. Lee and A. Clark. Charging the Future: Challenges and Opportunities for Electric Vehicle Adoption. (2018). Harvard Kennedy School. https://projects.iq.harvard.edu/files/energyconsortium/files/rwp18-026_lee_1.pdf Currently, some high-speed charging stations are dedicated to Tesla vehicle refueling and are incompatible with other EV models. It will be important to set consistent standards for vehicle charge point communication and payment as the infrastructure is built out in the future. Currently, the lack of sufficient high-speed public charging infrastructure is seen as a barrier to stronger EV adoption.

2.2.2. Costs of Passenger EVs Relative to Internal Combustion Engine Vehicles

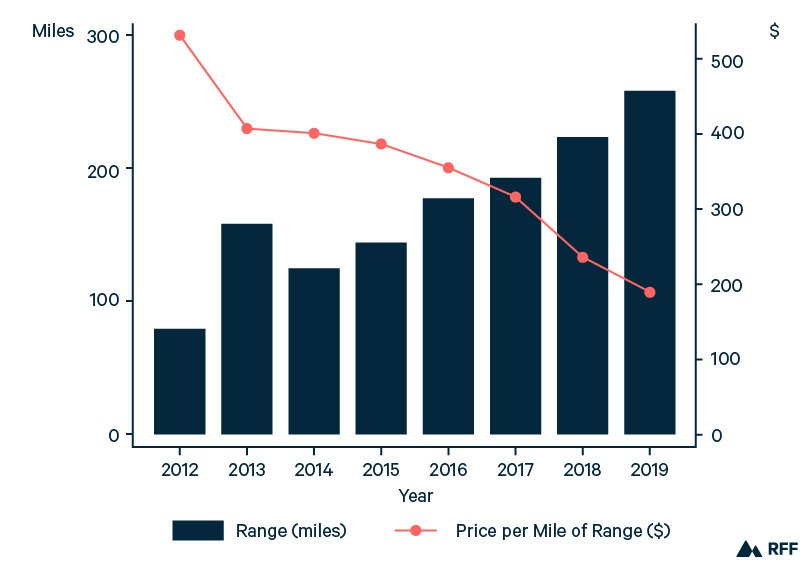

In 2011, EVs were prohibitively expensive for most new vehicle buyers. Since then, both government policies and technological improvements have contributed to bringing down costs, A relevant metric for comparing EVs to internal combustion engine (ICE) vehicles powered by gasoline is cost per mile of range, since EVs tend to have lower driving range than ICE vehicles. Figure 4 shows average driving range of battery EVs sold in the US along with price per mile of range, which is defined as the manufacturer suggested retail price divided by driving range.

Figure 4. Sales-Weighted Average Driving Range and Price per Mile of Range, 2012-2019

As shown in the figure, average driving range for battery EVs has increased substantially over the last decade, and cost per mile of range has fallen from over $500 per mile to under $200 per mile. For comparison, a typical gasoline vehicle has a driving range of between 400 and 500 miles per tank of gasoline, and has a cost per mile of range in the neighborhood of $100 per mile. While not yet at par with ICE vehicles, the average battery EVs on the road today are approaching the affordability of mainstream ICEs.

Much of this drop of cost per mile of range is attributable to reductions in the price of battery packs, which make up the bulk of the difference in purchase prices between battery EVs and ICE vehicles. Analysts predict that this trend will continue through the current decade. These declining battery costs mean the cost differential with ICE powered vehicles will get smaller over time, but there is uncertainly over how quickly price parity will be reached. JP Morgan, https://www.jpmorgan.com/jpmpdf/1320745238375.pdf. Total battery costs are falling more slowly recently, as consumers demand EVs with longer ranges and larger batteries. H. Lee and A. Clark. Charging the Future: Challenges and Opportunities for Electric Vehicle Adoption. (2018). Harvard Kennedy School. https://projects.iq.harvard.edu/files/energyconsortium/files/rwp18-026_lee_1.pdf. Thus, small vehicles with shorter range will have cost parity with gasoline vehicles first, likely within the next few years. Vehicles with longer range and larger vehicles require more and better batteries, and will take longer to be competitive with gasoline vehicles.

A fuel cell vehicle is also powered by electricity, but the electric power comes from a fuel cell system with on-board hydrogen storage. Manufacturers have been working on this technology for a number of years, and there are currently several fuel cell vehicles on the road. Examples include the Mirai by Toyota, and the Clarity by Honda. Fuel cell vehicles have good range and rapid fueling. But hydrogen fuel is expensive and must be distributed, which requires new infrastructure that is different from gasoline and electricity infrastructure. Costs of these vehicles are currently substantially higher than either a battery electric vehicle or a gasoline vehicle.

2.3. Medium and Heavy-Duty Trucks

As Figure 1 shows, medium and heavy-duty trucks are also a significant source of GHGs, contributing about one quarter of all transportation sector carbon emissions. More important is the fact that they represent a growing share of emissions from transportation. Light-duty vehicle emissions have grown about 15% since 1990, while emissions from medium and heavy-duty truck fleets have almost doubled during this period. From Fast Facts from US Transportation Sector GHG Emissions, 1990–2018. USEPA, 2020.https://nepis.epa.gov/Exe/ZyPDF.cgi?Dockey=P100ZK4P.pdf. As more progress is being made in the light duty fleet first, the medium and heavy-duty trucks will become an increasingly important target for GHG emissions in the future.

Medium and heavy-duty fleets cover a range of different vehicle sizes, types, and uses. Their size and diversity make emissions reductions more difficult. To date, little progress has been made on reducing emissions from the truck sector. While fuel economy regulations have been in place for light duty vehicles since the 1990s, initial federal fuel economy regulations for truck emissions began with the 2014 model year, with more stringent regulations that were to begin with the 2018 model year and become increasingly strict up to 2027. Fuel economy standards differ by truck category, with the three overarching segments being heavy-duty pickup trucks and vans, vocational vehicles, and combination tractors. https://www.eesi.org/papers/view/fact-sheet-vehicle-efficiency-and-emissions-standards. Although these requirements were put on hold during the Trump Administration, they are likely to become binding again when the new Administration takes office in January of 2021.

As we discussed with light duty vehicles above, heavier vehicles are more difficult and more expensive to electrify. For pure battery electric vehicles, larger or more batteries are needed for trucks, depending on vehicle use and recharging needs. There are currently some companies that have invested in electric vehicles in medium duty truck applications. Early candidates for zero emission technologies are for trucks that can be centrally fueled, have low average speed, and operate on stop-and-go duty cycles. This includes city buses, and some city or regional delivery fleets. Several manufacturers are starting to offer commercially available Class 3–8 battery electric trucks and vans. Nearly all truck manufacturers have EV demonstrations in progress or have announced plans for commercialization. Much of this is spurred by on-going regulations in California, as we discuss below.

