Decarbonized Hydrogen in the US Power and Industrial Sectors: Identifying and Incentivizing Opportunities to Lower Emissions

Tax credits could make hydrogen energy more competitive in the US industrial and power sectors, but reductions in production and storage costs and expansion of transportation infrastructure are necessary to achieve zero-carbon hydrogen use.

Abstract

Hydrogen has attracted significant interest for its potential contributions to a low-GHG economy, because of its capacity for storing chemical energy without carbon. In this report, we consider two methods of decarbonized hydrogen production, so-called blue and green hydrogen, for use in power generation, industrial heating, and as an industrial feedstock in the United States. We find that there is a near-term opportunity in using blue hydrogen to reduce feedstock emissions in oil refining and ammonia manufacturing. For green hydrogen to be competitive, substantial reductions in production and storage costs are necessary. However, if those costs decline sufficiently, green hydrogen has broad potential: for long-term energy storage, industrial heat, and as a feedstock for refining, chemicals, and steel. We then assess policy options to support decarbonized hydrogen in the power and industrial sectors. A tax credit has the advantages of familiarity (e.g., the 45Q tax credit for CCUS and the PTC for wind) and not raising prices within the sectors. Although an efficient tax credit for decarbonized hydrogen would be more complex than 45Q, we find that it could properly account for the climate benefits from decarbonized hydrogen.

Key Findings

- Hydrogen produced from natural gas and using carbon capture technology is a viable near-term option for low-carbon hydrogen, which would reduce current emissions in oil refining and ammonia manufacturing.

- For significant penetration, the cost of zero-carbon hydrogen from renewable or nuclear power must decline drastically, and inexpensive storage and pipelines must be established beyond the Gulf Coast.

- If cost reductions and infrastructure expansion can be achieved, zero-carbon hydrogen offers the potential for long-term energy storage and as a decarbonized industrial fuel and feedstock.

- Assuming that a carbon price that includes the industrial sector is unrealistic in the near term, a tax credit for decarbonized hydrogen would be a feasible and effective policy option.

- A production-based tax credit, modeled on the 45Q expanded tax credit, would support decarbonized hydrogen to compensate producers or users for its climate benefit.

1. Introduction

Using decarbonized hydrogen is an avenue to a low-carbon economy that has attracted renewed interest. Assessments by the International Energy Agency (IEA), consulting firms, trade associations, and academic organizations (e.g., IEA 2019; IRENA 2019; Hydrogen Council 2020) have examined how technological developments and cost reductions could allow hydrogen to contribute significantly to a decarbonized economy. Building on those technical roadmaps, this report considers the role of public policy: should decarbonized hydrogen be promoted, and if so, what approach would be effective and feasible?

The motivations for supporting decarbonized hydrogen are based on the two functions of hydrogen—as a feedstock and as a fuel. A vast amount of hydrogen is already used as an industrial feedstock, mostly for ammonia manufacturing and petroleum refining. Since current hydrogen production results in substantial emissions of carbon dioxide (CO2), changing to low- or zero-carbon hydrogen production processes is a critical step in decarbonizing existing feedstock applications. The greater cost of low-carbon versus high-carbon processes is the primary barrier to such change. Additionally, decarbonized hydrogen could replace high-carbon feedstocks in novel processes, such as for steel production.

The use of hydrogen as a fuel is less developed than as a feedstock because fossil fuels are cheap to produce and handle. However, hydrogen offers considerable potential because it has the unusual property of generating no CO2 on combustion. For some applications, such as high-temperature industrial heat and long-term energy storage, that have limited options for reducing emissions, decarbonized hydrogen is a promising alternative. Challenges include the increased costs of fuel production and infrastructure, as well as the potential need to change power or industrial equipment for hydrogen use.

Of the policy options for promoting decarbonized hydrogen, the preferred instrument—a carbon tax—is not possible in the current legislative and regulatory environment, leaving tax credits and standards. The successful track record of a tax credit, numerous applications for decarbonized hydrogen, its uncertain cost trajectory, and concerns of carbon leakage and job losses all favor a tax credit over a standard.

