Can Federal Efforts Help Build Economic Resilience in New Mexico’s Oil and Gas Communities?

In this analysis, the report authors interview stakeholders in New Mexico’s oil- and gas-producing regions to understand how the federal government can support local efforts to strengthen economic diversification.

Abstract

Efforts to reduce greenhouse gas emissions are projected to reduce demand for oil and natural gas, creating economic risks for the hundreds of communities and hundreds of thousands of workers who depend on those industries. However, very little research has sought to identify policy options for building economic resilience in oil- and gas-producing communities. In this analysis, we use semistructured interviews with stakeholders in New Mexico’s oil- and gas-producing regions to understand how the federal government can support local efforts to strengthen economic diversification. We find that although local stakeholders are generally skeptical of the federal government, they would be receptive to federal support. However, numerous challenges stand in the way of effective federal intervention, including insufficient capacity to access and administer federal grants, barriers to economic development on federal lands, and disagreements among stakeholders about certain energy technologies, particularly carbon capture. In addition, it is not clear which economic sectors might replace the high-paying jobs and substantial tax revenues generated by oil and gas development. Our interviews indicate that building economic resilience in the state’s oil and gas communities will be challenging, and require early, substantive, and ongoing engagement with a wide range of local stakeholders to ensure that federal resources support local priorities.

1. Introduction

In 2022, the United States was the world’s largest producer of oil and gas, with New Mexico accounting for 13 and 6 percent of domestic production, respectively (EIA 2023). Although researchers and policymakers have paid considerable attention to the economic transition of energy communities after coal plant and coal mine closures, far less attention has been paid to the oil and gas sector, which currently plays a much larger role in the US economy.

Although US oil and gas production is at or near all-time highs nationally and in New Mexico, scholars and practitioners focused on the local economic challenges of energy transitions emphasize the importance of building economic resilience well before a prolonged downturn causes irreparable damage (Haggerty et al. 2018; Just Transition Fund 2020; Look et al. 2021). Long-term projections of global energy demand indicate that even under scenarios that limit global warming to 1.5°C or 2°C, oil and natural gas will continue to play an important role in the energy system for at least 10 to 20 years (Raimi et al. 2023). However, building economic diversity in oil- and gas-producing regions will likely require years, if not decades, of planning and investment, suggesting the need to develop strategies as soon as possible.

The purpose of our analysis is to begin this process by identifying the challenges and opportunities facing oil- and gas-producing communities as they seek to build economic resilience in the face of an uncertain economic future. To gather this information, we traveled to two major oil- and gas-producing regions in New Mexico and interviewed a wide range of stakeholders over one week. Our results are one of many inputs that will be needed to develop policies at the federal level that can mitigate the negative consequences of a turn away from fossil fuels.

Although the Inflation Reduction Act of 2022 and several other federal efforts have begun targeting federal economic support to communities that are heavily dependent on fossil fuels, we believe—and our interview results reveal—that these efforts represent only the beginning of a process that demands sustained engagement between federal agencies and local stakeholders.

The remainder of this report proceeds as follows. First, we provide historical context for oil and gas development in the Permian and San Juan basin regions of New Mexico, along with summaries of state-level policies that have shaped the course of economic diversification and energy transition. In the second section, we describe the methods for our semistructured interviews with stakeholders. Finally, we synthesize the takeaways from those conversations to inform federal policymaking for economic resilience in the energy transition.

