What Can Federal Place-Based Economic Policies Teach Us about the Energy Transition?

This report reviews the literature on the effectiveness of three major types of federally funded, place-based economic development programs: Empowerment Zones, Opportunity Zones, and the New Market Tax Credit.

Abstract

Place-based policies designed to support fossil fuel–dependent communities are emerging in the United States and abroad. However, there has been little analysis to understand which, if any, existing place-based economic development policies can serve as models in the energy transition. In this analysis, we review the empirical evidence on the effectiveness of three major federally funded place-based economic development programs, then assess their relevance to the energy transition. We find that existing policies, depending on their design details, can be effective in directing investment and improving local economic outcomes in targeted locations. However, these programs can contribute to neighborhood gentrification, and economic benefits may flow primarily to residents living outside the targeted community. Adapting any of these policies to an energy transition context would require changes in eligibility criteria, geographic targeting, selection mechanisms, and more. We offer several conceptual models for how such policies could be structured but caution that much additional research and community engagement will be needed to determine which mix of interventions is likely to be most effective in ensuring an equitable transition toward a clean energy future.

1. Introduction

The transition away from polluting energy sources has serious implications for local communities that are heavily reliant on fossil energy production for jobs, economic growth, and government revenue. One option to mitigate the economic disruption is through federal programs that specifically target these communities to help them build economic resilience against an uncertain future. Such place-based policies are not new and have previously sought to stimulate economic growth in disadvantaged communities by incentivizing private investments. Indeed, recent federal policy such as the Infrastructure Investment and Jobs Act and Inflation Reduction Act include place-based energy-related provisions that will create hubs for specific energy technologies in certain regions, incentivize investment in coal communities, and more.

In this report, we summarize the empirical evidence and draw lessons from scholarly articles that have examined the impacts of US federal place-based economic development policies. Note that we do not focus on local- or state-level place-based policies, which have been widely critiqued as costly and ineffective (e.g., Bartik 2020; Decker 2020).

Our objective is to understand whether, and to what extent, previous policies can inform future place-based policies targeting fossil energy–dependent communities.