In this report, we will first review the processes, and the respective costs, of hydrogen production—both the high-emitting methods that currently predominate as well as the decarbonized methods that a tax credit could support. Understanding the costs and emissions of hydrogen production processes allows us to assess whether a tax credit tied to climate benefits would make decarbonized hydrogen competitive with current production methods.

Next, we will consider three broad end uses for decarbonized hydrogen: for dispatchable low-carbon power, as a source of industrial heat, and as an industrial feedstock. Of particular interest are the emissions profiles of the fuel or feedstock that decarbonized hydrogen would replace and the cost-effectiveness of using decarbonized hydrogen. Our goal is to identify which applications for decarbonized hydrogen would be competitive with existing fuels or feedstocks if there were an efficiently priced tax credit.

Note that we are not examining the potential for decarbonized hydrogen either in the transportation sector—for passenger vehicles, buses, or trucks—or in the residential and commercial sectors for space heating. Although these areas may hold promise for emissions reductions with decarbonized hydrogen, they are outside the scope of our report. Nevertheless, a tax credit is sufficiently versatile to promote decarbonized hydrogen for these uses.

Having examined the costs and emissions—of decarbonized hydrogen and of the fuel or feedstock that it would replace—we will assess the design of an effective tax credit. The level of the tax credit is a key consideration. If the tax credit were set to equal the social cost of carbon (SCC), would this level be sufficient to make decarbonized hydrogen competitive in power and industrial applications? Several other features are also important to effective design: the structure of the tax credit (either production- or investment-based), the assignment of the credit to the producer or user of hydrogen, the duration of a production-based credit, deadlines and eligibility rules, monitoring and enforcement, and coordination with the 45Q tax credit for carbon capture, utilization, and storage (CCUS).

2. Hydrogen Supply

Because of extensive demand for industrial feedstocks, the global production of hydrogen is a big business, with dedicated annual production of 70 million tons and a market value of $115 billion in 2017 (Wood Mackenzie 2019; IEA 2017). Hydrogen production also has a significant energy footprint, consuming roughly 2 percent of primary energy demand (IEA 2019). In this section, we review the principal methods of hydrogen production, as well as their CO2 emissions intensities and costs. We then focus on the low-carbon methods—their development, component costs, and projections of future production costs. We describe the infrastructure requirements for the transportation and storage of hydrogen, whose costs must be included when hydrogen is compared with other fuel and feedstock options. We summarize by identifying when different methods and locations of hydrogen production are likely to become competitive, after accounting for carbon costs.

2.1. Methods of Hydrogen Production

Hydrogen can be produced through numerous methods, but current production is dominated by just two, steam reforming of methane and gasification of coal. Both of these production processes emit significant quantities of CO2, but they can be decarbonized if combined with CCUS. The leading alternative low-carbon production method is electrolysis using power from nuclear or renewable energy sources.

