Policies to Increase Mitigation of Agricultural Greenhouse Gas Emissions

This issue brief considers three policy approaches to voluntary reduction of ag-GHGs, all of which reward farmers and ranchers who shift practices toward lower-GHG production.

Introduction: Why and How to Mitigate Agricultural Greenhouse Gas Emissions

Achieving economy-wide net-zero greenhouse gas (GHG) emissions will require seizing mitigation opportunities in agriculture. In 2018, gross GHG emissions from agriculture accounted for roughly 9 percent of the US total (Figure 1). Gross emissions is total emissions before adjusting downward for carbon storage in lands and forests (sinks). These figures reflect direct emissions from agricultural processes, not counting emissions from energy consumption in agriculture. After accounting for sinks (Figure 2), net agricultural emissions were about 10 percent of net US emissions. Although this is less than many other sectors of the US economy, reducing agricultural emissions (even as output expands to meet growing global demand) contributes to net zero by reducing the need for “negative emissions”—that is, carbon capture and storage in sectors other than agriculture.

Discussion of alternatives for mitigating ag-GHG emissions has been spurred not just by reauthorization of the Farm Bill but also by the passage of the 2022 Inflation Reduction Act (IRA). In Title II, Sections 21001 and 21002 of the act call for about $20 billion in new funding for several USDA conservation programs to support voluntary ag-GHG mitigation (https://www.congress.gov/bill/117th-congress/house-bill/5376).