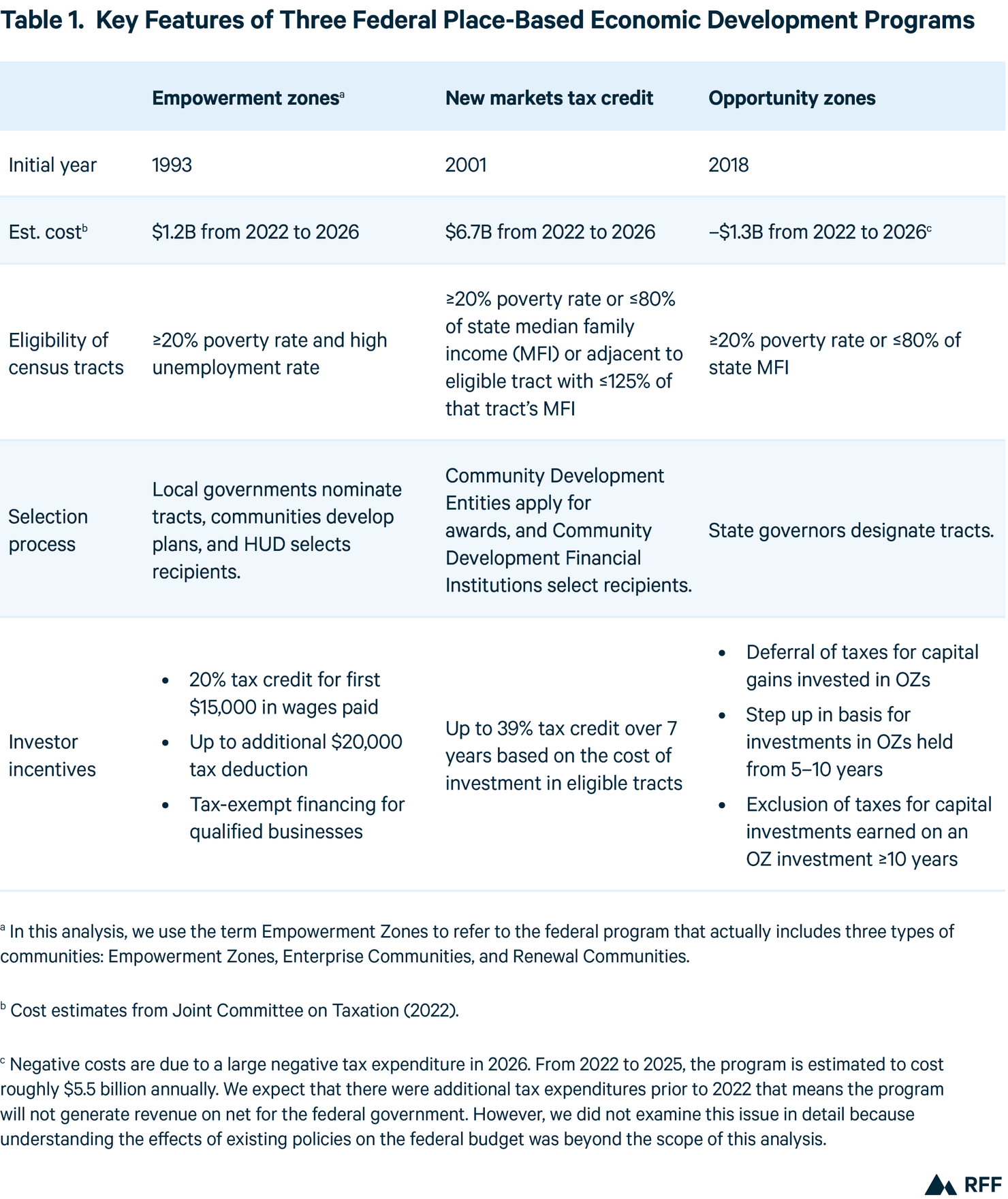

Our review focuses on three programs—Empowerment Zones (EZs), Opportunity Zones (OZs), and New Markets Tax Credit (NMTC)—each of which seeks to spur private investment in economically distressed communities using tax incentives and grants. These programs differ across a variety of dimensions, including eligibility criteria, selection mechanisms, and the available incentives, which we summarize briefly in Table 1. For additional detail on the history and unique features of each program, see Marples (2011, 2022a,b).

2. Key Findings from the Literature

2.1. Empowerment Zones

In 1993, Congress began allocating funds to support qualified EZs and their counterparts, Enterprise Communities and Renewal Communities (throughout this analysis, we use the term “EZ” to refer to all three types of communities), with funds jointly administered by multiple federal agencies (GAO 2022). Overall funding for these programs has been fairly modest, totaling $1.8 billion (2011 US$) from 1993 through 2011 (Marples 2011), with estimated future tax expenditures of $1.2 billion from 2022 through 2026 (Joint Committee on Taxation 2022).

Empirical evidence on the effectiveness of the program is mixed, with some studies finding substantial economic benefits but others reporting little effect. At the national level, Krupka and Noonan (2009) observe an increase in home values of 25 percent or more as a result of the EZ program (a result that implies local gentrification and potentially regressive economic outcomes). Ham et al. (2011) conclude that EZ designation reduced local unemployment rates by 1.6 percent, decreased poverty rates by 6.1 percent, and increased wages and employment. Using confidential microdata, Busso et al. (2013) report that, relative to a similar comparison group, the initial round of the program led to a 12–31 percent increase in tract employment and an 8-3 percent increase in wages for tract residents. Reynolds and Rohlin (2015) find that on average EZ designation increased household income by roughly $2,000 and home values by $27,000 compared with a counterfactual scenario. However, they note that most of these benefits accrued to higher-income households and that the most disadvantaged households did not benefit from the program.

Taking a more localized view, Rich and Stoker (2010) identify varied effects across jurisdictions. In five of the six major cities they examine, the number of jobs and level of investment improved due to EZ designation. The effects of the EZ program on other measures, such as unemployment rates and housing investment, were more mixed.

However, not all analyses find positive effects. For example, Oakley and Tsao (2006), who focus on data from four large US cities, report that EZ designation had no statistically significant effect on local income, unemployment, or poverty rates when compared with a group of non-EZ census tracts that the authors identify using propensity score matching. Hanson (2009) observes that EZ designation slightly increased local residents’ employment in an ordinary least squares (OLS) regression approach but had no effect when using an instrumental variable approach that accounted for endogeneity issues present in the OLS approach. Additionally, Neumark and Young (2019) reanalyze Ham et al. (2011) and argue that endogeneity in the selection of EZs renders their findings largely moot. The authors also contend that EZs in general, particularly when implemented by state governments, are ineffective.