3. Potential for EVs to Reduce GHGs in the Transportation Sector up to 2025

While EVs have had only a small impact to date, they are anticipated to play a much larger role in decarbonizing the transportation sector in the future. Here we analyze the possible impacts that EVs will have on GHG emissions by 2025.

These next five years are critical for setting the stage for much larger EV sales in the future. If sales growth continues with the associated technology advances and learning rates, then sometime after 2025 many EV sizes and types will be in a position to compete with gasoline vehicles on cost and driving range. Government policies will be needed during this phase while EVs are still too expensive and less convenient in many applications. We first look at passenger vehicles, and then at the heavy-duty trucking sector.

3.1. Small GHG Reductions even with Increasing Sales of EVs in the Passenger Vehicle Sector by 2025

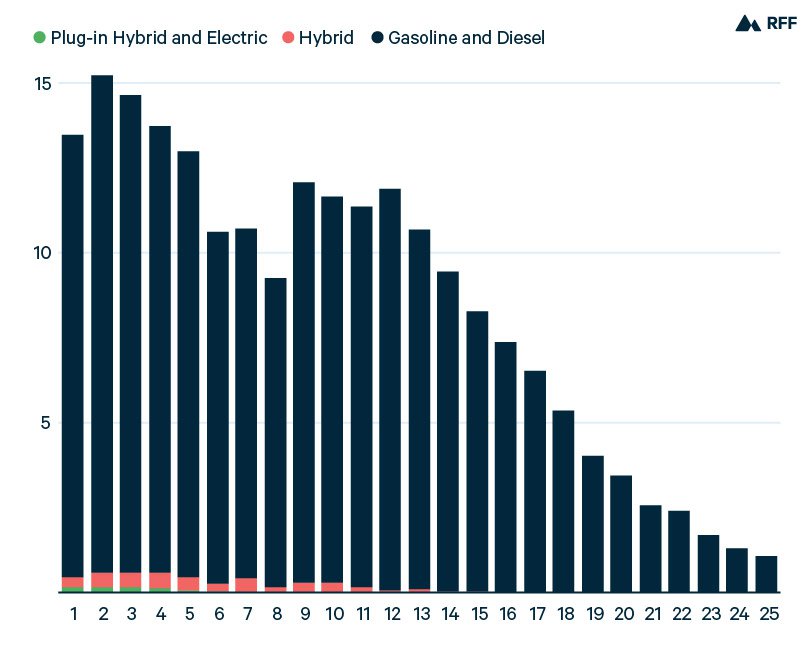

Even with accelerating new EV sales, near term reduction in carbon emissions from the light-duty vehicle fleet is extremely challenging. Figure 5 shows the composition of the passenger vehicle fleet owned and operated by households in 2017. The figure shows the number of vehicles in operation by age and by fuel type. Each bar represents a count of the number of vehicles in operation for a given age. For example, in 2017, about 15 million two-year old vehicles were owned and operated by households.

The figure shows startling features of the passenger vehicle fleet. The first is that a large majority of the passenger vehicle fleet is run on gasoline or diesel fuel, as represented by the blue bars. Tiny slivers of plug-in hybrid and battery EVs begin to appear at age 4. The second feature is that gasoline vehicles are long lived. The figure shows that households continue to own 12-year-old vehicles nearly as frequently as they own new vehicles. Ownership of vehicles only older than 12 years of age eventually starts to decline. This figure has changed slightly since 2017, as new EV sales have increased since then. But the overall picture remains the same: a large majority of US households own and operate gasoline vehicles, and these vehicles last a long time before being replaced.

These features make it extremely challenging for EVs to have a significant effect on transportation sector emissions in the short term. New EVs enter the left side of the age distribution in the figure. Gasoline vehicles remain in the fleet until they get scrapped, which can take several decades.

It is important to note that because gasoline vehicles remain in the fleet for so long, and they continue to be sold along side EVs (as long as EV sales are less than 100%), continued improvements in gasoline fuel economy are critical for reducing GHGs as the fleet is transitioning to electricity.

Figure 5. Composition of US Passenger Vehicle Fuel Types by Age in 2017

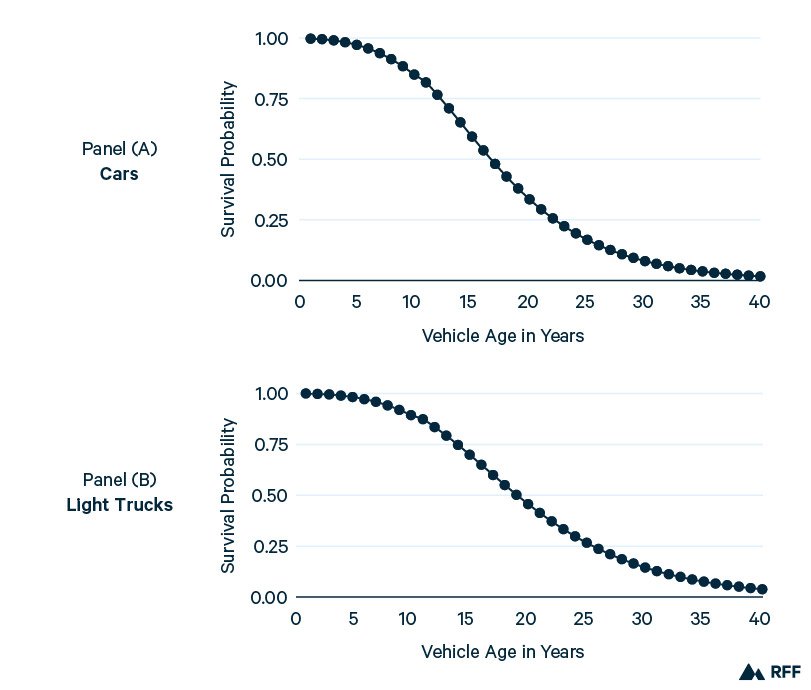

For EVs, their impact on emissions depends on two factors: the new vehicle market share of EVs and the rate at which vehicles survive over time. Currently, the new vehicle market share for EVs is 2 to 3 percent, so that new bars being added to the figure above will look similar (with a small green share and a large blue share of new gasoline vehicles). However, sales of EVs are expected to accelerate over the next few years, with many new models with higher range coming into the market, including offerings by GM, Volvo and VW in the compact crossover segment. Prices of these vehicles will be above similar ICE vehicles, but with continuing innovation in EV technology and greater scale in production, prices will continue to fall and range will increase. But the emissions effect of increases in new EV sales—due to new models entering the new vehicle market and improvements in vehicle attributes—is limited in the short run by a second factor, which is the turnover or scrappage rate of the current stock of vehicles. Figure 6 shows the likelihood that vehicles survive up to certain age. Panel (a) shows the survivability schedule for cars and panel (b) shows the schedule for light trucks.