2. Background and Context

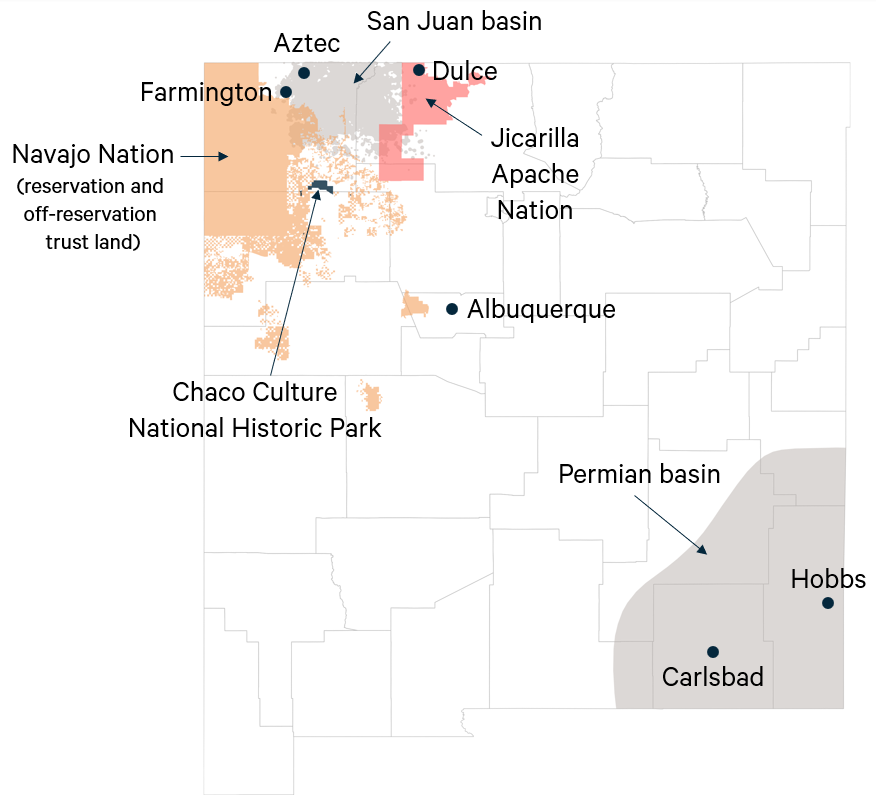

New Mexico has a long history of natural resource development. Ancient Puebloan cultures distributed turquoise across trade routes that included parts of New Mexico, California, Nevada, and Colorado for perhaps more than 1,000 years (Hull et al. 2014), and the region’s Hopi people used coal for household heating and pottery production for hundreds of years prior to European colonization (Freese 2003, 112). In the 1500s, early Spanish colonists pursued illusory troves of previous metals in the area (Ferguson et al. 1985). Commercial oil and natural gas production, however, came much later, and was centered in the San Juan and Permian basins (Figure 1).

Figure 1. New Mexico’s San Juan and Permian Basins, Select Native American Reservations, and Cities

Source: Map by authors

2.1. History of Oil and Gas Development in New Mexico

Oil production began in the San Juan basin in the early 1920s. New Mexico’s first commercial well was drilled in 1922 on the Navajo Nation, roughly 20 miles west of Farmington, after the Navajo Nation Council, which was established in part by the Department of Interior for the express purpose of approving leases, agreed to the activity (Curley 2023, 48). See Holtby (2013, 78–81) for a detailed account of the formation of the Navajo Nation Council. Two years later, new wells at Rattlesnake Dome, also on the Navajo Nation, ushered in a more prolific era of production. In subsequent years, the federal government and the Navajo Nation would dispute revenue-sharing arrangements (Holtby 2013, 79), foreshadowing a long history of problems related to federal mismanagement of tribal resources (Grogan et al. 2011).

By the late 1920s, oil production began in the southeastern corner of New Mexico as oil companies moved from the Texas to the New Mexico side of the Permian basin, spending a then-unprecedented sum of $15 million to $18 million on exploration in a single year (Modisett 2009). The flat desert plain posed challenges for companies, whose geologists often interpreted surface features to determine promising drilling locations (Wells 2017). In 1928, State No. 1 well came in, an event widely considered “the most important single discovery of oil in New Mexico’s history” (Wells 2013). In the following years, production surged in the New Mexico Permian. Indeed, the city of Hobbs was briefly the fastest-growing town in the United States (Clampitt 2008). Even through the Great Depression, the industry grew rapidly: the market value of oil tripled from 1932 to 1942 (NMMA 2012).

From the early 1940s to 1970, oil production from the San Juan and Permian basins tripled, from roughly 40 million to more than 120 million barrels per year; natural gas production increased by a factor of 5 (Brister and Price 2002, 3). Gas output continued to grow over the following decades, but oil production peaked in the 1970s and began to decline, mirroring national trends (Brister and Price 2002, 2).

Although we do not focus on New Mexico’s long history of coal, uranium, or other mining activities in this analysis, it is important to understand how they have shaped perceptions of extractive industries. In particular, decades of neglect and mismanagement related to uranium mining in and around the Navajo Nation during the mid-20th century caused extensive environmental and health harms, including widespread exposure to high concentrations of radon gas in poorly ventilated mines and mismanagement of mining waste (Roscoe et al. 1995; Gilliland et al. 2000; RECP 2002). This legacy, in turn, has contributed to antagonisms between regional, tribal, and federal officials (Brugge and Goble 2002).

In the 1970s, as global oil prices skyrocketed primarily because of events in the Middle East, federal energy policy that sought to exploit the vast fossil fuel resources of the Four Corners region became an organizing political force in New Mexico and elsewhere in the Intermountain West (Griffith 1974). In response to Washington’s crisis-era energy planning, negotiated with little or no consultation with states, 10 western governors formed the Western Governors’ Association, whose Regional Policy Office identified legal tools available to develop energy resources at their own pace (Lamm 1975). Similarly, leaders of 25 Native nations organized the Council of Energy Resource Tribes, which helped reform federal policy so that tribes could exert more control over mineral development and be better compensated for energy production occurring on their reservations (Ambler 1990; Royster 1994; Black 2018). In the 1980s, as oil prices crashed and the domestic energy crisis faded, pressure to develop the state’s resources—particularly oil and natural gas—eased.