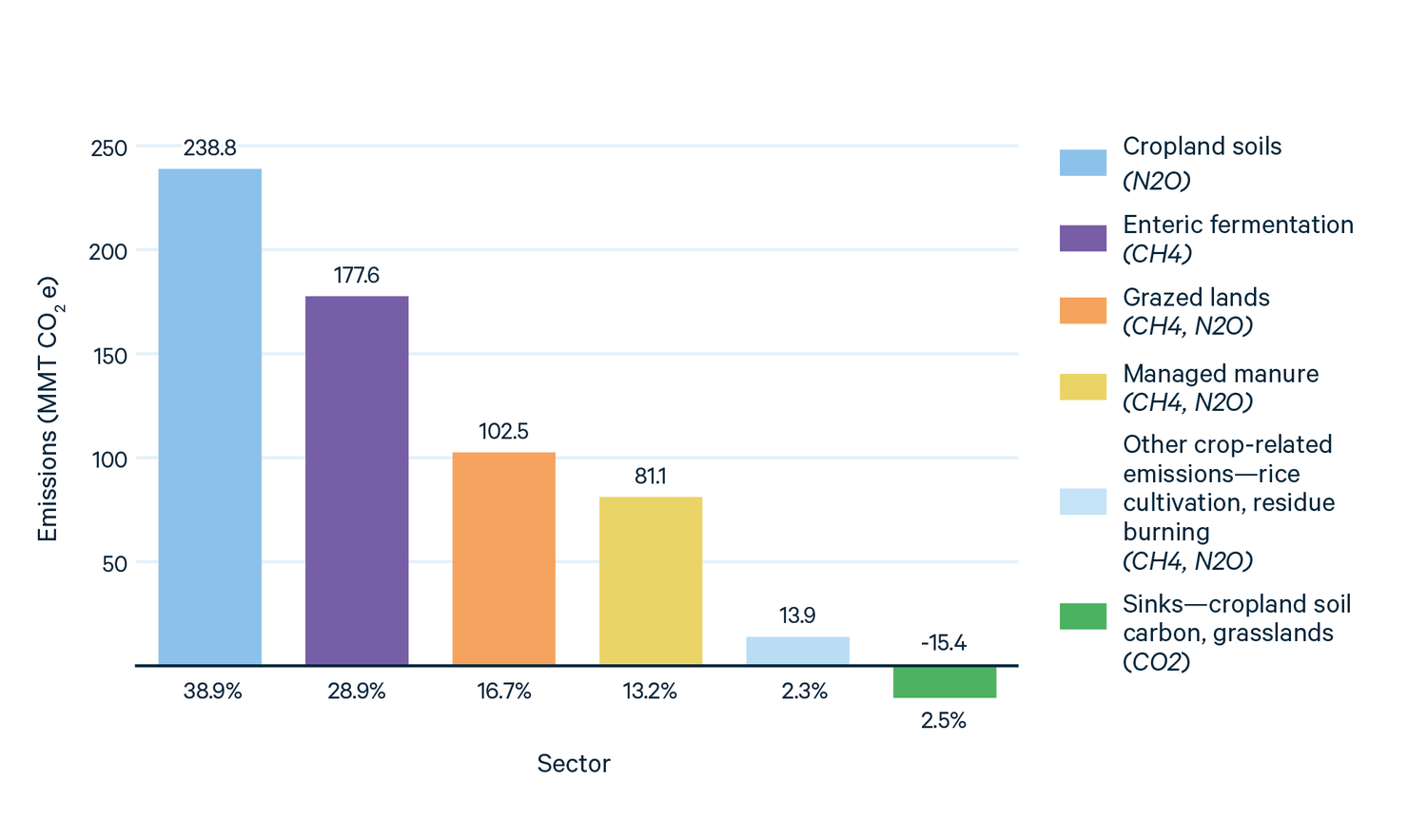

Ag-GHG emissions come from several sources (Figure 2), and some are inherently challenging to mitigate. Crop cultivation can release soil carbon to the atmosphere as carbon dioxide (CO2), depending on tillage practices, crop residue retention, and use of cover crops. Nitrous oxide (N2O) is emitted through chemical reactions in the environment from application of synthetic nitrogen fertilizers and organic fertilizers such as manure. N2O emissions are affected by agricultural land management that influences N fluxes among soils, crops, and the atmosphere (e.g., cultivation of N-fixing crops, such as soybeans). Methane (CH4) is emitted to the atmosphere through the digestive processes of farm animals and the anaerobic decomposition of manure. Livestock waste also produces N2O during the nitrification and denitrification of the organic nitrogen in livestock manure and urine.

We consider three policy approaches to voluntary reduction of ag-GHGs. Each functions by rewarding farmers and ranchers who shift practices toward lower-GHG production.

The first is increased government co-financing to induce lower-GHG agricultural techniques by farmers and ranchers. This approach builds on well-established USDA conservation funding mechanisms in Title 2 of the Farm Bill. The government also could offer expanded crop insurance coverage through its Risk Management Agency to cover potentially greater risk in production yields due to the use of lower-carbon techniques.

The second approach is “climate-smart” agricultural commodity programs. The Partnerships for Climate-Smart Commodities announced by USDA in spring 2022 will provide $2.8 billion to finance 70 pilot projects, with additional funding expected in a second phase (https://www.usda.gov/climate-solutions/climate-smart-commodities). The program overlaps with the conservation initiatives noted above, in that projects need to incorporate approaches for reducing ag-GHG emissions. However, it also supports improved practices for measuring and verifying GHG reductions and development of new markets for lower-GHG agricultural commodities (including lower-GHG supply chains). One question is how large the latent demand for such commodities might be, especially if they raise prices.

The third approach is ag-GHG emissions reduction credit mechanisms. A farmer or rancher using a lower-GHG agricultural method could earn credits based on the estimated GHG savings relative to business as usual over a specified time period, then sell the credits. The revenues from credit sales would allow farmers and ranchers to recoup the cost of more ambitious emissions mitigation. Many companies are already looking for high-quality emissions reduction credits as part of their voluntary plans for reducing their carbon footprints. Ag-GHG emission-reduction credits could be one source. They also could play a role in complying with mandatory GHG limits.

Beyond voluntary or regulatory measures, technological innovation can help reduce ag-GHG emissions. The design of policies to support technological innovation is beyond the scope of this paper, but this approach has great potential for moving the sector toward net-zero. Innovation is not a simple linear process. To illustrate, livestock feed additives can reduce methane production from enteric fermentation. Most feed additives provide only limited reductions (around 10 to 15 percent) (Hristov et al. 2013). Innovative feed additives include red algae (Asparagopsis), which seems to have the potential for reducing ruminants’ emissions by 50- to 90 percent, but its long-term effectiveness and consequences for human or animal health are unknown. In addition, the species of red algae under consideration is considered invasive in many countries (Hegarty et al. 2021).

Figure 1. 2018 US MMT CO2e Emissions Breakdown by Sector, Percent of Total Emissions

Figure 2. US MMT CO2e Agricultural Emissions by Activity, Percent of Total Emissions

2. Farm-Level and Programmatic Barriers to Implementation of Ag-GHG Mitigation Policies

Before discussing the three approaches, we note some challenges in implementing ag-GHG mitigation policies. Two general categories of barriers may hold back adoption of lower-GHG practices by individual farmers and ranchers.

