Carbon Pricing 104: Economic Effects across Income Groups

A review of how the economic impacts of different carbon pricing policies may be distributed across households.

Carbon pricing—implemented either through a carbon tax or cap and trade—is widely thought to be one of the most powerful policy options for reducing greenhouse gas emissions. As described in “Carbon Pricing 101,” introducing a price on emissions changes the cost of using fossil fuel, leading people to use less. Because a carbon price causes the costs of energy and other goods to increase, many express concern that carbon pricing would be regressive, negatively affecting low-income households in particular. However, just the opposite could result; low-income households may be better off under a carbon price, and relatively higher income households could be worse off. The distribution of a carbon pricing policy’s economic impacts across households depends on how the policy is implemented—and in particular, how carbon pricing revenue is used.

Impacts on Households Can Be Positive and Negative

Households are financially affected by carbon pricing through two primary channels: changes in expenditures and changes in income.

Progressive Policy vs. Regressive Policy

Many public policies affect households differently; these differences are described as the distributional effects, or incidence, of a policy. When considering the distributional effects on households with different levels of income, policies are often described as progressive, proportional, or regressive. A policy is progressive if the costs constitute a larger proportion of income for high-income households than for low-income households and regressive if the costs constitute a larger proportion of income for low-income households than for high-income households. It is proportional if the policy’s costs constitute the same proportion of income for households with different income levels.

Expenditures

An increase in the cost of energy under carbon pricing would affect households through changes in the prices of primary types of energy, including gasoline, heating fuel, natural gas and electricity. Moreover, although to a smaller extent for most households, energy price changes could increase the costs of services and goods like food.

The amount of energy a household consumes directly or indirectly is associated with income. Higher income households tend to consume more of everything, including energy, so they would likely see a greater increase in expenditures. However, low-income households may be more vulnerable to changes in energy prices; although low-income households consume less energy, it accounts for a larger share of their budgets (Figure 1). Consequently, it would at first appear that carbon pricing would be regressive, because the costs to low-income households would represent a greater share of their income.

However, the burden on low-income households can be offset by various government programs such as Social Security payments and the Earned Income Tax Credit, Worker’s Compensation, and Supplemental Nutrition Action Payments. These programs, and others, are indexed to inflation (the payments automatically adjust over time to reflect the higher cost of goods). Therefore, a change in the cost of living triggers an increase in transfer payments, which will decrease the effect of carbon pricing for low- or fixed-income households that receive benefits from these programs (Figure 2).

Incomes

Another factor that lessens the impact on expenditures across all households is that not all of the carbon price is passed on to consumers through increased prices; some of the cost is paid by the companies that sell products. When a product’s price increases, most consumers have at least some ability to purchase a different product instead. Producers have to balance the change in their costs with the possibility of fewer sales, and consequently they are unlikely to pass the full carbon price to consumers through changes in product prices. The resulting decrease in producer profits under a carbon price tends to reduce incomes for households that own businesses or greater amounts of capital, which are generally the relatively high-income households.

Revenue Use Determines Impacts

The most significant factor that determines distributional impacts is how revenues from carbon pricing are used. (For more detail on possible uses of carbon pricing revenue, read this explainer.) Returning revenues as an equal-per-household dividend (in California, this is called a “climate credit”) could offset the change in expenditures and result in a net financial gain for a majority of households, especially low-income households. If a dividend were treated as taxable income, then the policy would be even more progressive because higher income households typically face higher marginal tax rates. If eligibility for such a dividend were limited to households with incomes below a specific level, more revenue would be available for eligible households, again making the policy more progressive.

There are trade-offs, however; when revenues from a carbon price are returned as dividends to households, those revenues are not available for other purposes. For example, federal, state, and local governments will spend billions to help communities prepare for climate change; carbon pricing revenues could be used towards that effort. Another use of revenues might be to reduce the burden of other taxes. This could help the economy grow even more than would dividends, though it would have different distributional effects, tending to provide greater benefit to relatively higher-income households who pay more in taxes.

Variation across Households

RFF has developed modeling capabilities that can shed light on how the various factors described above come into play under different carbon prices. Our modeling accounts for the changes in both expenditures and income that are expected to result from carbon pricing and the differences across the income distribution. Figure 3 assesses an illustrative national $45 carbon tax per ton of CO₂ and displays the changes in household welfare that would occur in the policy’s first year, without accounting for the use of carbon revenues. Increases in expenditures on both energy and non-energy goods decrease welfare for average households in each income quintile. Incomes decline for most quintiles, and more greatly for higher income households.

