Promoting Energy Affordability Using State Climate Policy

This issue brief explores how state governments can improve electricity affordability for households while advancing environmental goals.

States can lead on climate policy while shielding households from the affordability impacts of rising policy uncertainties.

Energy affordability is a concern to households across the country. Buchsbaum and Kahn-Lang (2025) summarize data from the US Energy Information Administration to illustrate that national average real electricity prices have risen over the past four years after nearly two decades of flat or decreasing real prices. Inflationary pressure in the electricity sector is especially salient with the rapid expansion of data centers and an anticipated increase in electricity demand resulting from electrification of other sectors (Robertson and Palmer 2025). The concern about energy affordability has been turbocharged in light of changes in federal regulations withdrawing support for clean energy investments.

This issue brief considers an opportunity for state governments to respond to this challenge by enhancing electricity affordability for households and concurrently boosting environmental outcomes. Investments in renewable energy and energy efficiency would reduce electricity costs. With the loss of federal support for these investments, we explore the potential introduction of a price on carbon dioxide (CO2) emissions in the electricity sector at the state level, via a cap or limit on power sector emissions sources, and coupling that price with a policy to direct program revenues to reduce residential electricity rates (Meng and Prasad 2025). An example of this approach is embodied in recently proposed legislation in Pennsylvania (House Bill 503), which would introduce an electricity-sector carbon market and direct 70 percent of the auction proceeds to paying rebates to electric ratepayers, calculated on a per-kilowatt-hour basis. In California, under the state’s existing carbon market, residential electricity and natural gas customers receive an equal per-customer-account payment every six months. Recent research considers revising this program to direct proceeds to reduce volumetric electricity prices (Meng and Prasad 2025). The scenario examines the implementation of the policy in eight leadership states that have previously pursued clean energy policies such as renewable portfolio standards but do not currently have carbon pricing in place. Electricity-sector emissions are already subject to carbon pricing in the 10 currently participating Northeast and mid-Atlantic states Regional Greenhouse Gas Initiative (with two other observer states) and in California and Washington. Oregon has a regulatory cap on emissions. We model an electricity-sector carbon price implemented through an emissions cap in Arizona, Colorado, New Mexico, Illinois, Michigan, Minnesota, Wisconsin, and North Carolina.

1. The Impact of the Reversal of Federal Policy

The phaseout of the clean energy tax credits under the 2022 Inflation Reduction Act (IRA) through passage of the 2025 budget reconciliation bill heavily restricts federal support for investments in relatively low-cost renewable energy generation. Investment in clean electricity is further constrained by uncertainty around what remains of the credits while the industry awaits guidance from the Department of Treasury on implementation of the 2025 budget reconciliation bill. A recent executive order directs Treasury to define Foreign Entity of Concern and commence construction to restrict the usage of the credits that remain after the budget bill. This reversal is coupled with federal efforts to extend the life of uneconomic fossil fuel generators while the deployment of new gas-fired capacity is also constrained. RMI’s Utility Transition Hub estimates that the uneconomic operation of coal-fired power plants has incurred $24 billion in unnecessary expenditures from 2015 to 2024.

Repeal of the tax credits for clean energy and the general removal of Department of Energy clean energy programs is likely to result in further increases in national average electricity prices (Jenkins et al. 2025; King et al. 2025; Orvis et al. 2025; Roy and Palmer, 2025) The reversal means that not as much cheap capacity that is quick to come online will get built to meet growing demand. Consequently, electricity prices are estimated to increase by 6–10 percent by 2035 under baseline levels of electricity demand (Bergman et al. 2025). Price increases could be magnified further by higher electricity demand, and CO2 emissions in the electricity sector could increase by 448 million metric tons annually by 2040, compared with 395 million metric tons under the baseline level of demand in 2040.

The exact timing of impacts for electricity ratepayers is still unknown. Only new wind and solar projects initiated sometime before 2027 will qualify for the tax credits. Projects coming online as late as 2029 might still qualify for the credit depending on their current construction status and compliance with the as-yet-undetermined Foreign Entity of Concern requirements. While price effects could arise sooner, electricity prices will certainly be affected by the IRA repeal by 2030 and increasingly thereafter.

2. The Opportunity for States

We use RFF’s Haiku electricity market model to conduct this exercise, building a hypothetical baseline without the IRA. This hypothetical baseline assumes the IRA was not implemented and may describe price effects that are greater than what will be realized by 2030, in contrast to a scenario that describes repeal of the IRA, which has supported some new investments in renewable electricity generation. On the other hand, we do not represent evidence of recent increases in electricity demand or federal measures to preserve relatively uneconomic fossil resources that had been slated for closure, which could lead to relatively greater price differences in the opposite direction. We find that every state we model can use carbon pricing, such as a cap-and-invest program, to achieve environmental goals and concurrently reduce household electricity costs.