2.1.1. The San Juan and Permian Basins

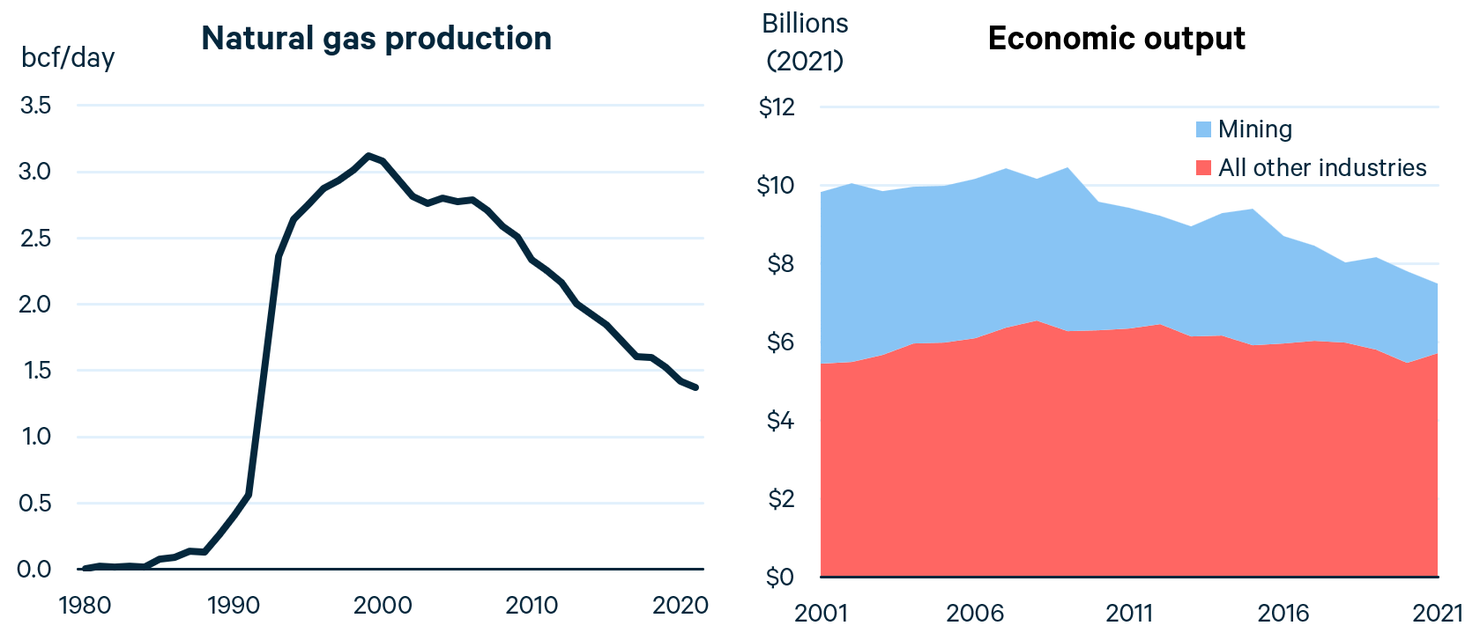

Over roughly the past 30 years, both the San Juan and Permian basins have seen drilling booms. In the 1990s, new technologies enabled the rapid growth of coalbed methane production, sending natural gas production in the San Juan basin surging from essentially zero to more than 3 billion cubic feet per day by the late 1990s. During that time, the mining sector grew to account for almost half of the region’s economic output. However, as Figure 2 illustrates, this boom faded relatively quickly as natural gas production shifted to more profitable plays exploiting “tight” gas and shale gas formations in other parts of the nation. By 2021, the San Juan basin’s natural gas production had fallen by more than half. Coupled with a regional decline in coal mining and coal-fired power generation, the decline in natural gas production has been a leading cause of the region’s shrinking economic output.

Figure 2. New Mexico San Juan Basin Natural Gas Production and Economic Output, by Sector

Data sources: New Mexico Institute of Mining and Technology (2023) for production data and US Bureau of Economic Analysis for gross economic output data. The data we gathered for 1992 production were implausibly high (i.e., orders of magnitude higher than any other year in the data set), so the level of production in 1992 shown here is interpolated from 1991 and 1993 data. bcf = billion cubic feet.