Figure 6. Vehicle Survivability Schedules as a Function of Age

The figure shows that vehicle survivability probabilities are close to 100% for vehicles 5 years old or younger. Survivability probabilities are above 85% for both cars and light trucks that are 10 years old. These schedules along with the distribution of gasoline vehicles on the road in 2017 imply that a large majority of gasoline vehicles will remain in operation through 2025.

Thus increasing sales of EVs will result in slow reductions over time in GHG reductions. Given current technology improvements and policies in place to promote EVs, the best estimates are that share of EVs in new vehicle sales will reach about 10–15% of the passenger fleet by 2025. ICCT prediction based on market and regulatory evidence. https://theicct.org/sites/default/files/publications/US_charging_Gap_20190124.pdf. This will result in only modest GHG reductions. However, government policies in place through this period will affect how likely these sales rates will be reached, and these next few years set the stage for much larger growth in EVs in the future.

3.1.1. Current Policies that Provide Incentives for Passenger EVs

Several transportation sector policies provide incentives for sales of light duty EVs. These include policies at the federal, state and local levels. Here we discuss several of the major policies that have had an impact on EV adoption. We discuss the federal tax credit of up to $7,500, CAFE and GHG standards for passenger vehicles, and state level Zero Emission Vehicle (ZEV) sales mandate programs. We also include a brief summary of the many state and local policies that have been enacted to promote sales of EVs.

Federal and State EV Tax Credits

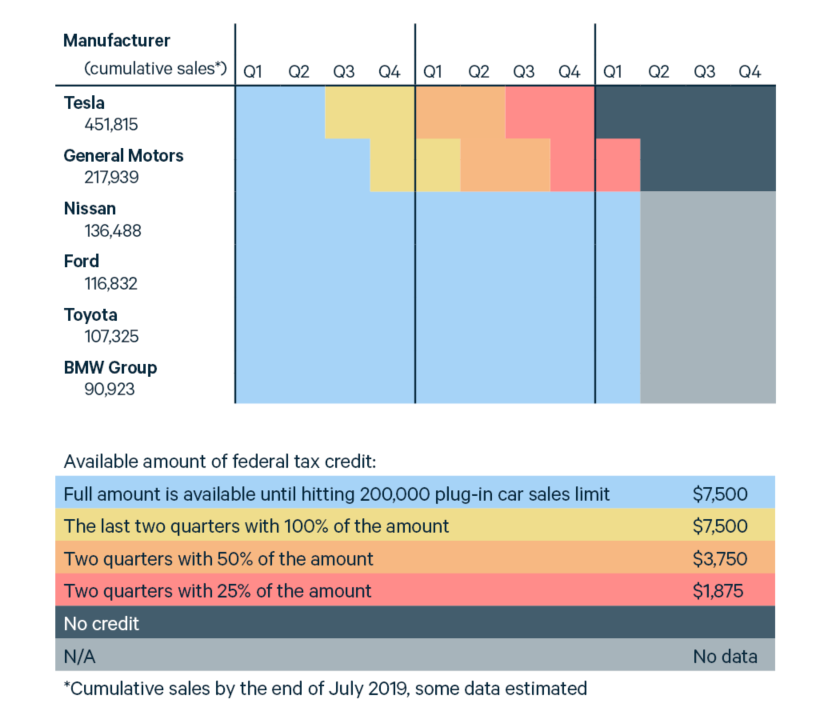

In 2008 the federal government enacted an EV tax credit of up to $7,500 for EV buyers. These credits were to be phased out for each manufacturer after their EV sales reached 200,000. The credit makes new EVs more affordable, and has led to higher sales of EVs. This credit is gradually being phased out as automakers hit the sales cap of 200,000 vehicles. Figure 7 shows the historical phase out of the tax credit.