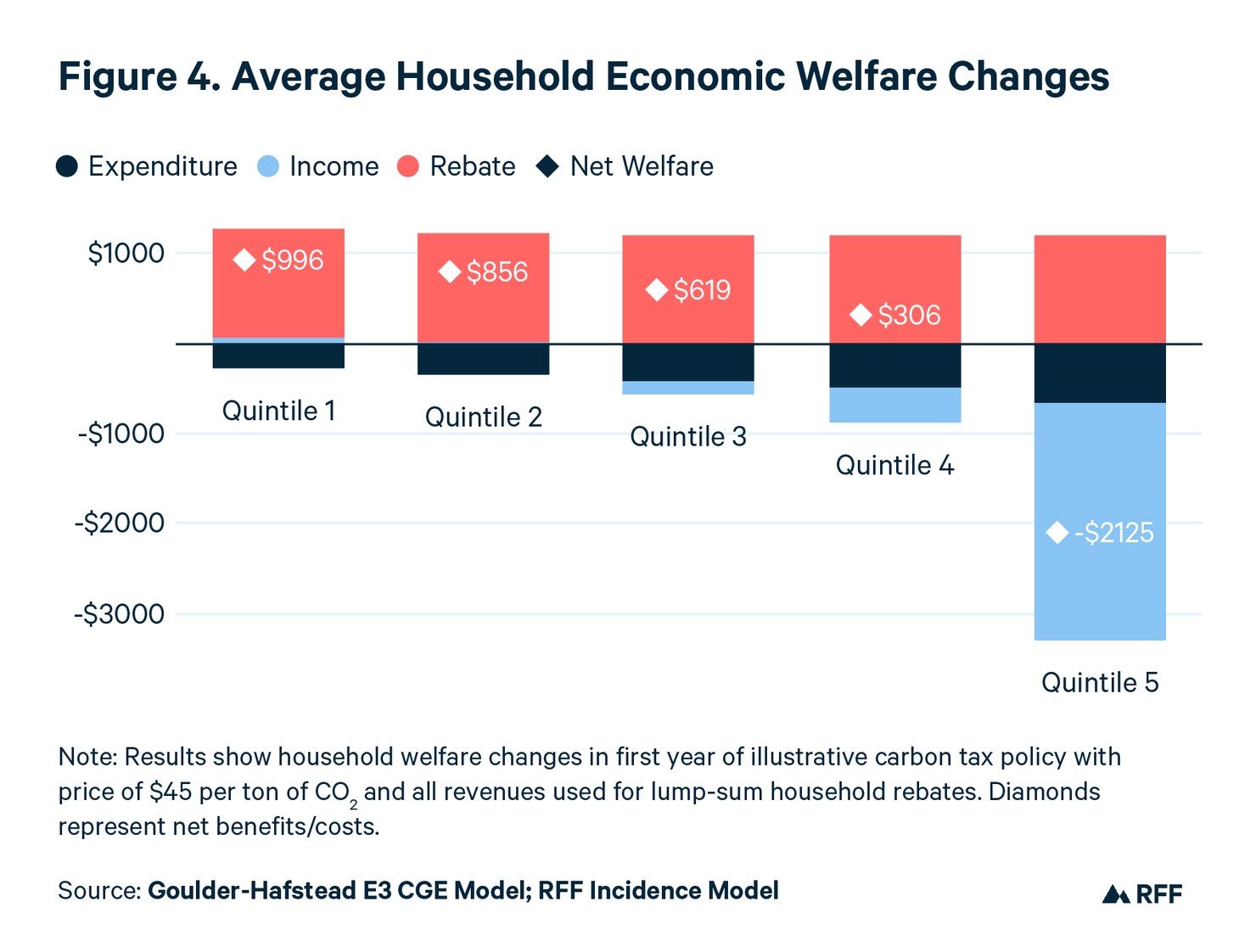

The most substantial factor that drives variation between households is the use of revenues. Figure 4 shows average household welfare effects for the illustrative $45 carbon tax, including a carbon revenue rebate distributed equally to all households. As a result of the rebate, average households in all income quintiles besides the top quintile would enjoy economic welfare benefits even before accounting for any environmental and public health benefits from carbon pricing.

An important consideration in every case is that differences across households within an income group can be almost as great as differences across income groups. Within the same income group, some households will be barely affected while other households may experience a substantial effect, negative or positive. Policy design will strongly influence this outcome, and the single most important factor is the way that revenues from a carbon tax are reintroduced into the economy.