The emissions target we model would reduce carbon dioxide emissions from the electric power sector to 80 percent below 2005 levels in 2030. The modeled targets cover electricity generation for domestic consumption and export in each state. Imported electricity is assigned an emissions intensity associated with the average annual rate in the adjoining state, taken from the no-policy baseline, and emissions associated with imported electricity are included under the emissions cap. The emissions rate associated with imported electricity from an adjoining state is pegged at the no-policy baseline average annual emissions rate of an importing state to reflect our assumption that the carbon-pricing scenario we model hinges on state-specific decisions achieved on an individual state basis. We do not model coordination among states in a regional carbon market, such as the Regional Greenhouse Gas Initiative, which would lower average costs and improve cost-effectiveness. This ambitious target is consistent with the stated climate goals of many leadership states that have committed to meeting emissions levels consistent with the US Nationally Determined Contribution under the Paris Agreement for economy-wide emissions reductions, where the power sector will need to deliver the majority of near-term emissions reductions. Early decarbonization of the power sector is key to cost-effective economy-wide decarbonization (Donohoo-Vallet et al. 2023).

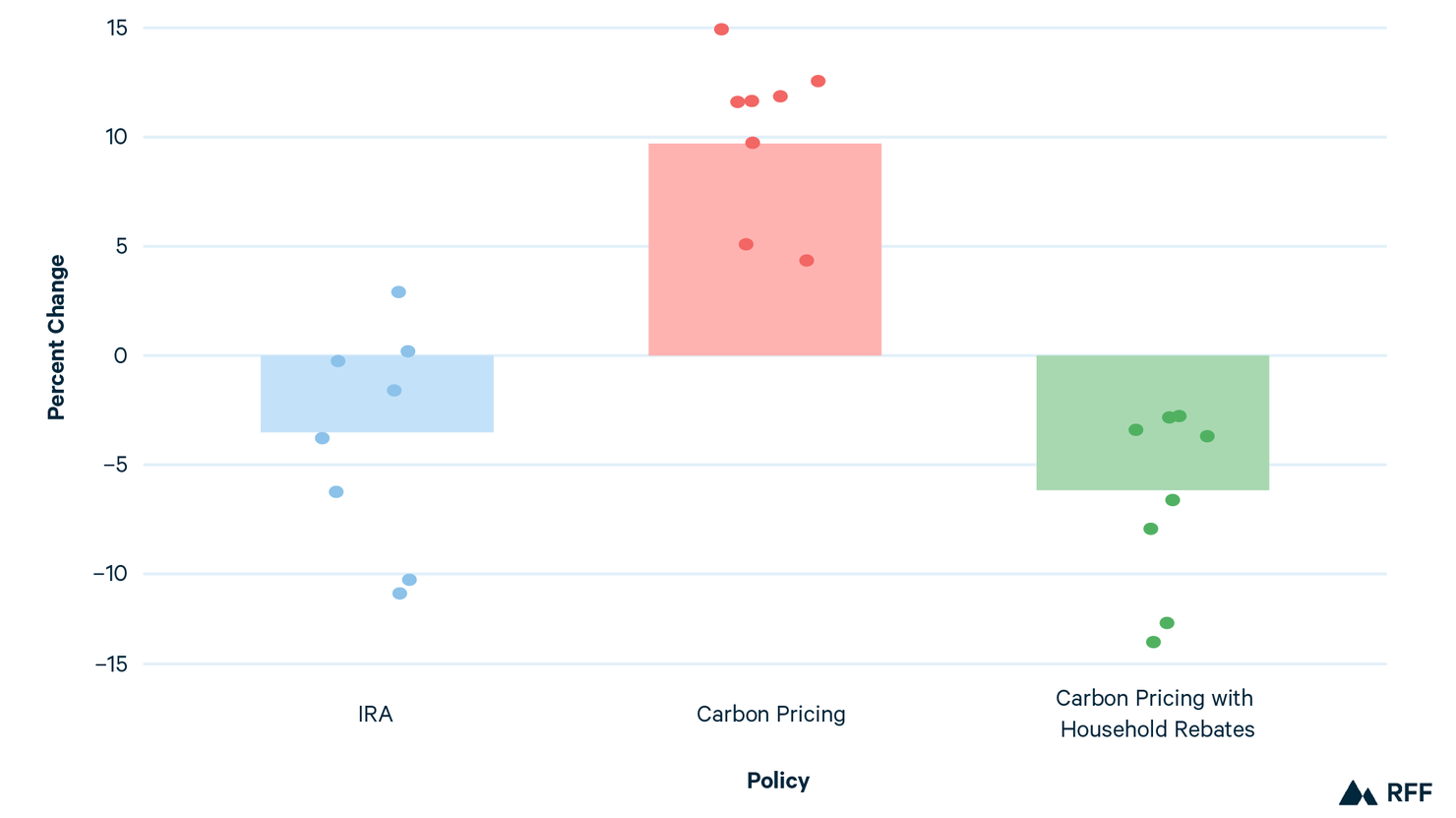

Figure 1 shows the impact of the state emissions caps and the associated percentage change in electricity prices for residential class customers in the eight states we model, which have shown clean energy leadership but do not currently have a carbon price. The changes in the figure are compared with the no-policy baseline scenario without the IRA.