Figure 7. Phase Out Schedule of US Federal EV Tax Credit

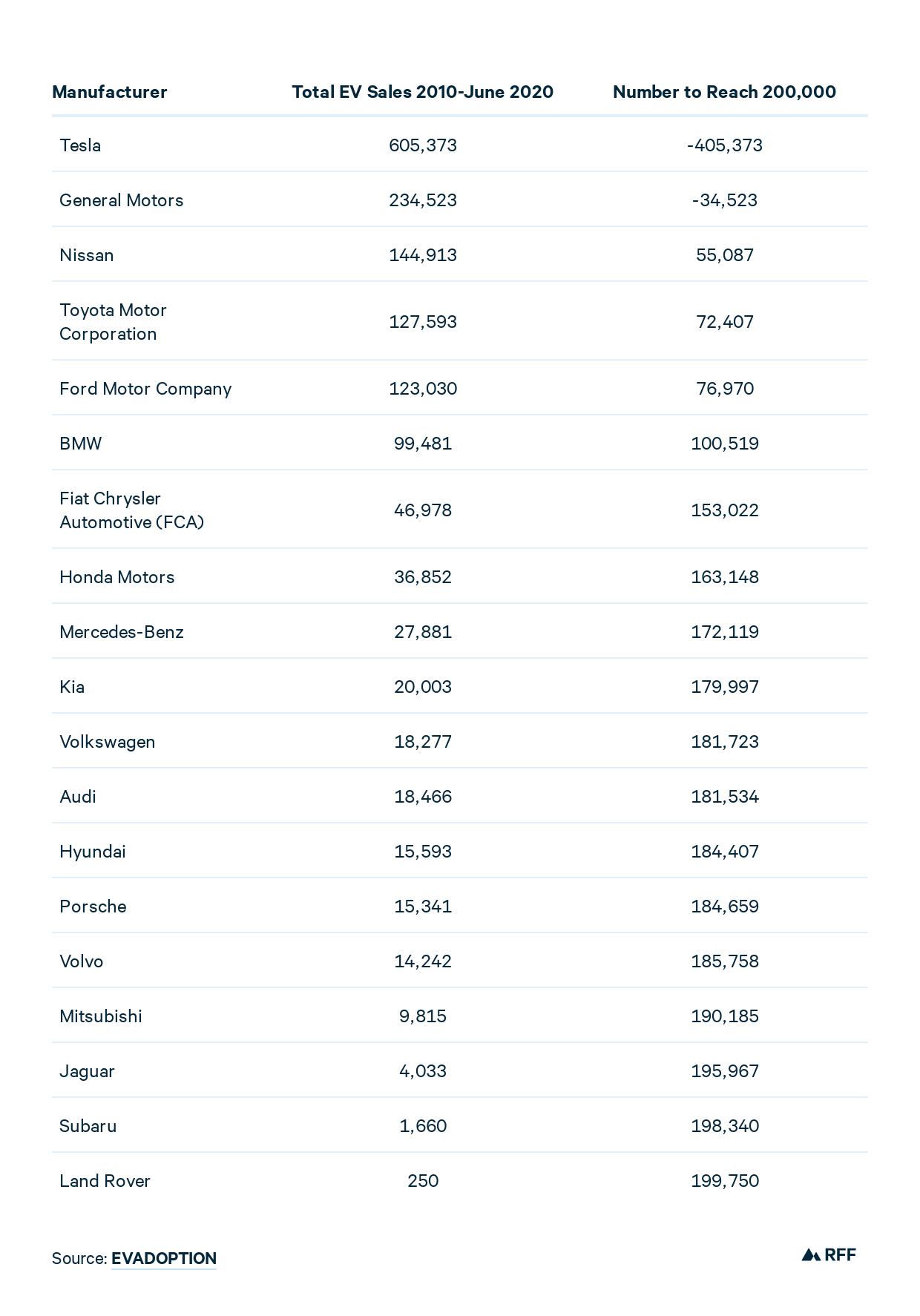

Table 2 shows the status of the tax credit through June 2020. The federal tax credit has completely phased out for the two largest sellers of EVs, Tesla and General Motors. Nissan, Ford, and Toyota, are approaching the sales cap of 200,000 and are expected to surpass the cap within the next year or two. As the credit phases out for more automakers, EVs effectively become more expensive to buy, which reduces their sales share of the new vehicle market. Unless the tax credit cap is removed or the design of the credit is modified, we expect EV demand to shrink without the credit in place.

Table 2. Status of Manufacturers Relative to Federal Tax Credit Cap, June 2020

The tax credit could be redesigned to be a more cost effective and equitable policy for increasing EV adoption. The current design of the tax credit tends to favor high income buyers, who are most likely to be able to claim the full tax credit. An alternative design of the credit could follow California’s Clean Vehicle Rebate Program (CVRP), which offers a direct rebate instead of a tax credit and has eligibility requirements that depend on household income: single filers with an income above $150,000 or joint filers with income above $300,000 are not eligible for the CVRP.

Redesigning the federal EV tax credit to follow the design of the CVRP would certainly make the credit more equitable and would likely make it more cost effective. Since lower-income households are generally more sensitive to vehicle purchase price, redesigning the federal tax credit to attract these households would likely lead to more “additional” EV sales, or sales that would not have occurred had the subsidy not been available. This would increase the number of EV sales sold per dollar spent under the program.

Another possible change to the current tax credit policy would be to remove the sales cap for each manufacturer. As we discussed above, two successful EV manufacturers, General Motors and Tesla, have already exceeded the sales cap. Meanwhile, EVs sold by other manufacturers continue to be eligible, including vehicles to be sold by new manufacturers such as Rivian and Lucid. The cap penalizes first movers and could cause consumers to delay purchases of EVs to obtain the credit from emerging companies.

Federal CAFE and GHG Standards for Passenger Cars

Federal GHG standards for passenger cars provide automakers an incentive to sell more EVs to meet the standards and to sell excess credits to under-compliant firms. EVs are treated as having zero GHG emissions under the GHG program. Therefore, by selling more EVs, automakers have an easier time complying with the standards. In addition, the federal standards play a key role in reducing GHG emissions during the phase-in of the transition to an electric fleet. As we have shown above, even with growing numbers of EV sales, many new vehicles sold each year will continue to be gasoline vehicles that will remain on the road for a long time. The more fuel-efficient those vehicles are, the lower the GHG emissions from the transportation sector as a whole.

In March 2020, the Trump administration finalized the SAFE Vehicles Rule that rolled back the 2017–2025 Obama CAFE and GHG standards for passenger vehicles. The new rule requires year-over-year increases in fuel economy and reductions in GHG emissions of 1.5% per year through 2026. This increase is much lower than the earlier standards passed under the Obama administration, which would have required a 5% annual year-over-year increase. However, with the election of a new President in November 2020, it is likely that there will be a return to stricter standards.

State Zero Emission Vehicle Programs

Zero emission vehicle (ZEV) programs require automakers to sell a certain number of EVs, typically determined as a fraction of total vehicle sales. They are another key policy that increases the market share of EVs in select states. Currently 11 states have ZEV programs: California, Colorado, Connecticut, Maine, Maryland, Massachusetts, New York, New Jersey, Oregon, Rhode Island, and Vermont. These states represent about 30 percent of new car sales in the United States. California, the largest new vehicle market among all ZEV states, and has EV sales requirements that increase significantly through time, with requirements for about 12–15% of sales by the 2025 model year.

Other State and Local Policies for EVs

Although some federal policies and grants are important for accelerating adoption of EVs, many policies are best tailored to the state or local level. This is because early EV adoption is emerging more quickly in some areas than others. Greater density of EV adoption is occurring where policies encourage it, and where costs can be kept low due to higher volumes of sales and charging usage. Policies that are being used at the state and local level include purchase rebates, states tax credits, grants or incentives for building of infrastructure, HOV lanes, and incentives or requirements for fleet acquisition of EVs.

3.1.2. Role of Infrastructure for Passenger EVs

Scaling up infrastructure will be critical to the goal of increasing EV sales over the next five years. Current estimates are that that only one-fourth of the workplace and public chargers needed by 2025 are in place, and that growth in charging infrastructure deployment would have to grow at about 20% per year to meet the 2025 targets. M. Nicholas, D.Hall and N. Lutsey. Quantifying the Electric Vehicle Infrastructure Gap across US Markets. (2019). ICCT. Washington, D.C. https://theicct.org/sites/default/files/publications/US_charging_Gap_20190124.pdf. The number of charging spaces needed depends on population density and consumer preferences for EV range and driving needs. National Plug-in Electric Vehicle Infrastructure Analysis. US Department of Energy. (2017). The charging needs are greatest in markets where electric vehicle sales are likely to grow most rapidly, including in many California cities, Boston, New York, Portland, Denver, and Washington, DC.

The types of infrastructure needed and the cost of that infrastructure vary a great deal across EV buyers. The majority of charging will continue to be from home often from standard Level 1 outlets (120 volt), but there is likely to be a relative shift in the residential market to higher power Level 2 (240 volt) charging as battery size and vehicle range increases. Low cost residential chargers combined with time-of-use electricity pricing that allows drivers to plug in during off-peak hours will soon allow some EVs to be competitive with gasoline vehicles.