In another relevant analysis, Hanson and Rohlin (2011) focus on how EZ designation may alter the composition of investment and employment in a community. The authors find that retail and service sector establishments expand by 0.16 to 0.30 percent, while transportation, finance, insurance, and real estate industries decline by 0.16 to 0.19 percent. They hypothesize that these changes in industry composition reflect businesses’ differential ability to take advantage of the tax credits, which primarily incentivize spending on labor (rather than capital).

2.2. New Markets Tax Credit

The New Markets Tax Credit (NMTC) offers incentives for capital investment in eligible communities through Community Development Entities (CDEs) and can support private sector enterprises or community facilities such as schools or museums. CDEs seek investors, then apply for tax credits allocated through a competitive process administered by the Community Development Financial Institutions Fund within the Department of Treasury. If the CDE is awarded credits, investors in the CDE benefit from a credit value of 5–6 percent annually over a seven-year period based on the total amount of investment (Marples 2022b).

The literature on outcomes of the NMTC generally reports that the program led to additional investment and employment in eligible census tracts. However, studies also find evidence that longtime community residents did not necessarily benefit the most, as new residents moving into eligible tracts and workers from other communities received many of the new jobs and wages resulting from NMTC investments.

According to Gurley-Calvez et al. (2009), early evidence from the program shows that the NMTC induced firms to shift their investments from nonqualified to qualified tracts but did not increase the overall level of investment in the economy. Freedman (2012) observes that the program had meaningful effects across some measures in the early 2000s, with an 8 percent reduction in poverty rates and a 5 percent reduction in unemployment rates in eligible communities (relative to a noneligible comparison group), along with some evidence of gentrification occurring as household turnover rates increased. Similarly, Freedman (2015) reports that a $1 million investment led to 46 additional jobs in the relevant tract, but these new jobs often went to people living outside the community.

Looking at which sectors were affected, Harger and Ross (2016) identify positive effects of the NMTC on existing firms, particularly in the retail and manufacturing sectors, which saw a 10.4 percent and 8.8 percent increase in employment, respectively. However, they also note a decrease in new firms in the wholesale and transportation sectors. Freedman and Kuhns (2018) focus on local food systems, finding that the program modestly increased the entry of supermarkets into low-income communities.

In the most long-term analysis we identified, Theodos et al. (2022) use data from 2001 to 2016 and report that projects intended to increase firms resulted in 18 new firms entering the market, while projects intended to create jobs and boost incomes generated around 101 additional jobs on average (27 of which went to community residents), reduced local poverty rates by 0.7 percent, and slightly boosted incomes. Like previous work, this analysis finds evidence of gentrification, with NMTC communities experiencing an influx of college-educated adults.

2.3. Opportunity Zones

The literature on the effects of the OZ program are also mixed but mostly show little to no economic benefit for low-income communities and their residents. Unlike the EZ and NMTC programs, where administrators make decisions about project- or community-level awards based on a discretionary application process, OZs are selected by the governor of each state. As long as a census tract meets certain criteria (see Table 1), governors could select up to 25 percent of their state’s tracts as OZs. Perhaps unsurprisingly, governors’ decisions reflected a preference for the communities that supported them politically. Specifically, governors favored tracts that were represented in the state legislature by a member of their political party on average by 7.6 percent over those that were not (Frank et al. 2022).

For investors and owners of eligible properties, the OZ program appears to have created substantial benefits. Sage et al. (2023) report that qualified properties appreciated by 7–20 percent as a result of OZ designation, while vacant land prices rose by up to 37 percent post designation. Wiley and Nguyen (2022) note that although eligible industrial properties enjoyed a 21 percent premium following designation, investment did not flow to the most distressed communities. Instead, there was evidence of cherry-picking, with investment flowing to properties that had other physical advantages (e.g., available excess land) or socioeconomic strengths (e.g., high employment rates and strong population growth).