Figure 1. Change in 2030 Residential Electricity Expenditures

The blue column on the left side of the panel shows that full implementation of the IRA would lead to a 3 percent reduction in electricity prices in the set of eight leadership states in 2030. The figure shows a range of outcomes in those states, as illustrated by the array of blue dots. The horizontal arrangement of the dots is only for visual clarity and has no other interpretation. Compared with these leading clean energy states, other states with a heavier fossil fuel portfolio would realize overall greater reductions in electricity prices under full implementation of the IRA, which is not illustrated here (Domeshek et al. 2024).

The red middle column displays the effects of the emissions caps and carbon prices in the absence of the IRA and without using any of the revenue for rebates (or investments in renewable energy or energy efficiency). This scenario would cause residential electricity prices to increase in all states and by 9 percent on average. We represent separate carbon markets in each of the eight states, resulting in allowance prices that range from $38 to $94 per ton of carbon dioxide emissions (2023$).

The green column on the right shows that returning the revenue collected across the sector to residential ratepayers to address electricity affordability concerns for households would reduce electricity prices in all states and by 6 percent on average. This reduction equates to twice the savings that would have been realized on average by full implementation of the IRA in this set of states.

This approach to using carbon proceeds to directly reduce electricity rates is only one option, and although it clearly addresses household affordability concerns, it may not be the best option. Alternatively, states could consider returning a portion of the revenue to consumers as a climate credit, perhaps targeting low-income customers (Meng and Prasad 2025; IEMAC 2025), while using revenues left over to reinvest in clean energy and resilience.

To accentuate this state-level analysis, we point to the possibilities at the national level. Domeshek et al. (2024) found the IRA would reduce national average electricity prices by 6 percent in 2030. Further, they found that the IRA would reduce the carbon price that would be necessary to achieve the 2030 emissions target at the national level by more than half. The national carbon-pricing proceeds could be used to reduce residential electricity prices by 9 percent on average. It is noteworthy that in this scenario, households in fossil fuel–dependent states benefit even more than in the eight leadership states from the carbon price with proceeds returned to residential customers.

The impact on household budgets could be substantial. Annual household electricity-sector expenditures in the eight modeled states are estimated to be $1,498 in 2030 in the no-policy baseline without the IRA. This assumes the number of households per state in the 2020 Residential Energy Consumption Survey from EIA released in 2023. On average at the national level, our modeling estimates that if the IRA had been fully implemented, this would have reduced 2030 electricity bills by $101. For the eight states we model, the household savings from the IRA are estimated to be about half, at $55 on average.

In the absence of the IRA, the introduction of a carbon price without reinvesting any of the revenue into new investments that decrease energy demand or returning proceeds to consumers would increase 2030 electricity bills in these states by $145. However, even without the IRA, returning the carbon revenues to reduce residential electricity prices would result in a net reduction of $92, greater than what was anticipated from full implementation of the IRA.

States have the capacity to amplify the impact of these rebates to adapt to changing circumstances. If states want to raise more revenue, they can strengthen emissions targets to enhance the rebates for households. States might also concentrate the use of the revenues for rebates during high-cost months of the year, for times of day with low emissions intensity of grid-supplied electricity, or to low-income households.