On the other hand, some housing requires upgrades to existing electricity systems with higher costs for apartments and attached housing, costing as much as $1500 in some settings. Demand for workplace charging and public charging will also increase and is more expensive than residential charging. Public fast chargers, which allow for a charge in about an hour or less are the most expensive with stations costing from $25,000 to $100,000 or more.

The technology for charging will continue to improve. Tesla has recently introduced V3 supercharging stations in some locations—an expensive technology that can bring charge times down and serve many vehicles at once. However, charge times are still longer than for fueling a gasoline vehicle, and even with high utilization rates, charging costs per vehicle are high. Currently only the long range Tesla model 3 is capable of using these stations, and that model is more expensive than the standard, https://techcrunch.com/2019/07/18/teslasnew-v3-supercharger-can-charge-up-to-1500-electric-vehicles-a-day/. With variability in demand in different locations, and uncertainty in the size of markets and usage rates, it is proving difficult for public fast charging to be economically viable at least in the short run. H. Lee and A. Clark. Charging the Future: Challenges and Opportunities for Electric Vehicle Adoption. (2018). Harvard Kennedy School. https://projects.iq.harvard.edu/files/energyconsortium/files/rwp18-026_lee_1.pdf. But, public fast charging stations are important for ensuring greater EV sales over time.

Some states have developed innovative ways to fund infrastructure. In California, the Low Carbon Fuel Standard provides an incentive for electric utilities and others to put in fast charging stations by giving them LCF credits, which they can sell to gain revenue. Also, states can use up to 15% of the Volkswagen lawsuit settlement of $2.7 billion to invest in charging infrastructure. https://www.epa.gov/enforcement/third-partial-and-30l-second-partial-and-20l-partial-and-amended-consent-decree. There are many other state and local policies that have been used to subsidize EV infrastructure, often based on revenues from gasoline taxes or vehicle registration fees. States and local governments will need to develop new and creative ways of financing infrastructure in the future, as gasoline tax revenues decline with the transition to EVs. Cost-sharing arrangements between the federal government and local governments can be tailored for cities with high EV ownership, and efficient plans for use of funds.

3.2. Electrification of the Medium and Heavy-Duty Truck Sector to 2025

As we discussed above, there are a relatively small number of electrified medium duty trucks on the road today, but interest and activity in this sector is growing rapidly. Though currently few models are available in the various size categories, one analyst predicts that there will be as many as 195 models by 2023. https://blog.fleetcomplete.com/how-will-electric-vehicles-impact-the-trucking-industry. Growth in electric trucks is likely to be strongest for urban delivery and transport uses, and for urban buses in the short run. For example, one start-up firm, Arrival, has designed electrified urban buses, and will begin production in the United States. in 2022. UPS is partnering with Tesla and Amazon with Rivian to purchase thousands of electric delivery vans over the next few years. Nikola, a start-up company, will roll out its combined electric and fuel cell pick-up truck to the market in partnership with GM in the next few years. This segment represents an opportunity for EVs to make a difference in GHGs, because urban and local region delivery represents a growing share of truck VMT.

The largest long-haul freight trucks are also under development, and there are now a number of EV prototypes. The most promising technology for this segment may be powered by fuel cells, because of its efficiency and power. Over the next few years, upfront costs and infrastructure issues will keep these heavy-duty freight vehicles out of the market for vehicle electrification. But these vehicles are an important target for reducing costs as time goes on, because they currently contribute over 60% of all truck GHG emissions (FHWA).

During this period, the up-front costs of electrified trucks in even the most cost-effective applications will remain above ICEs. The upfront cost of zero emission trucks can be as much as 50–60% higher than for equivalent ICE (source: HIS through LA Times). But the total cost of ownership (TCO) calculation, which trucking firms use to purchase new trucks, will be falling for electrified vehicles as battery costs fall, and infrastructure improves. Combined with government policies, as we discuss below, electrified trucks will enter the market in larger numbers.

However, the effect of the entry of a small share of electrified trucks during this period is likely to have only a small impact on overall emissions from this sector for the reasons we discussed above for light duty vehicles. The large number of current gasoline and diesel trucks will remain on the road for a long time, and many new gasoline and diesel trucks will continue to be sold. Further, most trucks have even longer survival rates than cars.

3.2.1. Government Policies Will Help Jump-Start Electrified Trucks during this Period

Fuel Economy and GHG Regulations

Federal fuel economy and GHG regulations are in place for medium and heavy duty trucks through the 2027 model year, and they project a 25% improvement in fuel economy and GHG emissions from 2015 levels. Stricter fuel economy requirements may induce some fleets to move toward electrification as a way of complying, but this is unlikely to be a major factor for transition to electrification. However, as we pointed out above, the stricter fuel economy regulations play an important role in keep GHG emissions down in carbon-fueled vehicles during the transition to electricity. The Trump administration chose not to enforce fuel economy standards for trucks over the last few years, ACEEE, At Risk: Heavy Duty Vehicle Fuel Economy, https://www.aceee.org/blog/2019/08/epa-stalls-progress-heavy-duty. but the new Biden Administration is likely to enforce or even strengthen them.

Zero Emissions Mandate

The California Advanced Clean Trucks program requires manufacturers of medium-duty and heavy-duty commercial trucks to begin selling zero-emission versions in 2024, requiring 100,000 to be sold in California by 2030 and 300,000 by 2035. Some have suggested the program be delayed for two years, until 2026, to allow more time for truck-specific charging systems to be installed and for the consideration of policies to encourage the purchase of such vehicles. The mandate includes trucks ranging from pickups that can haul three-quarters of a ton to large semi-tractor trailer trucks. About 75,000 such trucks are currently sold each year in California. If these requirements can be enforced, they would have a significant effect on new truck sales in California. But we note that previous sales mandates for passenger cars in California were delayed by many years due to technological and cost considerations. See McConnell and Leard (2019): https://www.rff.org/publications/working-papers/californias-evolving-zero-emission-vehicle-program/.

State Vehicle Purchase Incentives

Several states have put policies in place that provide subsidies for the purchase of zero emission trucks and buses. California’s Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) gives up to $315,000 at the point of sale for low and zero emission vehicles that operate in California. The program has been so popular that the entire $142 million budget has been spent, and the state is looking for more funding sources.