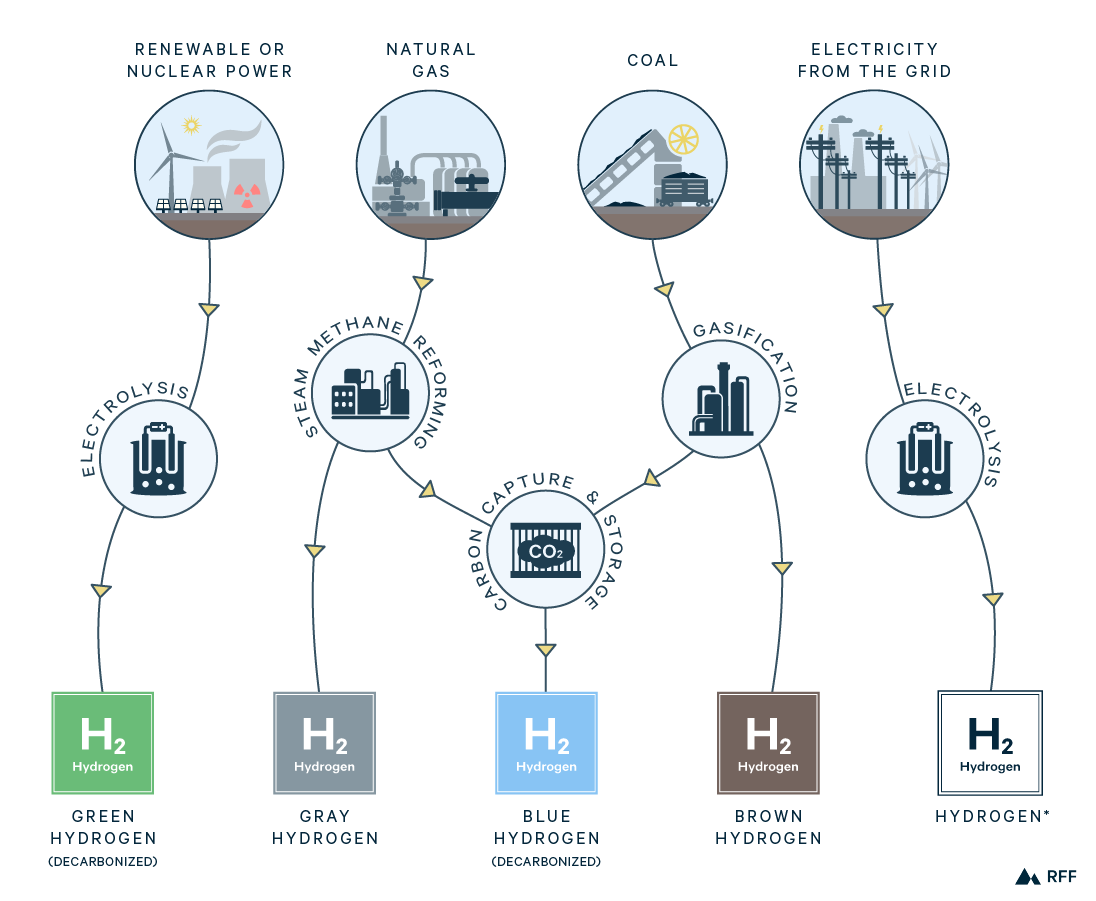

A couple of notes on hydrogen production. First, following the convention in popular media and most industry reports, we use colors to indicate particular pathways of hydrogen production (Figure 1). Second, the methods described are those used in the dedicated production of hydrogen. One-third of current hydrogen supply is from industrial processes that generate hydrogen as a by-product (IEA 2019). Because our interest is production that would scale according to the demand for hydrogen, we focus on dedicated production methods.

2.1.1. Gray Hydrogen from Natural Gas (without CCUS)

Natural gas accounts for roughly three-quarters of global hydrogen production, and reciprocally, hydrogen production consumes 6 percent of global natural gas supply (IEA 2019). The predominant method of hydrogen production from natural gas is steam methane reforming (SMR), in which methane is reacted with high-temperature steam to produce hydrogen and carbon monoxide. Natural gas has two functions in SMR—as the feedstock (natural gas is mostly methane) and for combustion to generate the necessary heat. Since SMR produces a mix of hydrogen and carbon monoxide (known as synthesis gas, or syngas), the subsequent water-gas shift and pressure swing adsorption reactions increase the hydrogen yield, consume carbon monoxide, and remove carbon dioxide and various impurities.

Figure 1. Hydrogen Production Processes

Although the term gray hydrogen is often used interchangeably with SMR, there are alternative reforming methods using natural gas to produce hydrogen. These include partial oxidation, in which oxygen replaces steam in the SMR reaction, and autothermal reforming (ATR), in which both oxygen and steam are used as reactants. In partial oxidation and ATR, heat is generated inside the reactor vessel by the reactions themselves, whereas with SMR, natural gas is combusted externally for heat. With a higher yield of hydrogen, SMR is generally the least-cost gray hydrogen production method. However, if CCUS is included in the process (as we discuss below), ATR could be more cost-effective.