Technological and economic knowledge barriers. How does a particular lower-GHG method fit with other elements of the farm’s technology base? How costly is it to find that out and then evaluate the return from using the new practice? How much will the required investment reduce adoption incentives, especially for smaller and less well capitalized operations? What technological and economic uncertainties could hinder adoption by farmers and ranchers who are risk averse (Barham et al. 2014)?

Social and behavioral barriers. What noneconomic hurdles might impede adoption of a lower-GHG method? See Baumgart-Betz et al. (2012) and Reimer et al. (2012) for discussion of factors affecting adoption of agricultural practices. For example, would an agricultural community’s social norms and customs about what constitutes good farming comport with the new practices?

Three fundamental challenges arise in implementing policies or programs for ag-GHG mitigation. How these challenges are addressed will determine the efficiency and effectiveness of a policy or program.

Measurement uncertainty The word “measurement” is taken here to include indirect measurement through proxies or partial reliance on modeled outcomes. is due to technical limitations on measurement capabilities and scientific debate about the effectiveness (including permanence) of practices for reducing GHGs. One important example is including measures to restore or increase soil carbon on working lands; see Powlson et. al. (2014); and Amundson and Biardeau (2018). The debate concerns both measurement challenges (Oldfield et al. 2021) and the increase in N2O emissions that often accompanies these practices (Lugato et al. 2018; Davies et al. 2021). It is amplified by heterogeneity in farm-level conditions. In lieu of direct measurements, various quantitative models are used to estimate the impacts of ag-GHG mitigation activities. Most models describe “average farms,” however, because they are not parametrized to account for farm-level heterogeneity in emissions reduction and cost. Even when models can simulate a variety of soil and environmental conditions, parameterizing them for numerous individual farm types is unrealistic.

Baseline uncertainty arises because it is difficult to establish what farmers’ and ranchers’ agricultural practices and GHG emissions would have been if, hypothetically, they had not chosen a lower-GHG approach. For example, would they have grown the same crops with higher-GHG methods, or would they have done something different? Heterogeneity in farm-level conditions (soil types, weather, practices used) further complicates assessment of baseline emissions.

Additionality requires determining whether an observed change in agricultural practices was induced by the policy incentive. If the farmer would have used the lower-GHG approach anyway, then the policy incentive is not generating new GHG reductions beyond business as usual. However, comparing actual and hypothetical outcomes is challenging.

3. Three Approaches to Reduce Ag-GHG Emissions

3.1. Increased Government Cofinancing

USDA conservation programs under Title 2 of the Farm Bill that take this approach include the Farm Service Agency’s Conservation Reserve Program (CRP), and the Conservation Stewardship Program (CSP) and Environmental Quality Incentives Program (EQIP), administered by the Natural Resources Conservation Service (NRCS). The IRA provides $18 billion in additional funding for existing programs, including $8.45 billion for EQIP and $3.25 billion for CSP. The funding is available for conservation practices or enhancements that improve soil C, reduce N losses, and lower CO2, CH4, or N2O emissions associated with production. An additional $1 billion is allocated for the Natural Resources Conservation Service to provide conservation technical assistance, and a further $300 million is allocated for a program to quantify, monitor, and track carbon sequestration and CO, CH4, and N2O emissions outcomes associated with activities covered by EQIP, CSP, and other NRCS contracts. See https://www.nrcs.usda.gov/wps/portal/nrcs/main/national/programs/ for information on these programs.

Title 2 programs have a well-established infrastructure for providing cost-sharing and technical assistance to farmers for ag-GHG mitigation activities. This reduces technological and economic knowledge barriers that could inhibit adoption of the activities. However, the programs require significant effort by farmers and ranchers as well as USDA experts to assess what strategies are appropriate and practical for achieving the goals (McCann and Claassen 2016). Farmers and ranchers choose which practices to adopt given their individual circumstances (including any social or behavioral barriers they may face) from lists of options maintained by the programs, and program experts make detailed assessments of anticipated environmental effects. Grant amounts are scaled according to type of activity and regional cost indexes. Costs can differ considerably across options, but farmers’ and ranchers’ grant amounts can increase based on changes in those cost factors (though not for farm-specific cost increases). Programs in this category also can provide cobenefits, such as improved water quality from nutrient management, and enhanced farm resilience to climate shocks (Feng and Kling 2005; Du et al. 2022). This raises the possibility of “stacking,” (e.g., an ag-GHG mitigation activity might also generate water pollution reduction credits). To the extent that the government financing for the activity undertaken and the value of water pollution credits generated together reflect the overall societal value of the activity, this does not entail double-counting.