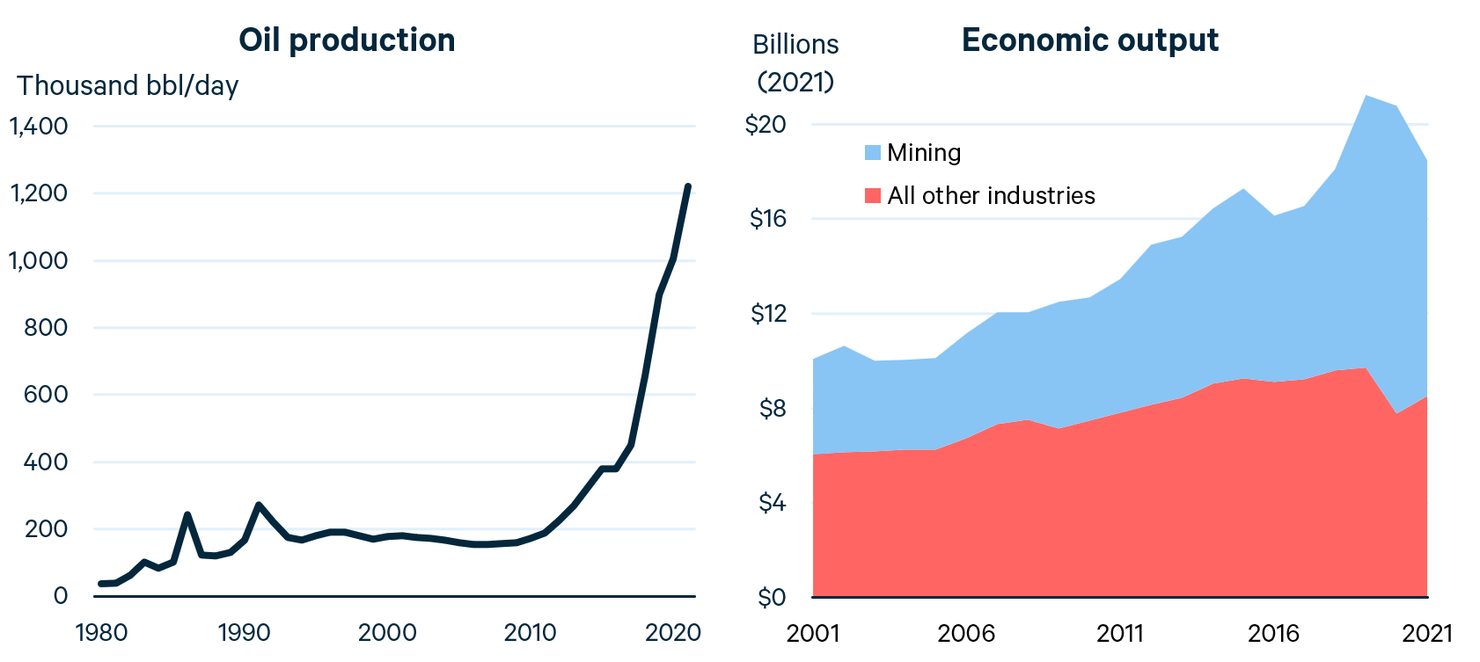

Development in New Mexico’s Permian basin has followed a very different path in recent decades. Although oil and gas production continued in this region after its inception in the late 1920s, improvements in oilfield technology—particularly horizontal drilling and hydraulic fracturing—led to a new boom that has made the Permian basin one of the world’s premier oil plays. Between 2010 and 2021, production on New Mexico’s side of the Permian basin grew from less than 0.2 million barrels per day (mbd) to more than 1.2 mbd (production from the Texas side of the Permian basin grew to exceed more than 4 mbd). Local economic output in the New Mexico Permian has roughly doubled over the past 20 years in real terms, driven by the mining industry, which in 2021 accounted for more than half of the total (Figure 3).

Figure 3. New Mexico Permian Basin Oil Production and Economic Output, by Sector

Data sources: New Mexico Institute of Mining and Technology (2023) for production data and US Bureau of Economic Analysis for gross economic output data. The data we gathered for 1992 production were implausibly high (i.e., orders of magnitude higher than any other year in the data set), so the level of production in 1992 shown here is interpolated from 1991 and 1993 data. bbl = barrels.

In both the San Juan and Permian basins, employment in the oil and gas industry is also substantial. These jobs are particularly important because they typically pay high wages, sometimes $100,000 a year or more (US Bureau of Labor Statistics 2023), sustaining families and supporting other local businesses indirectly.

2.1.2. The Economic and Fiscal Importance of Oil and Gas in New Mexico

For New Mexico, the economic importance of the oil and gas industry extends well beyond the boundaries of the San Juan and Permian basins. Particularly with the boom in production in the Permian basin, where a large proportion of production occurs on land owned by the state and federal governments, the state has come to rely heavily on the industry for tax and leasing revenue to support public services, not just in and around the producing regions but across the entire state.