2.1.2. Brown Hydrogen from Coal (without CCUS)

Coal accounts for almost one-quarter of global hydrogen production, which consumes about 2 percent of annual coal supply (IEA 2019). A large proportion of coal-based hydrogen production is in China, where natural gas prices are almost three times higher than in the United States (IGU 2019), making coal the preferred source. Hydrogen is generally produced through gasification, a similar reaction concept to ATR, with the hydrocarbon (coal, in this case) being reacted with oxygen and steam to produce hydrogen, carbon monoxide, and carbon dioxide. As in the natural gas methods, subsequent water-shift and pressure swing adsorption reactions increase hydrogen production and remove other gases. The primary difference between the gasification of coal and reforming of gas is that coal contains a greater ratio of carbon to hydrogen, along with other elements (e.g., sulfur and nitrogen). Therefore, the gasification of coal generates more carbon dioxide and various impurities.

2.1.3. Blue Hydrogen from Natural Gas or Coal (with CCUS)

CCUS can be applied to any of the natural gas– and coal-based hydrogen production processes discussed above. Conceptually, CO2 can be captured from the process stream, the combustion flue gases, or both. For SMR, about 55 percent of the total CO2 emissions are a byproduct of the reforming and water-shift reactions; the remaining 45 percent result from combustion for heating (Sandalow et al. 2019). The process stream has a higher concentration of CO2 than is present in the combustion flue gases, resulting in higher efficiency and lower cost of capture (Friedmann et al. 2019). For this reason, the first stage in SMR blue hydrogen development has been to capture the process emissions, which several plants around the world already do. To achieve a higher total capture rate, CO2 capture from combustion gases must be included. Consequently, ATR, in which all the CO2 emissions are contained within the process stream, may be more cost-effective than SMR if the goal is to attain a high percentage (90 percent and above) of CO2 capture.

CCUS applied to the gasification of coal also produces blue hydrogen, and in countries with high natural gas prices, like China, this may be the least-cost method for decarbonized hydrogen production. Assuming CO2 capture from both process and combustion emissions, CCUS applied to coal gasification can achieve a 90 percent total capture rate. Nonetheless, because of coal’s high carbon content, coal-based blue hydrogen emits nearly twice the CO2 of natural gas–based blue hydrogen even if capture rates are identical (IEA 2019).

2.1.4. Green Hydrogen from Zero-Carbon Power

Rather than using a hydrocarbon, such as natural gas or coal, as a feedstock, hydrogen can be produced by splitting water into its constituent elements, hydrogen and oxygen. The most common method of splitting water is electrolysis, in which an electric current breaks water down, transforming electricity into chemical energy. Less than 0.1 percent of dedicated hydrogen is currently produced through water electrolysis, but the electrolysis of sodium chloride to produce chlorine generates byproduct hydrogen, which accounts for two percent of total hydrogen supply (IEA 2019). All the various types of electrolyzers involve two electrodes (an anode and a cathode), an electricity source, and an electrolyte that together form a circuit. Electrolyzers cause water to be reduced at the cathode (adding electrons, generating hydrogen gas) and to be oxidized at the anode (removing electrons, generating oxygen gas).

There are three main classes of electrolysis for hydrogen production: alkaline electrolysis, proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOECs). The most mature technology is alkaline electrolysis, which uses an alkaline electrolyte like sodium hydroxide. Alkaline electrolyzers have long lifetimes (up to 90,000 hours) and comparatively low capital costs because of their use of inexpensive materials (IEA 2015). However, alkaline electrolyzers operate at relatively low pressure and current density, increasing hydrogen production costs (Schmidt et al. 2017). PEM electrolyzers, in which a polymer serves as the electrolyte, are a less mature but still commercial technology. PEM electrolyzers currently have higher capital costs and shorter lifetimes than alkaline cells, but further development of PEM technology may be able to reduce these relative disadvantages. Moreover, PEM electrolyzers can operate at high current density and very flexible capacity—of particular importance when the power is variable (IEA 2019). Lastly, SOECs are a promising, but not yet commercial technology using a ceramic (solid oxide) electrolyte. SOECs convert electricity to chemical energy at a higher efficiency than alkaline or PEM electrolyzers, but their high capital costs and short lifetimes mean that further research and development is needed for SOECs to be commercially viable. Additionally, SOECs operate with high-temperature steam rather than liquid water, so they would need a low-carbon heat source to minimize production emissions.