Low Carbon Fuel Standard

California’s Low Carbon Fuel Standard (LCFS) provides a strong incentive for fleet operators to purchase electrified trucks. Fuels supplied for transportation in the state must comply with a maximum carbon content, so high carbon fuel suppliers such as gasoline and diesel companies need to buy clean credits to offset their emissions. Fleet operators who purchase electrified trucks will earn credits that they can sell. Revenues from such sales can reduce total cost of ownership of zero emission trucks significantly. Figure 1. https://www.c2es.org/site/assets/uploads/2020/02/Insights-On-Electric-Trucks-For-Retailers-And-Trucking-Companies.pdf.

Zero Emission Zones in Cities

Cities are beginning to designate zero emission zones, or central downtown areas of cities that require low or zero emissions, as a way both reduce pollution and provide a strong incentive for electrified vehicles. A small area of Santa Monica is planning to soon require that all deliveries within the region be done by zero emission vehicles. It will be important to assess the costs and benefits of such experiments.

3.2.2. Infrastructure for the Trucking Sector

Infrastructure investment will also be important in this initial growth period for EV and fuel cell trucks. Charging infrastructure is different for electric trucks because of the size of truck batteries, and because in some cases fleets of trucks can be fueled at central locations. The charging infrastructure would be high cost, but can be used efficiently at high usage rates. One recent example is the Frito-Lay plant in Modesto, California that is in the process of going to all-electric freight delivery equipment instead of diesel. Funding for the project comes in part from revenues generated by the cap and trade program that is part of California’s Climate Initiative.

Fast charging public infrastructure for on-road medium and heavy trucks will be even more expensive than for passenger vehicles. However, there may be more certainty about routes and usage rates for large long distance freight trucks. Predictability and efficiency in trucking may mean that infrastructure for EVs will be less of a barrier than it is for passenger vehicles. Federal, state and local policies for funding infrastructure will be important in the early years of EV introduction.

4. Role and Impact of EVs in Decarbonizing the Transportation Sector in Longer Term, after 2025

4.1. Decarbonization of Light Duty Fleet in the Longer Term, 2025 to 2050

With continuing technological improvements and government policies, electrified vehicles are likely to come into the market in increasingly large numbers after 2025. And most estimates are that the overall costs of ownership for EVs are likely to fall below the cost of that for ICEs before 2030 for all but the largest vehicles. Forecasts suggest this will happen around 2027 for EVs with about 250 miles of range, and earlier for lighter or shorter range vehicles. Lutsey and Nicholas (2019). Update on Electric Vehicle Costs in the United States through 2030. ICCT, working paper 19-06. https://theicct.org/sites/default/files/publications/EV_cost_2020_2030_20190401.pdf. Others caution, however, that estimates of EV penetration have been overly optimistic in the past, and that getting costs down for both battery electrics and fuel cell vehicles to compete with ICEs for a large share of the market will still require technology innovation and strong government policies. Even when EV costs and range are similar to those of gasoline vehicles, consumers are heterogeneous and not all will chose to purchase an EV. Recently, a survey of drivers found that about 57% of them would consider buying an EV. That percentage may grow over time but it is unlikely that all buyers will chose EVs. Plugging In: New Survey Examines American Perception of—and Resistance to—Electric Vehicles. Resources for the Future, 2020.

For larger vehicles, significant improvements in battery density are needed for battery electric vehicles. For fuel cell vehicles, hydrogen storage and safe hydrogen delivery are critical. How quickly costs fall for hydrogen fuel and associated infrastructure will determine the extent to which fuel cell vehicles emerge along side battery electrics during this period.

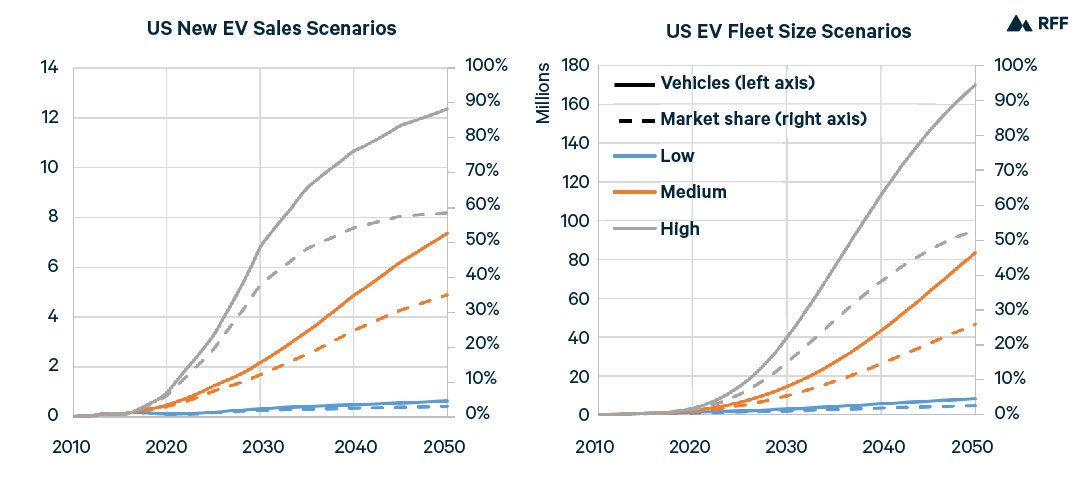

Although the future path of the light duty EV market in the US is uncertain, there are several forecasts that attempt to reflect this uncertainty. One set of forecasts by the Electric Power Research Institute (EPRI) builds off actual EV sales through 2016, and is informed by government and private sector forecasts. The EPRI document: https://www.energy.gov/sites/prod/files/2019/12/f69/GITT%20ISATT%20EVs%20at%20Scale%20Grid%20Summary%20Report%20FINAL%20Nov2019.pdf. Informed by National Academy of Sciences panels, Bloomberg, the US Energy Information Agency and NREL. This forecast is only for light duty battery electric vehicles, and does not include fuel cell vehicle projections. These forecasts depend on assumptions about technology improvements and policies.

Figure 8. EPRI Forecasts of EV Sales, 2020-2050

Figure 8 shows the EPRI forecasts for low, medium and high forecasts. The medium forecast projects 2.2 million in EV sales by 2030, which is 12% of new car sales in that year (figure on left). Sales up to this year as shown in the figure on the right will then result in a total of 14 million EVs on the road, or 5% of the fleet. By 2050 the medium forecast shows that close to 30% of LDVs on the road would be EVs.

The federal government’s major forecast of energy trends up to 2050 (AEO, reference case) https://www.eia.gov/outlooks/aeo/pdf/AEO2020FullReport.pdf. projects EV sales rates only slightly above the low forecast shown above. Those forecasts do not include any policy or major technology change from what is in place by 2020. We can conclude then that the low estimate above reflects the case of no further policies, and no significant technology innovations. To get to the medium or high paths will take significant policy actions.