One recent analysis estimates that between 2015 and 2019, oil and gas production-related activities directly generated $2.3 billion per year for state and local budgets (Raimi et al. 2022), and those sums have increased in recent years. In 2022, New Mexico collected more than $2.5 billion from oil and gas royalties on federal lands (ONRR 2023) and more than $2 billion from production on state lands (New Mexico State Land Office 2023). These revenues fund annual expenditures, and revenues from state lands are deposited into the Land Grant Permanent Fund, whose principal has grown over time; the fund now allocates more than $1 billion per year to public schools, universities, and inclusive education programs (NMSIC 2023).

As fossil fuel revenues have grown, state and federal policymakers have increasingly (and somewhat paradoxically) focused on the need to reduce greenhouse gas emissions. Recognizing the risk to public revenues such a transition would create, some researchers, policymakers, and advocates have sought to identify options to ensure that public budgets remain solvent as consumption and production of oil and gas decline (NM Voices for Children 2023; PFM 2023). For example, New Mexico Senator Martin Heinrich introduced in 2021 the Schools and State Budgets Certainty Act, which would replace federal mineral leasing revenue with temporary “energy transition payments” (Volcovici 2021). Similarly, the federal Interagency Working Group on Energy Communities (IWG) has established the Four Corners Rapid Response Team to support economic and revenue diversification in the San Juan basin; such teams have also been created for several other coal-dependent regions (IWG 2022).

2.1.3. State Efforts to Build Economic Resilience in the Energy Transition

New Mexico has taken a variety of steps to build economic resilience while advancing the energy transition. In 2018, the state legislature passed the Energy Transition Act (Candelaria et al. 2019), which seeks to reduce statewide power sector emissions to net zero by 2050 while also supporting economic and workforce development efforts in coal-dependent communities (we note issues with implementing the act in Section 4).

In October 2021, the state Economic Development Department (EDD) released a 20-year strategic plan that identified nine target industries to promote: aerospace, biosciences, cybersecurity, film and television, outdoor recreation, sustainable and valued-added agriculture, intelligent manufacturing, global trade, and sustainable and green energy (New Mexico EDD 2021). Developing low-carbon energy sources presents another economic opportunity, although state-support research from 2020 found that many workers perceived low-carbon energy jobs as undesirable because of relatively low wages and high barriers to entry (UNM 2020).

In 2023, state legislators budgeted $100 million for a variety of energy transition efforts, including workforce, economic, and infrastructure development. A substantial portion of the funding was earmarked to support displaced coal workers in the San Juan basin, along with roughly $37 million that would be allocated by EDD following input from stakeholder groups (Diaz 2023). There was also an effort to establish, within EDD, an economic transition division that would have developed a statewide transition plan in partnership with other stakeholders. However, this effort did not succeed in 2023 because, according to news reports (Grover 2023a), it was combined with another bill that would have promoted carbon capture, nuclear, and blue hydrogen—technologies opposed by some stakeholders who would have otherwise supported transition planning and funding (we return to this issue in Section 4).

2.1.4. Federal Efforts to Build Economic Resilience in the Energy Transition

Recent federal policies have also begun to steer resources to New Mexico energy communities to build economic resilience. As noted in Section 2.1.2, the federal IWG on energy communities has established a rapid response team in the San Juan basin to help local governments, Native nations, and other stakeholders access federal economic and workforce development resources. As of this writing, the team is in its initial “learning and listening” phase and has identified near- and mid-term focus areas that include regional rail expansion, broadband deployment, programs for workforce development, and assistance with federal grant writing (IWG 2023). Although primarily focused on the San Juan basin because of coal retirements (IWG 2023), the IWG’s work could help mitigate further economic damage resulting from declining oil and gas development.

In the Infrastructure Investment and Jobs Act, the federal government also authorized roughly $4.7 billion in nationwide funding for identifying and decommissioning orphaned oil and gas wells (DeFazio 2021). These funds could support employment, reduce environmental hazards, and boost local economies in both the San Juan and Permian basins, as well as other regions with substantial numbers of orphaned wells (Raimi et al. 2020; O’Donnell 2021).

More broadly, federal legislation, including the Infrastructure Investment and Jobs Act, the Chips and Science Act (Ryan 2022), and the Inflation Reduction Act (Yarmuth 2022), has sought to boost clean energy deployment and invigorate domestic manufacturing across a variety of technologies, including semiconductors, clean energy technologies, and their supply chains. Although these efforts are not specifically targeted toward New Mexico or its oil- and gas-producing communities, they could spur additional investment in manufacturing, clean energy, and other sectors, helping to diversify the economies of both the San Juan and Permian basins. As of mid-2023, however, relatively little policy-induced investment appears to be flowing to either region (Haskins and Parilla 2023). In Section 4, we discuss whether, and to what extent, local stakeholders are observing the effects of these relatively new federal efforts.