For alkaline and PEM electrolysis, CO2 emissions from hydrogen production depend almost entirely on the source of electricity. Electrolysis using power from the grid—given the present mix of US power sources—would not, on average, be a low-carbon method of producing hydrogen. For hydrogen to be green, the power mix must be low-carbon, namely renewable or nuclear energy. Although electricity produced from natural gas with CCUS or coal with CCUS would be low carbon, using such power for electrolysis would be an inefficient way to decarbonize hydrogen production. Applying CCUS directly to hydrogen production (i.e., blue hydrogen) would avoid the efficiency loss from an additional step of energy conversion. However, if electrolysis were powered by a single variable renewable energy source, particularly a source with low capacity utilization, like solar, the production cost of hydrogen could be prohibitive. We discuss the effects of power source on electrolysis emissions and costs in further detail in Sections 2.2 and 2.3.

2.1.5. Other Hydrogen Production Methods

Although the natural gas reforming, coal gasification, and electrolysis methods cover the present state of the industry, numerous other pathways to hydrogen generation exist. These methods range from lab scale to commercially mature, but they have not yet received the breadth of interest as have the methods above.

First, biomass can be used as a feedstock for hydrogen production. Solid biomass, including specialty crops (e.g., switchgrass) and residues from agricultural or forest products, can be gasified like coal. Alternatively, biomass can be converted to liquid biofuel (e.g., ethanol) and then reformed like natural gas (DOE 2020a). Accounting for plant regrowth, biomass-based methods have low net CO2 emissions. If CCUS were applied to biomass gasification, CO2 emissions could be negative (Royal Society 2018). However, biomass is limited by the available resource, so it would be unable to scale to the extent of blue or green hydrogen. For example, converting current US hydrogen production to biomass-based hydrogen would require one-sixth of the technical potential of US biomass, compared with 1 percent of wind or 0.1 percent of solar for electrolysis (Ruth et al. 2017). Technical potential is defined as the resource potential constrained by geographic and system limitations but not economic or regulatory barriers (see Ruth et al. 2017).

Second, one natural gas–based route to hydrogen production emits little CO2 without capture. Methane splitting (or methane cracking) is a high-temperature method of separating hydrogen from carbon, generating hydrogen gas and carbon black, a solid form of carbon used as an industrial material. Methane splitting thus generates two valuable products and reduces the CO2 footprint of both (Gusev 2019). To produce both carbon black and hydrogen, the firm Monolith Materials has a pilot plant in California and is constructing a commercial plant in Nebraska, expected to be complete in 2020 (Monolith Materials 2020).

Third, solar energy can power the splitting of water in processes other than electrolysis. Solar thermochemical hydrogen production uses the heat from concentrated solar power to drive a cycle of reactions that generate hydrogen from water. Photoelectrochemical water splitting uses light energy (photons) to separate hydrogen from oxygen using a method similar to that of photovoltaic solar power. The US Department of Energy characterizes both methods as long-term production pathways, which it includes in a portfolio of hydrogen production, transportation, storage, and utilization technologies funded under the H2@Scale program (DOE 2020b).