Figure 8 shows again the difficulty of the transition away from carbon-based vehicles. It takes a long time to turn the fleet over. And what are the implications for GHG emissions as a result of, for example, a path for EVs like the medium scenario? One analysis found that growth in sales of EVs like the medium scenario resulted in GHGs from LDVs 31% lower by 2030 than 2015 levels, and 63% lower in 2050. Transitions to Alternative Vehicles and Fuels, National Research Council, National Academy of Sciences, Washington, DC. 2013, pg 110. https://www.nap.edu/read/18264/chapter/. However, to get these results, a set of strong government policies was needed.

Such a reduction in GHG emissions by 2050 is still a relatively small share of emissions from the transportation sector. The light duty fleet that accounted for 59% of emissions in 2018 (Figure 1 above) will be a smaller share of the total emissions from transportation by 2050. Emissions from this sector are likely to fall due to EVs and better fuel economy of ICEs, even accounting for projected higher vehicles miles traveled. In contrast, emissions from the heavy and medium duty trucking sector are projected to grow at a more rapid rate in terms of vehicle miles travelled, and fuel economy improvements and EV sales are unlikely to offset that growth. AEO (2020): https://www.eia.gov/outlooks/aeo/pdf/AEO2020FullReport.pdf.

California and 15 other states joining California are trying to accelerate the turnover of the fleet in their states. California’s recent policy to require that sales of all new passenger car sales be zero emitting (electric or fuel cell) by 2035 would put California on a faster path than the high estimate shown in Figure 8 above. Executive Order N-79-20 requires 100% of sales of new passenger vehicles in California to be zero-emission by 2035. This goal is to some extent aspirational, but it signals how serious the state is about reducing GHG emissions.

4.2. Decarbonization of the Medium and Heavy-Duty Fleets in Longer Term

Technology and policy to reduce carbon emissions from the medium and heavy-duty fleets are at initial stages now as we described above. There will continue to be progress after 2025 in reducing emissions from these trucks, both because it is likely that fuel economy standards will continue to become stringent over time, and because of the introduction of more electric and fuel cell vehicles. How quickly emissions are reduced will again depend on policies put in place and innovations in zero emission technologies.

As an example of the potential importance of policy, a coalition of 16 states including California just this year signed a Memorandum of Understanding (MOU) committing to accelerate the adoption of zero-emission technology for medium and heavy duty vehicles, with a target of 100% zero-emission new medium and heavy-duty truck sales by 2050. One analysis of the GHG impact of this effort is that it would reduce total nation-wide truck emissions by 1% by 2035 and by 2% by 2045. If a similar commitment were to be made for the entire country, truck GHG emissions are predicted to fall by 5% by 2035 and 18% by 2045. Rhodium Group. States Pave the Way for a Zero Emissions Future. 2020, https://rhg.com/research/states-zero-emission-vehicles/.

4.3. Infrastructure and Policy after 2025

We expect that the set of issues facing the transition to electric vehicles will change sometime after 2025. If EVs do achieve cost and range levels that are similar to gasoline vehicles in many vehicle segments, then at least some of the government policies we have described could be phased out. Fast charging infrastructure and its interface with the electricity sector could still be evolving, but much will be learned about types and usage of chargers in the next 5–7 years.

However, as the market moves toward a much larger share of EVs, there will be other issues that become important. The electricity needed from the utility sector will become significant, and that load will need to be managed efficiently, with new rate designs and better smart metering. Further, GHGs emissions from the regional electricity providers will become key. In fact, the success in reducing GHGs from the shift to large numbers of EVs on the road in 10 to 20 years will depend on GHG emissions from electric utilities.

5. Discussion of Policies for Accelerating Adoption of EVs

We have described several policies above that are in place for encouraging the transition to EVs. Here we briefly discuss the approach to policy going forward and identify the advantages and disadvantages of some of the major policy tools.

Government policies to encourage greater sales of EVs should be most intensively used in the next 5–10 years as battery and fuel cell costs continue to fall to the point where they are comparable to gasoline vehicles for many vehicle sizes and buyers. These policies include incentives to consumers, and incentives for the building of infrastructure. Policies such as sales mandates of vehicles affect the supply of EVs but will not be as effective if they are not combined with policies to also increase demand such as an EV subsidy or a carbon tax. S. Yeh, D. Burtraw, T. Sterner and D. Greene. (2020). Tradable Performance Standards in the Transportation Sector, Resources for the Future Working Paper 20-18. https://www.rff.org/publications/working-papers/tradable-performance-standards-transportation-sector/.

As technology improvements continue, spurred by higher volumes and learning, and many electric vehicles are able to compete commercially with gasoline vehicles, other policies will become more important. Issues that arise due to the large scale of electricity generation and charging will need to be addressed. And, the unprecedented increase in battery purchases to power millions of vehicles will require major increases in the extraction of metals such as lithium, nickel and cobalt around the world, creating scarcity in some of these markets. And, the environmental and human impacts of US purchases of these metals will need to be addressed in environmental and trade policy.

Some major policy tools include the following:

Fuel Economy Standards

The Federal fuel economy standards will continue to get stricter over time for both passenger vehicles and for medium and heavy-duty trucks. These standards improve fuel efficiency and reduce fuel use, although they are subject to a rebound effect—the cost per mile for driving falls so drivers have an incentive to drive more. They are likely to have only small effects on adoption of electrified vehicles, but they provide important GHG reductions from gasoline vehicles as the fleet is becoming electrified over time.

ZEV Sales Mandates

A sales mandate has been used in California and other US states to require the sale of EVs, as we described in the policy sections above. California implemented a sales mandate for light duty vehicles 30 years ago, though it has only been effective at bringing EVs to the market in the last roughly 10 years. See California’s evolving zero emission vehicle program. McConnell and Leard (2019) Resources for the Future: https://www.rff.org/publications/working-papers/californias-evolving-zero-emission-vehicle-program/. Technological improvements were more challenging than expected in the early years of the program.

At the federal level, Senators Merkley and Levin recently proposed a national mandate for promoting EVs, the Zero-Emission Vehicles Act. This proposal would follow California’s recent announcement to ban the sale of new gasoline vehicles in California by 2035. It would stop the sale of new US gasoline-powered vehicles in all 50 states by 2035. To phase this in, the Act would require that 50 percent of new passenger vehicles sales are ZEVs by 2025. This requirement would increase 5 percent each year to reach 100 percent by 2035. It is not clear how this policy would be implemented. It would take huge subsidies and other major policy initiatives to get to 50% sales of EVs by 2025. On the supply side, it is not clear that it is even possible to move that quickly to retool vehicle manufacturing facilities.