Even with adjustments of USDA payments based on external cost indexes, the voluntary nature of the programs implies that the cost-share that farmers would be willing to accept will be limited unless participation also provides other benefits to farmers, such as increased productivity or lower operating costs. That limits the scope of ag-GHG mitigation alternatives that farmers are willing to consider.

Payments are conditioned on adoption of the specified practices in the agreement between the farmer and USDA, rather than on actual GHG reductions. Thus, farmers and ranchers do not face risks related to performance if they have followed the specified practices. This can reduce incentives for improving the implementation of mitigation practices.

Another challenge for the USDA programs is staying abreast of technical innovations that lower the cost of reducing ag-GHGs and thus deliver increased mitigation for a given budget. Innovative approaches also may be more additional—that is, exceed what farmers might have done anyway. However, introducing innovative approaches soon after they become available also implies smaller cost savings from their use, reducing incentives for adoption.

Novel agricultural practices adopted to reduce ag-GHGs also may increase yield risks—or at least be perceived that way. For example, both cover cropping and nutrient reductions may be seen as potentially jeopardizing yield (Sawadgo and Plastina 2022). This barrier to adopting ag-GHG mitigation practices might be lowered if agricultural insurance covered yield risks due to use of lower-GHG agricultural practices. However, insurance could also create perverse incentives for farmers to be less proactive in seeking to maximize their yields (Miao et al. 2016). Designing insurance against adverse yield or revenue effects from lower-GHG practices is complicated in situations when insurers cannot readily observe how farmers implement new practices.

3.2. Climate-Smart Agricultural Commodity Programs

The Partnerships for Climate-Smart Commodities grants promote commodities with lower GHG intensity, buttressed by improved practices for measuring and verifying GHG reductions. One intent of this program is to provide opportunities for marketing the climate-smart commodities to climate-conscious purchasers willing to pay some price premium, similar to programs for certifying wood products produced using sustainable forestry practices and for electricity ratepayers to pay more for green power.

What carbon-intensity standards would be used to designate commodities as climate-smart? How much of a premium might purchasers pay for products with a climate-smart designation? As a starting point, it would be useful to assess how much purchasers have been willing to pay for other environmentally-friendly goods and services, such as certified wood and green electricity. This turns out to be a somewhat difficult question to answer. As described in a report from NREL (Heeter et al. 2021), the appropriate metric for evaluating electricity users’ willingness to pay for green power is the market value of a “voluntary, unbundled Renewable Electricity Credit (REC).” The value of these RECs was less than 0.1 cents per kWh ($1 per MWh) during 2015–2020, reached 0.15 cents per kWh in late 2020, and then shot up in 2021 to well over 0.6 cents per kWh in September before declining again (but not to the prior low values). Regardless of the causes for that price shock, these values of less than one penny per kWh are a small fraction of total retail utility prices. On the other hand, the NREL report shows that total volumes in the voluntary, unbundled REC market have doubled since 2010. Declining costs of renewable electricity (especially solar), not scarcity of demand, are holding down prices for green power. Knapp et al. (2020) provide evidence on the determinants of customers’ willingness to pay a premium for green power.

3.3. Ag-GHG Emissions Reduction Credit Mechanisms

With market-based ag-GHG credits, the financial incentive for farmers and ranchers to adopt lower-GHG practices comes from the ability to sell credits to another party seeking them to offset its own emissions (either to meet a voluntary mitigation obligation or to satisfy a regulatory obligation to reduce emissions). Thus, an emissions reduction credit system can bring in significant private financing to increase ag-GHG mitigation. Several studies have been undertaken of the potential applicability of GHG credit mechanisms in agriculture (Gonzalez-Ramirez et al. 2012; Proville et al. 2020; Croft et al. 2021). In principle, any of the ag-GHG mitigation options for the expanded Title 2 programs also could generate emissions reduction credits.

Emission credits create different incentives than government financing (leaving aside measurement issues). If farmers bear the risk when ag-GHG practices do not perform as well as expected, they may avoid practices seen as technologically riskier, but they will implement their chosen approaches as effectively as they can. They also will gain from using innovative practices that reliably reduce ag-GHGs for the same cost. That provides a channel for innovation to enter credit markets once the reliability of a novel practice has been demonstrated.