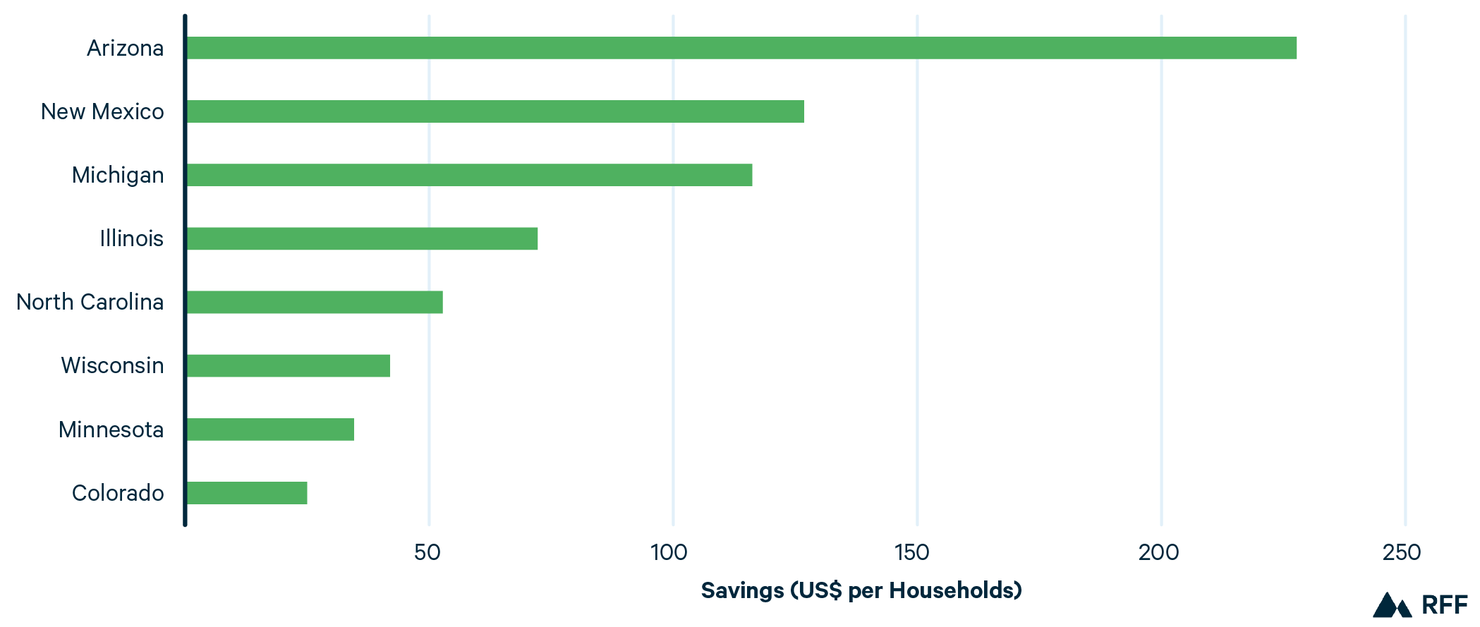

Figure 2 shows projected household rebates in 2030 with state-level carbon pricing. The percentage changes in residential electricity prices map into different dollar amounts at the state level because of the variation in electricity prices across the country and because of differences in the net imports in these states. The carbon price is applied to generation for domestic consumption and for export. The emissions intensity of imports is measured on an annual average basis from each neighboring state in the no-policy baseline, which is applied in the model to estimate emissions that are included under the state’s emissions cap. The magnitude of the annual household electricity bill savings across the eight states we model ranges from $62 to $178, with one outlier over $250 per year. The state-specific estimates are subject to important caveats because the IRA has already influenced investments and emissions rates in many states, which is not reflected in our assumed model baseline, and the pattern of net imports is likely to be affected, with important effects on potential revenue. However, the dispersion of outcomes across the set of states and the average impact are both expected to be robust.

Figure 2. 2030 Household Rebates with State-Level Carbon Pricing

3. The Missing Other Shoe: Investments in Clean Energy

This issue brief illustrates a bookend scenario in which states direct all the proceeds raised with a carbon price to reducing household electricity rates. However, households are affected in multiple ways by the environmental impacts of fossil-fired electricity generation, and states may want to adopt a portfolio approach to pursue remedies that accelerate the transition to a clean energy economy.

A clean energy pathway results in other economic changes, including an employment profile that differs from fossil fuel dependence. Electricity prices also face less uncertainty from exposure to volatile fossil gas prices under clean energy pathways (Pelinski and Roy, 2025).

The clean energy pathway also leads to reductions in emissions of conventional air pollution such as nitrogen oxides and sulfur dioxide. Reducing these emissions reduces the hidden tax of air pollution households pay through higher health care costs and accelerated mortality. These benefits come in addition to the 120-ton reduction in CO2 emissions from the eight states in 2030, yielding $27 billion in additional climate-related benefits in that year alone (Rennert et al. 2022).

In 2025, climate policy at the federal level has been suppressed, while concerns about affordability have assumed center stage. This analysis shows that climate policy and affordability can be addressed together. We illustrate one of many options for states. In general, the most affordable pathway for households includes a substantial role for renewable energy, which also contributes to meeting climate goals and air quality improvements. States could also choose to use carbon revenues to fill the hole left by withdrawal of federal support for renewable energy and energy efficiency.

The reversal of federal policies will have severe impacts on environmental outcomes and electricity affordability for households. However, state policymakers have the tools to shape their state’s electricity supply infrastructure and enhance affordability, while addressing climate change and improving the state’s economy and environment.