For communities and their residents, most evidence shows little to no economic benefit from the OZ program. Atkins et al. (2021) identify no effect of OZ designation on job openings and a small (1.5 percent) increase in posted job salaries that is not significant across different statistical specifications. Snidal and Li (2022) evaluate data on loan issuance and report that OZ designation did not increase local lending in the commercial or residential sector, indicating that the policy did not stimulate new investment by community members in designated tracts. Freedman et al. (2023) use restricted microdata from 2013 through 2019 and observe no benefits of OZ designation in terms of employment, earnings, or poverty rates. One exception is the finding of Arefeva et al. (2021) that designated census tracts experienced 3.0–4.5 percent higher employment growth in metropolitan areas than similar tracts that were not designated. However, they see no effect in nonmetropolitan areas, and most employment growth benefited residents who lived outside the designated tract.

3. Implications for the Energy Transition

Although none of the three programs discussed in Section 2 were designed to support the communities that may be negatively affected by a shift away from fossil fuels, evidence on their effectiveness can inform how similar policies might be designed to support fossil energy–dependent communities. In this section, we first identify key themes from our literature review that provide such information, along with relevant implications for future policies (Table 2). We then discuss how certain design elements of each program could be adapted to fit an energy transition context, offering several conceptual models for how policies could be structured.

Although the implications described in Table 2 do not constitute a comprehensive set of lessons that policymakers can use to craft measures to support fossil fuel–dependent communities in the energy transition, they highlight several critical policy design elements that deserve further scrutiny and offer specific guidance on certain topics, such as eligibility criteria and geographic units. In some cases, elements from existing place-based economic policies may serve as models for future programs. For example, one major feature of the EZ program is its community-led approach, whereby local stakeholders come together to craft a vision for future economic development that the federal government can then support with financial and technical assistance. This approach requires extensive resources and capacity in the communities developing the project proposals, however, two things that many rural fossil fuel–dependent communities lack.

Another option to consider is the NMTC’s use of a federal entity, in this case housed within the Department of Treasury, to make decisions about how to allocate financial benefits. (These are tax credits in the context of the NMTC but could include other types of assistance in an energy transition context.) Such an entity could function similarly to other federal grantmaking institutions, such as the Department of Commerce’s Economic Development Administration or Department of Agriculture’s Rural Development, but would also need to avoid burdensome administrative requirements that can make it difficult for rural energy communities to access federal aid (Raimi and Whitlock 2023).

Policymakers could also consider adapting elements of the OZ program to target fossil fuel–dependent communities. Under this model, new investment in eligible locations (perhaps known as “energy counties”) could be incentivized by federal tax credits that encourage the private sector to develop new economic growth engines in regions that are currently heavily dependent on fossil fuel production, refining, or use at power plants. This model is somewhat similar to the “energy communities” provision of the Inflation Reduction Act but could be broadened to encourage investments outside the clean energy sector (Raimi and Pesek 2022). However, the relative ineffectiveness of the OZ program cautions against adopting some of its design elements, such as the structure of the program’s tax benefits and the determination of eligible locations by state governors.

To be clear, we are not recommending that policymakers undertake any of these specific approaches at this stage. Rather, we see these adaptations of existing policies as potential models to support equity in the energy transition. Additional research is needed to better understand which mix of policies will be most effective in supporting the regions that have powered the US economy for over a century. And regardless of which models policymakers choose, significant additional funding will likely be needed to build economic resilience in fossil energy-dependent communities.

4. Conclusions

We have reviewed place-based policies designed to support economically distressed communities and find that some existing policies can be effective in directing investment and improving local economic outcomes. Adapting any of these policies to an energy transition context would require changes in eligibility criteria, geographic targeting, selection mechanisms, and more.

We expect that economic development policies will be one of multiple components that can work together to build more diverse and resilient economies in fossil fuel–dependent regions. Additionally, different policy mechanisms such as federal block grants, which states and localities can use flexibly, may be more effective at spurring local economic development than federal policies narrowly focused on economic development (Bartik 2020).

Finally, and crucially, any federal intervention should include early and continuous engagement with affected communities. Such engagement is essential to ensure that federal policies and investments align with local priorities and that local, state, and federal policymakers communicate about what is working and what is not in the years ahead. Looking forward, additional research and community engagement are needed to determine which mix of interventions is likely to be most effective in ensuring an equitable transition toward a clean energy future.

Authors

Srutakirti Mukherjee

University of Wyoming