Private, voluntary GHG credit mechanisms for agricultural emissions are already operating (e.g., Bayer, Indigo, and Nori; see Hendricks and Cameron-Harp 2021). In AB32, California’s GHG regulation system, emissions from several agricultural sources are being considered (https://ww2.arb.ca.gov/sites/default/files/2022-06/2022_Scoping_Plan_FAQ_6.21.22.pdf). However, use of ag-GHG credits in AB32 currently is limited to manure-based biogas that can be upgraded to renewable natural gas.” Once biogas is collected from manure, it can be upgraded to renewable natural gas (RNG) by removing impurities and increasing the methane content. However, the required equipment is costly. According to EPA’s Livestock Anaerobic Digester Database (https://www.epa.gov/agstar/livestock-anaerobic-digester-database), uptake of this option has been relatively limited, despite opportunities for USDA co-financing of capital costs, and sizable regulation-driven economic incentives for using RNG in the transportation sector (Myers Jaffe et al 2016; MJ Bradley and Associates 2019). In the European Union’s Emissions Trading System, ag-GHG emissions are part of the Effort Sharing Regulation, passed in 2018. A proposed revision to the regulation would focus on opportunities for increasing soil carbon storage (see https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3543).

Institutional ingredients for ag-GHG emissions credits include a registry for credits and a market that serves both credit sellers and prospective credit buyers. If small and historically disadvantaged farmers find it difficult or costly to enter markets for ag-GHG credits (Croft et al. 2021), the government could provide very short-term subsidies to cover their transaction costs, or “aggregators” could combine small-scale GHG reductions by individual farmers into larger packages for credit validation and marketing.

The effectiveness and credibility of a credit system depend on accurate measurement of the emissions effects of the GHG-reducing activities that farmers undertake to create credits, and the baseline emissions against which reductions are calculated. The weaker the capability for measuring the reductions claimed by farmers for creating credits from ag-GHG reduction practices, the less confident buyers can be in what they are purchasing. The less confident buyers are, the less they will pay and the less sellers can obtain from their investment in ag-GHG reduction. A system based on a lot of guesswork also invites chicanery.

Environmental integrity—confidence in the amounts of GHG mitigation delivered—is especially important when ag-GHG mitigation credits are used by purchasers to meet regulatory obligations, since uncertainty or bias in the assessment of project-specific emissions reductions becomes uncertainty or bias in achieving the regulatory objectives. The less reliable the GHG-reducing effects of credit-generating activities, the greater the concern that the credits reflect “hot air” (Wongpiyabovorn et al. 2022; Schulte-Moore and Jordahl 2022). That in turn undermines public confidence in the approach. One approach could be to reduce (“discount”) the quantity of GHG reductions credited to a project based on some judgment about the risk that actual GHG reductions may be lower than stated reductions. This approach is fairly arbitrary, however, and data to help gauge differences between actual and stated GHG reductions are limited. Another approach is to make credit buyers liable for shortfalls in actual emissions reductions delivered by credit suppliers. Although this increases the risks for buyers in using ag-GHG credits, it creates built-in incentives for buyers to seek more from sellers to validate the integrity of credits. Environmental integrity for emission credits also requires that the GHG reductions embodied in credits be additional to reductions from government-financed conservation and climate-smart commodity programs. Otherwise, emissions reductions financed by those programs are lost when purchasers obtain credits based on the results of those programs and then increase their emissions. Another way to see this is that when the government finances emissions reductions, it becomes the owner of any credits based on those reductions. Since the government’s aim in its programs is to reduce total emissions, not just reallocate emissions reductions across different parts of the economy, the government in effect chooses to retire the emissions reductions it finances rather than selling credits. Since there is uncertainty in the magnitude of ag-GHG mitigation financed by government, the baseline for calculating additional emissions reductions for credits will be correspondingly more difficult to determine.

4. Going Forward

As the agriculture sector seeks to expand global food supplies in an environmentally sustainable fashion (Khanna et al. 2018), new policies and measures for ag-GHG mitigation are needed. Policy initiatives should be well grounded to increase their effectiveness and avoid unintended negative consequences. They also should reflect the available capability for assessing costs and effects on emissions.

Given the considerable heterogeneity—in ag-GHG potential and in costs of different ag-GHG practices in different locations—the emissions reductions available from specific projects are uncertain, and the costs of evaluating and validating the emissions impacts can be significant. In addition, the availability of climate-smart commodities is impeded by lack of standards for qualifying products and uncertainty about customers’ willingness to pay potential price premiums.

To support progress in mitigation of ag-GHG emissions, we offer five observations.