3. Methods

Between March 13 and March 17, 2023, we conducted 12 semistructured in-person interviews with 47 individuals from 22 organizations in the San Juan and Permian basins and in Albuquerque. We also conducted a virtual meeting with one individual representing one organization. All meetings took place under “Chatham House Rules.” Participants were informed that the researchers would be free to use the information received, but that no comments would be attributed to individual speakers or their organizations without explicit permission. We did ask whether we could acknowledge the participation of each individual and their organization in the report. All stakeholders consented and are listed in the Appendix. We sought out individuals representing local governments, Native nations, local economic development practitioners, the oil and gas industry, community-based environmental organizations, labor organizations, and other stakeholders (see Appendix for the full list).

We elicited viewpoints on whether and how stakeholders were seeking to build local economic resilience in the face of an uncertain future for oil and gas development. Because climate change and energy policies are often contentious, we avoided using terms that have strong political salience, such as “just transition,” “energy transition,” or “climate policy.” Instead, we spoke about “economic resilience,” which we defined as a local economy that is robust against future trajectories of oil and gas production and prices.

We did not ask stakeholders to envision any specific scenario or set of policies. Instead, we sought to understand how they hoped to build economic resilience in the face of an uncertain future. We noted that this uncertainty could result from government policy, but it could also be the result of global economic conditions, decisions made by OPEC, technological innovations, and many other factors that could affect future prices and/or demand for oil and natural gas in the decades ahead.

We explained that our goal was to inform federal policymakers who were considering how best to support local economic resilience for oil and gas communities over the long term (e.g., 10–20 years), and that we believed that federal policymakers needed to understand local perspectives so that they could align resources with local priorities. Each interview was guided by five broad questions, though we emphasized that stakeholders could expand the scope of the conversation to better explain how they were seeking to build local economic resilience. The five questions were as follows:

- What are some of the steps you are taking, or considering taking, to help build economic resilience in your community?

- What types of federal policies, if any, do you think would be helpful in building economic resilience specifically in your community?

- What existing federal policies, including those in the Infrastructure Investment and Jobs Act (2022) and the Inflation Reduction Act (2022), may be helpful in pursuing these objectives?

- What existing federal policies are you concerned could inhibit the building of the type of resilient economy that you envision?

- What additional policies do you think the federal government could pursue to support economic resilience in US oil- and gas-producing communities, including in your community?

Interviews ranged from roughly 45 minutes to two hours and covered a broad range of topics. We did not record interviews because we believed that doing so would cause respondents to speak less candidly. Instead, we took detailed notes and at each stage of the conversation, repeated to interviewees what we understood their points to be. In the following section, we report the findings from our interviews.

4. Key Findings

Here, we summarize the main findings from our interviews, with a focus on informing federal policymaking to support economic resilience in the San Juan and Permian basins.

- The San Juan and Permian basins are at different stages of energy development, have different needs, and will likely need to pursue different strategies for building economic resilience. Whereas the San Juan basin faces an immediate economic crisis, the Permian region is experiencing record levels of oil production, boosting local employment and tax revenue. Federal efforts to support these regions would need to address immediate challenges in the San Juan basin while seeking to build economic resilience over the longer term in the Permian.

- Local stakeholders are skeptical but willing to work with the federal government to build economic resilience. Although many of our interviewees are not supportive of efforts to advance a rapid energy transition, most were willing to accept support from the federal government to build economic resilience against an uncertain future.

- Administrative capacity is a major limitation to accessing federal economic development support. This observation applies to all public entities but particularly those with limited capacity. Leaders of Native nations, county and municipal officials, and economic development practitioners all noted onerous requirements for obtaining federal funding. Most interviewees believe that future federal efforts would succeed only with concurrent support for administrative capacity and/or simplifying reporting requirements.

- Wind and solar energy development is unlikely to replace jobs and tax revenue from fossil fuels. Most stakeholders saw efforts to advance natural gas, blue hydrogen, carbon capture and storage, geothermal, and helium development as a more likely path to support high-quality jobs and local government revenue. However, these technologies are controversial and opposed by some stakeholders.

- Although energy technologies can help build economic resilience, it is unclear which economic sectors offer the most promising pathways for future development in each region. Additional research and planning, led by local stakeholders, will likely be necessary to identify specific strategies for each region.

- Regardless of which economic sectors local stakeholders choose to pursue, investments in physical and social infrastructure, such as broadband, transportation, and health care, will be essential building blocks for economic resilience. These investments will be particularly important if local tax revenues, which currently support these services and are driven by oil and gas development, decline in the years ahead.

- Federal lands policy creates challenges for economic development. Most of New Mexico’s San Juan basin is publicly owned, with a considerable area owned by the federal government. Private and public entities seeking to invest in the entertainment, recreation, and other sectors have been impeded by the challenges of obtaining permits for activities on federal lands.

In the remainder of this section, we summarize the findings from our interviews with stakeholders in the San Juan basin (4.1) and the Permian basin (4.2), and we provide a brief summary of statewide issues based on our interviews in Albuquerque (4.3).