2.2. Emissions from Hydrogen Production

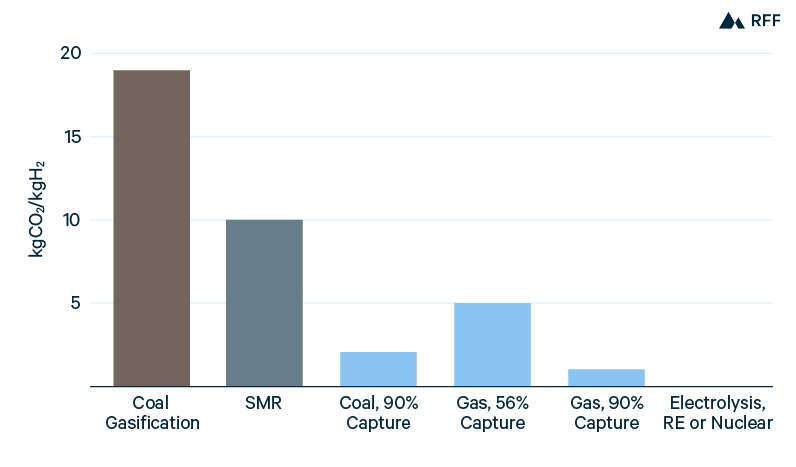

With almost all current production from either natural gas reforming or coal gasification and without CCUS, the generation of hydrogen is a substantial source of global CO2 emissions. In 2017, emissions from the dedicated production of hydrogen totaled 830 million tons, more than 2 percent of global fossil CO2 emissions and greater than the emissions from Germany (Wood Mackenzie 2019). Figure 2 shows the carbon intensities of production for brown, gray, blue, and green hydrogen. Emissions range from 19 kgCO2/kgH2 for brown hydrogen to essentially zero for green hydrogen. As discussed above, gray hydrogen has roughly half the emissions intensity of brown hydrogen, which in turn causes blue hydrogen from natural gas to have about half the emissions of blue hydrogen from coal (at equivalent capture rates). Blue hydrogen is further split between capturing only the process CO2 (50 to 60 percent capture) and capturing both process and combustion CO2 (about 90 percent capture).

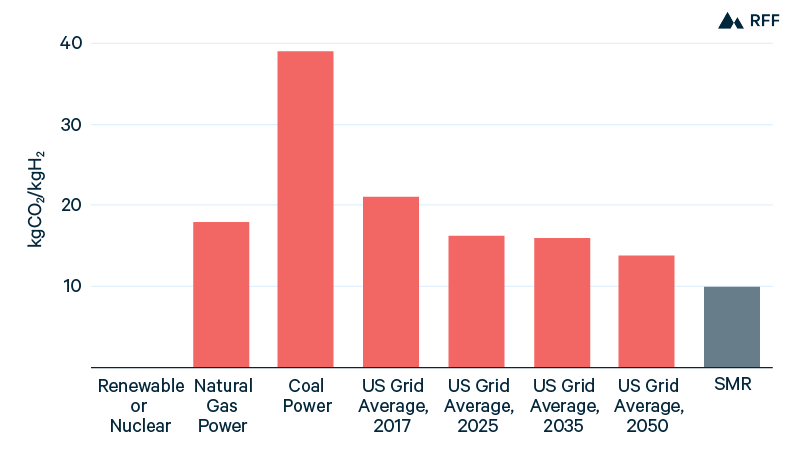

Although green hydrogen has almost zero emissions, electrolysis using other power sources has a large carbon footprint, as shown in Figure 3. In 2017, the US electricity grid had an average carbon intensity between that of natural gas– and coal-fired power. If average grid power had been used for electrolysis, the CO2 emissions intensity would be more than twice that of SMR because of the inefficiency in the additional step of energy conversion. With the retirement of coal-fired power plants and the increase in wind and solar power, the carbon intensity of the US power sector is decreasing. Still, without additional policies, the progress of grid decarbonization will likely decelerate within the next decade, thereby delaying the climate benefit of electrolytic hydrogen. For example, in the reference case of the 2020 Annual Energy Outlook, using average grid power in 2050 for electrolysis would emit 40 percent more CO2 per kgH2 than SMR.