1) Improved measurement of ag-GHG emissions is crucial to the success of any ag-GHG mitigation policies, so investments in improved measurement have large payoffs.

Improved empirical knowledge of the effectiveness and cost of ag-GHG mitigation options will have robust positive returns (Lal 2015). The IRA provisions to increase ag-GHG mitigation put new emphasis on improved measurement, and $300 million is appropriated for that purpose. Implementers should keep in mind the capabilities of those who would be using the new measurement strategies. “Precision agriculture,” which seeks to maximize yield and reduce input use through advanced methods for remote and in situ measurement, is an appealing idea (Khanna 2020). However, the cost of the required equipment is an investment that may be burdensome, especially for smaller operations (Lapidus et al. 2022). Support for reasonably straightforward and accessible GHG measurement strategies will be very useful. A good example is the “N-Visible” framework for N2O assessment recently developed by the Environmental Defense Fund (Eagle et al. 2020).

To improve measurement of ag-GHG emissions, USDA could undertake a large experimental program using sites in the National Resources Inventory, a nationally representative sample of plots used for scientific investigation of conservation. These activities might be supported through increased funding for the Agriculture Advanced Research and Development Authority (AgARDA), created in the 2018 Farm Bill “to develop technologies, research tools, and products through advanced research on long-term and high-risk challenges for food and agriculture” and focus on R&D “that private industry is unlikely to undertake” (https://www.ers.usda.gov/agriculture-improvement-act-of-2018-highlights-and-implications/research-extension-and-related-matters/). It appears that relatively little has been done with AgARDA since its inception.

2) New approaches that address additionality concerns are needed to enhance confidence in ag-GHG emissions reduction credits.

Additionality has been a persistent concern with project-based emissions reduction activities. It is a growing concern for corporations that consider meeting voluntary net-zero targets in part through purchases of credits (or “offsets”). Workable solutions may come from further research on general trends in agricultural practices that could be considered baseline, not additional. Such investigations should reflect the heterogeneity of the agriculture sector. Credits generated under relative loose standards should not just be “grandfathered” into credits for purchasers’ compliance to reward early actors.

Government cofinancing for ag-GHG mitigation amplifies the challenge of assessing additionality for emissions reduction credits. As measurement capabilities improve, technical experts could use a growing body of data on how various ag-GHG mitigation approaches affect emissions to establish baselines for validating emissions reductions beyond those resulting from government programs.

3) New approaches that can improve the targeting and cost-effectiveness of Title 2 programs for ag-GHG mitigation should be pursued.

The voluminous record of information from USDA conservation programs could provide opportunities to better understand the costs of different ag-GHG mitigation practices and how they vary with farm conditions. That cost analysis, along with improved understanding of emissions effects, could be used to improve the targeting of Title 2 project expenditures.

Another possibility, once measurement of emissions reductions gets better, is to revive use of “pay for performance” approaches (Winsten and Hunter 2011). EQIP was first implemented with competitive bidding for cofinancing, based on the amount of conservation to be accomplished. Because of inadequate enforcement of the contract obligations, however, farmers who had proposed elaborate measures later revised downward their ambitions once funding was allocated; the approach was accordingly abandoned (Cattaneo 2003).

4) Title 2 programs can provide a laboratory for innovative ag-GHG mitigation approaches.

Coordination between between government-financed conservation programs and emerging markets for emission-reduction credits also can be beneficial in lowering uncertainty about innovative but unfamiliar approaches for ag-GHG mitigation. Farmers interested in earning credits will be hesitant to adopt such approaches if they are at risk for shortfalls in the performance of the approaches. Funding through Title 2 programs could be used to pilot innovative approaches. In effect, the government would be reducing a technology risk that private insurance markets may hesitate to cover.

5) Pilot projects for advancing climate-smart commodities can be used to test the efficacy of various initiatives and craft effective strategies for scaling up well-performing approaches.

Now that USDA has awarded $2.8 billion under the IRA for work on piloting 70 projects aimed at advancing climate-smart commodities, the agency may be able to use information from those projects to learn more about how the measures adopted affected GHG emissions, cobenefits, producer productivity and profitability, and consumer responses to climate-smart commodities. Not all pilots will be cost-effective or provide substantial GHG emissions reductions. Independent third parties should participate in the evaluation to guard against undue influence by special interests.

Authors

Justin Baker

North Carolina State University

Robert Beach

RTI International

Hongli Feng

Iowa State University

Eileen McLellan

Environmental Defense Fund