4.1. San Juan Basin

As described in Section 2.1.1, fossil fuel development has been an integral part of the San Juan basin’s economy for generations. This development is not merely a consequence of the region’s wealth in natural resource, but also a direct result of federal energy planning, suggesting that federal policymakers bear a particularly important responsibility for supporting local communities in a transition toward a net-zero emissions energy system.

One common theme across stakeholders was that the San Juan basin faces an economic crisis, described by one interviewee as “a fight for our lives.” Recent and pending closures of the region’s coal-fired plants coupled with a prolonged decline in oil and gas extraction have created major challenges, and further declines in the oil and gas industry threaten greater economic damage. Local stakeholders are seeking new opportunities to diversify the regional economy by taking advantage of their natural resources, particularly natural gas (for export and hydrogen production), helium, and geothermal energy, and by boosting amenity values to attract remote workers and tourism.

However, most stakeholders perceived federal and state policies as primarily impeding rather than supporting their goal of economic diversification. Several expressed the desire for state and federal policymakers to “slow down” in their efforts to pursue an energy transition, feeling that the region has experienced rapid economic changes without sufficient time to plan. For example, funding for workforce retraining and economic diversification, promised by the state’s Energy Transition Act, was perceived as woefully insufficient and had yet to provide meaningful local benefits.

Local officials and economic development practitioners expressed frustration with the complexities of economic activity on publicly owned lands (in San Juan County, just 6 percent of land is privately held), particularly federal lands. For example, private efforts to host film or television productions and public efforts to construct hiking trails on federal lands have been stymied by the time required to obtain the needed federal permits, deterring investment in the entertainment and recreation industries. Reflecting this concern, the Rio Arriba County Board of Commissioners (2021) has stated its opposition to the Biden administration’s efforts to expand land conservation, believing it would further hinder economic development in their county.

More recent federal efforts, such as tax credits in the Inflation Reduction Act and the establishment of the IWG’s Four Corners Rapid Response Team, were seen as promising but had yet to bear fruit. Local economic development professionals expressed skepticism that these efforts would help them access federal economic development support, which requires significant grant-writing capacity. This issue was particularly pronounced for the Navajo and Jicarilla Apache nations, who have limited administrative capacity and, for some, a deep-seeded skepticism of federal interventions. In some cases their representatives were very skeptical that federal efforts would benefit Native nations at all. One Native interviewee found reporting requirements for federal grants ironic, noting, “We gave you the land, and we don’t ask for reports!”

Despite their shared challenges, the two Native nations bring different perspectives to the energy transition. The Navajo Nation continues to pursue large-scale investments in coal mining inside and outside the reservation but has also begun investing in solar energy and helium production. The Jicarilla Apache Nation has also pursued solar energy, with a 50-megawatt facility on its reservation with the potential for future expansion. However, it also expressed the desire for more technical support to inform decisionmaking about the future of energy development on its reservation, particularly with regard to natural gas, geothermal, and hydrogen.

Although they have borne, and still bear, the brunt of significant environmental burdens, both Native nations were eager to continue pursuing oil and natural gas development. For the Navajo Nation, a priority has been ensuring land is available for new leasing to drill around Chaco Culture National Park, which has been opposed by other Native nations and the Biden administration (Davenport 2023). Similarly, the Jicarilla Apache Nation remains reliant on revenue from natural gas development and is part of an alliance to build a new pipeline to export local natural gas to Asia through a new LNG facility on the Pacific coast. For details, see the Western States and Tribal Nations Natural Gas Initiative, at www.westernnaturalgas.org.

For these Native nations, along with other San Juan basin stakeholders, development of blue hydrogen is a priority, and the region is seeking to become a hydrogen hub, which would make it eligible for billions of dollars in federal funding to build out hydrogen production and related infrastructure (Krupnick et al. 2022). If the region’s bid is successful, the federal government would be playing a major role in supporting regional economic development activities, even if these activities are opposed by some environmental organizations (Section 2.1.3).

4.2. Permian Basin

The Permian basin is booming, offering a complex mix of economic benefits and environmental hazards for both the Permian region and the state. Oil and gas employment, economic output, and government revenue have surged to new highs while environmental and health risks have also increased. In general, local officials and economic development practitioners are very supportive of the oil and gas industry and are opposed to state or federal efforts that would restrain its growth. At the same time, these stakeholders are open to efforts that can build economic resilience to reduce their exposure to economic volatility or a potential long-term decline in demand for hydrocarbons.

Local environmental and labor advocates are focused on environmental and health protections, but their priorities differ. Some local environmental groups believe that oil and gas development poses unacceptable environmental and public health risks at local, regional, and global scales, and that drilling activity should slow to a stop, even if this causes economic harm. Labor advocates are more focused in the near term on improving workplace conditions, which they describe as extremely hazardous. In the medium to long term, they would also like to see a phaseout of oil and gas development but believe that the state and federal governments need to help build new economic opportunities to ensure that families and communities remain intact.

