Effects of 2017 US Federal Tax Overhaul on the Energy Sector

An examination of the effects of the 2017 Tax Cuts and Jobs Act (TCJA) on the US energy sector.

This paper examines how the Tax Cuts and Jobs Act (TCJA) will affect the US energy sector. It combines qualitative analysis of a range of TCJA provisions with estimates from the Tax Policy Center’s Investment and Capital Model of how a narrower set of provisions will change marginal effective tax rates (METRs) for five major energy industries.

Key Findings:

- The TCJA initially lowered effective tax rates for the energy sector substantially.

- However, long-run tax cuts are much smaller because of expiring provisions.

- By 2027, many energy sector firms (especially pass-through entities, such as master limited partnerships) will face higher effective tax rates than under pre-TCJA tax law.

- Cuts to corporate income tax rates substantially reduce METRs for corporations, with the largest decreases going to sectors with higher pre-TCJA effective tax rates, which means energy sector corporations on average benefit less (as a percentage of income) than corporations in other sectors of the economy.

- Within the energy sector, corporate income tax rate cuts provide a relatively large METR cut for petroleum and coal products and a much smaller cut for oil and gas extraction.

- Corporate tax rate cuts do not affect taxes for pass-through entities.

- Bonus depreciation for new investment cuts METRs more in the energy sector than in the rest of the economy.

- Oil and gas extraction gains relatively little from bonus depreciation, because it already benefits from existing provisions that accelerate investment deductions.

- Bonus depreciation phases down and then sunsets at the end of 2026.

- Limits on net interest deductions raise METRs for firms or sectors with relatively high debt loads. On average, this affects the energy sector more than other sectors of the economy. Renewable energy may be particularly affected by this provision, because it has a higher debt-to-equity ratio than other energy sectors (though we did not model that effect).

- Changes to the individual income tax also affect METRs. Cuts to individual income tax rates lower METRs for both corporations and pass-throughs. And the new 20 percent pass-through deduction substantially cuts taxes for qualified pass-throughs.

- Taken together, these two changes yield a relatively small METR reduction for corporations, which is largely similar across energy industries. They cut METRs more for pass-throughs, though that effect varies substantially across the energy sector, with relatively large cuts for petroleum and coal product pass-throughs but only a small increase for oil and gas extraction pass-throughs.

- Most individual income tax changes sunset at the end of 2025, including the individual rate cuts and pass-through deduction. But changes to inflation indexing (which slightly increase taxes) are permanent. Thus by 2026, changes to the individual income tax slightly raise METRs for all firms.

- The net effect of all the TCJA provisions modeled is lower METRs for the energy sector in the initial years after the TCJA took effect.

- But because the interest-deduction-limit change (which raises tax revenue) is permanent and more restrictive after 2021, whereas several of the taxcutting changes (bonus depreciation, individual rate cuts, and the passthrough deduction) are temporary, METRs rise over time.

- By 2027, many energy subsectors (including pass-throughs in all energy subsectors modeled and oil and gas extraction corporations) face higher METRs than they would have under pre-TCJA law.

- The base erosion and anti-abuse tax could reduce the value of the production and investment tax credits, but this effect seems unlikely to be substantial.

- Repeal of the domestic production deduction raises taxes for energy sector firms that previously qualified for this deduction, such as those in domestic oil and gas extraction and refining, as well as electric generation. But even for those firms, the loss of this deduction only partially offsets the benefit of the TCJA’s business tax cuts.

- New limits on net operating loss deductions substantially increase taxes for firms with highly variable income streams. This is potentially important for energy subsectors facing volatile prices, such as oil and gas.

- Repeal of the corporate alternative minimum tax provides a substantial benefit to industries that would otherwise have been subject to this tax. Mining and utilities have historically been disproportionately affected by this tax and thus are likely to benefit disproportionately from its repeal.

- The Joint Committee on Taxation (JCT 2017b) estimates that the TCJA cut revenues by $1.5 trillion over 2018–27 ($1.1 trillion when macroeconomic effects are included). All else equal, this will substantially increase federal borrowing.

- Higher federal borrowing will eventually lead to higher interest rates. This will raise the cost of borrowing for firms, and the energy sector is relatively capital- and debt-intensive.

- Increased borrowing will also likely lead to an appreciation of the dollar versus other currencies. This may have substantial effects on trade-exposed energy industries.

- Increased borrowing will create a greater need for future federal spending cuts or revenue increases, which could affect the energy sector.

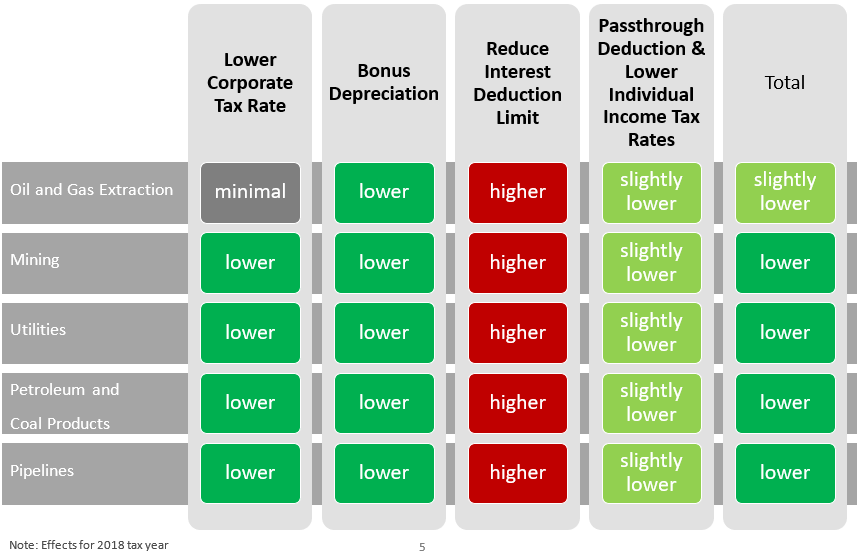

- Figures 1a and 1b summarize the effects of the provisions we model.

Figure 1a. How Tax Reform Provisions Change Effective Tax Rates for Energy Companies (Corporations)

Authors

Brandon Cunningham

California State University Employees Union (CSUEU)

Chenxi Lu

Urban Institute

Eric Toder

Urban Institute