Subsidies, Rebates and Tax Credits

Policies that influence the demand for EVs include subsidies which provide a direct payment to buyers of an EV, rebates which lower the price of an EV at the point of sale, and tax credits which lower a buyer’s tax payment at the end of the year. There is currently a federal tax credit enacted in 2008 for the purchase of many vehicles as we described above in section III. In addition, many states have rebates or credits available for EV buyers. These policies should be revisited with an eye to the goals of the policy and their costs and effectiveness. We argue above that the current federal tax credit disadvantages some manufacturers in today’s market. It is also highly regressive, favoring high income buyers.

Biden/Schumer Clean Cars for America Plan

In July 2020, Joe Biden introduced a proposal for increasing EV ownership in the US. A key feature of Biden’s proposal is the Clean Cars for America climate proposal, which is based on Chuck Schumer’s proposal of the same name. Under the Schumer plan, new car buyers who trade in a gasoline-powered vehicle that is at least eight years old would receive a rebate starting at $3,000 to purchase a new clean-energy vehicle. The size of the rebate would be larger for low-income households and for American-made cars. The rebates could reach as high as $5,000-$8,000. To remove dirty vehicles from the fleet, the traded-in gasoline-powered vehicles would be scrapped.

A key feature of this proposal that differentiates it from existing regulations is its emphasis on expediting the removal of gasoline vehicles from the fleet. Our analysis above illustrated that the existing gasoline fleet takes a long time to turn over. This proposal targets turning over the existing fleet more quickly by buying up older vehicles.

The proposal aims to use $392 billion to replace 63 million gasoline-powered vehicles with clean cars over 10 years. It is a much larger version of the earlier “cash for clunkers” program implemented in 2009. That program did remove older vehicles from the road, but it was found not to be a cost-effective approach for reducing emissions. Cash for Clunkers: An Evaluation of the Car Allowance Rebate System, Brookings Institution. 2013. https://www.brookings.edu/research/cash-for-clunkers-an-evaluation-ofthe-car-allowance-rebate-system/#%23Brookings. And Evaluating Cash for Clunkers: Program Effect on Auto Sales and the Environment, Resources for the Future, 2012. https://www.rff.org/publications/journal-articles/evaluating-cash-for-clunkersquot-program-effects-on-auto-sales-and-the-environment/.

Feebates

Feebates combine the approach of a rebate for EVs with a fee for vehicles that produce carbon emissions. They can be levied at the point of new vehicle purchase as a type of registration fee/rebate, thereby providing incentives for EVs and disincentives gasoline vehicles. One way of implementing a feebate system is to assign a fee or a rebate according to each vehicle’s GHG emissions. A benchmark or average vehicle can be set so that the policy is revenue neutral—in other words, rebates to vehicles that are lower emitting are just offset by higher fees on higher emitting vehicles, so the program needs no revenue from other sources. Such feebates change the relative cost of different vehicles and can accelerate the adoption of the higher cost EVs without the need for raising money for EV subsidies. Several countries are now using feebate policies with some success. For example, France has had a feebate policy in place for several years. https://theicct.org/blog/staff/practical-lessons-vehicle-efficiency-policy-10-year-evolution-frances-co2-based-bonus. Some modified feebate system could be effective in the US for providing incentives for EVs.

State and Local Policies

State and local policies will continue to be important tools for accelerating the transition to EVs. The diversity of preferences, driving needs, and population density across states and local areas create a need for flexible and differentiated policies.

EV sales are highest in local and metropolitan areas with the highest incentives, such as in Los Angeles, San Jose, Denver, and Seattle. Credits in these areas tend to be between $2,000 and $5,000 per vehicle. A. Bui et al., “Update on Electric Vehicle Adoption across US Cities,” report (Washington, DC: International Council on Clean Transportation, 2020), https://theicct.org/publications/ev-update-us-cities-aug2020. Such incentive policies are costly, so innovative regulatory approaches that generate revenue to be used for EV programs can be developed, such as California’s cap and trade program, and its low carbon fuel standard.

6. Conclusion

Electric vehicles are a key part of the effort in the US to significantly reduce GHG emissions by mid-century. Despite significant success in recent years in achieving lower battery costs and increasing model availability and sales of new EVs, EVs remain more expensive than gasoline or diesel vehicles and take longer to refuel. But the transition has begun, and innovation and policy will both spur further progress.

We highlight in this paper several significant barriers in the transition to EVs: EVs enter the fleet only as a share of new cars, and the turnover of the entire fleet happens slowly, turning over completely in 20 years for cars and up to 25 for trucks. Progress in reducing GHGs will thus be gradual. However, policies can increase the rate of adoption of EVs and the time to turnover of the fleet. Another barrier is the cost of infrastructure, especially public high speed charging. EVs must be able to compete with gasoline vehicles on all dimensions to induce consumers and businesses to buy them in large numbers. Fast low-cost charging is essential if EVs are to compete with internal combustion engine vehicles, but high speed charging infrastructure and fueling has a ways to go before it is economic. Federal-local partnerships for developing fast-charging infrastructure projects that are cost-effective is a promising opportunity for Congressional support during the economic recovery over the next few years.

A range of policies will need to be adopted, some for the next five to ten years as costs of EVs continue to decline, and different policies later. Shorter term policies will need to target consumers to induce them to buy more EVs, and others will target manufacturers to produce and market EVs. A carbon tax or a gasoline tax would have an incentive effect on both consumers and producers and could be implemented together with many of the policies we described above. Fuel economy standards have been in place since the 1970s and remain a popular way to regulate vehicle emissions. They will induce some manufacturers to produce and sell more EVs, but they also help reduce GHG emissions during the period of transition when gasoline vehicles are still being sold.

Because regulatory policies will be so important during this transition to EVs, it is key that there is transparency and stability of policies on the part of regulators. A significant amount of long-term planning and coordination will be necessary to ramp up the volume of batteries, electricity, hydrogen and vehicles that will be needed to make EVs a significant fraction of new vehicle sales. Coordinated and cost-effective policies will allow the private sector to meet these goals efficiently.

An important issue that we have not addressed in this paper is that for both light duty vehicles and trucks, the effect of electrification of vehicles on GHG emissions depends on carbon emissions from the power sector. Carbon emissions from the power sector currently and through 2025 will vary a great deal by geographic areas of the country. In fact, a full assessment of the GHG implications of the transition to EVs depends on developments in the power sector. RFF will be undertaking such and analysis in the coming year.

![EV Report v2[26849]_Page_01.jpg](https://media.rff.org/images/cover_1YCfXNe.2e16d0ba.fill-620x800.jpg)