A major challenge recognized by all stakeholders interviewed is that current opportunities for economic diversification are limited, but there was no consensus on which economic sectors present the greatest promise for local growth. Local government and economic development practitioners support an effort to expand nuclear waste storage in the region, which they argue would provide new jobs and generate significant public revenues. However, this effort is opposed by local environmental organizations and the current governor (Grover 2023b). A similar dynamic exists for the development of blue hydrogen: it is largely supported by local officials but opposed by local and state environmental groups. Renewable energy also offers some opportunity for the region, which has high-quality solar and wind resources (Sengupta et al. 2018; US DOE 2023).

Despite the lack of agreement on which economic sectors may prove most promising, stakeholders agreed that upgrades in both physical infrastructure, such as roads and water infrastructure, and health care and education services would be an enabling factor. Currently, the oil and gas industry funds much of this infrastructure through taxes and royalty payments. In a future where oil and gas development declines, maintaining, let alone improving, local infrastructure would require finding large new revenue sources.

Like the San Juan basin, New Mexico’s Permian basin has extensive federal lands. Local stakeholders largely view federal landownership as an impediment to economic development, particularly oil and gas development. Although the federal government provides substantial payments in lieu of taxes, In FY2023, Eddy and Lea counties received $4.2 million and $1.3 million, respectively, PILTs from the federal government. See https://pilt.doi.gov/counties.cfm for details. in local officials believe that land conservation or other efforts that restrict land uses will deter new investment.

Although local officials had considerable misgivings about federal energy and land management policies, all of our interviewees were open to receiving additional support from the federal government to build local economic resilience. For example, several interviewees who generally oppose current federal energy policies stated that they would welcome a rapid response team similar to the one established for the Four Corners region.

At the same time, local economic development practitioners noted that they often lacked capacity to seek federal support for local priorities, in part because of high staff turnover. An example: one oil and gas industry-supported nonprofit has hired professional grant writers to help local governments prepare applications and train new grant writers working in these communities. In a future scenario where the economic impact of the oil and gas industry shrinks, tax revenues to support grant-writing capacity would fall, and in-kind donations to support it would presumably decline as well.

4.3. Statewide Issues

As discussed in Section 2.1.3, a current impediment to a concerted energy transition policy is division among environmental advocates over the role of certain technologies, particularly those involving carbon management. Although this issue may continue to divide the environmental community, our interviewees were generally encouraged by the $100 million in funding for economic transition programs and by ongoing state-level efforts to develop a more comprehensive strategy to build economic resilience in energy communities.

One issue that is not specific to oil and gas communities but may affect the speed of decarbonization efforts statewide is an acute labor shortage in the trades. Trade workers, who will be needed in large numbers to build and install clean energy infrastructure—renewable energy generators, transmission lines, heat pumps—are often attracted to higher-paying opportunities in New Mexico’s national laboratories and industrial facilities. To address this shortage, representatives of state labor unions argued for immigration reform to expand the labor pool and an enhanced focus on the trades in high schools.

5. Conclusion

New Mexico’s oil- and gas-producing regions are at different stages of development but both face considerable challenges building economic resilience. Although many stakeholders would like to slow or halt federal efforts to rapidly reduce greenhouse gas emissions, all are supportive of federal efforts to support local economic diversification.

For these efforts to succeed, our interviews suggest, they will need to meet two challenging goals. First, federal intervention needs to support local economic development priorities. Because stakeholders have different views, particularly about the role of nuclear, blue hydrogen, carbon capture and storage, and geothermal, identifying local priorities will require extensive engagement with a wide range of stakeholders. Indeed, it is likely that not all stakeholders will agree on a single approach to build local economic resilience. Nonetheless, research has indicated that early, deep, sustained community engagement is essential to achieving procedural justice in the energy transition (Carley and Konisky 2020; Spurlock et al. 2022).

Second, federal efforts to build economic resilience need to reduce the barriers to entry for capacity-constrained local governments and other stakeholders. Addressing this challenge likely includes capacity-building strategies, such as the IWG’s Rapid Response Team, but may also require reforms to federal grantmaking processes to reduce the administrative burden for all applicants. It is also possible that emerging technologies, such as generative artificial intelligence, could be deployed to assist local grant writers or to review applications at the federal level.

Building economic resilience in communities that are heavily dependent on oil and gas extraction will be difficult, and even the best-designed efforts from federal or other agencies will not guarantee success. Some communities have thrived primarily or solely because of their oil and gas resources. In the years ahead, policymakers must answer challenging questions about how, whether, and where to target support to enable an equitable energy transition across the many regions where oil and natural gas are central to the local economy.