Figure 2. CO2 Emissions, by Hydrogen Production Method

Figure 3. CO2 Emissions from Electrolysis, by Power Source

Note that none of the estimates of CO2 emissions are based on the life cycle. Most important are methane emissions, caused by leakage or purposeful venting, from all prior stages of the natural gas value chain—drilling, production, processing, transportation, and distribution. Because methane is a greenhouse gas with a global warming potential (GWP) many times that of CO2 (28 to 36 over 100 years; EPA 2020), this exclusion understates the emissions for hydrogen produced from natural gas, whether by methane reforming or electrolysis using natural gas power. For example, the Committee on Climate Change (2018) estimates upstream methane emissions for blue hydrogen from natural gas in the UK of 1 kgCO2-eq/kgH2 to 5 kgCO2-eq/kgH2, which would substantially raise the emissions profile of natural gas–based blue hydrogen. Notably, including upstream methane emissions would disadvantage blue hydrogen relative to green hydrogen, but the relative effect against gray hydrogen would be quite small (because of the minor increase in natural gas consumption for a plant with carbon capture). Moreover, as we discuss in Section 3, many of the potential applications for decarbonized hydrogen currently use natural gas, which would entail similar upstream methane emissions.

Although upstream methane emissions are significant, they vary considerably by location, and a hydrogen producer may have little control over them. Consequently, a tax credit for decarbonized hydrogen would not be well suited to account for methane emissions and promote their reduction. Instead, methane-focused policies (if not comprehensive carbon policies) would be the appropriate mechanisms.

As a final note on emissions, although the combustion of hydrogen does not produce CO2, hydrogen itself is an indirect greenhouse gas with an estimated GWP of 5 (Derwent et al. 2020). Further research is needed to better characterize the climate effects of hydrogen, but if hydrogen infrastructure becomes widespread, preventing leaks may become significant for mitigating the social cost of fugitive hydrogen emissions.

2.3. Costs of Hydrogen Production

2.3.1. Current Hydrogen Production Costs

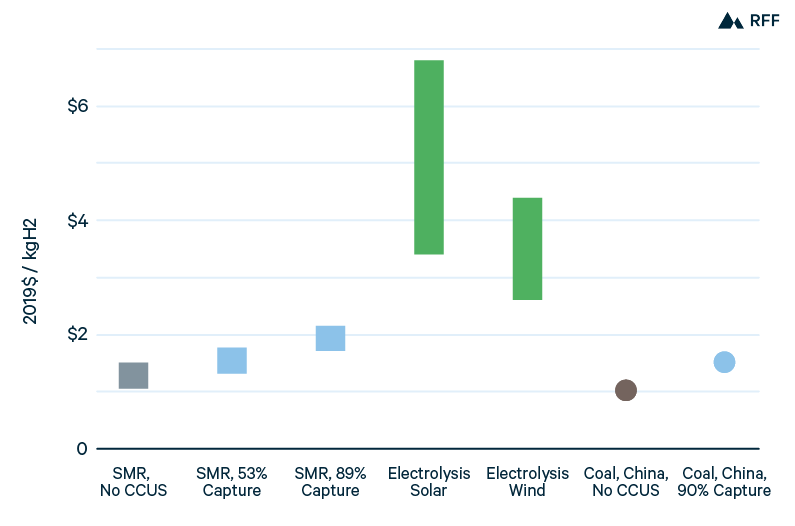

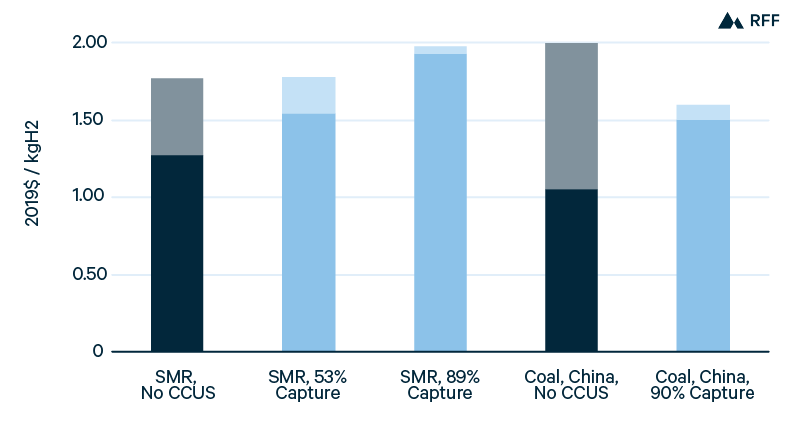

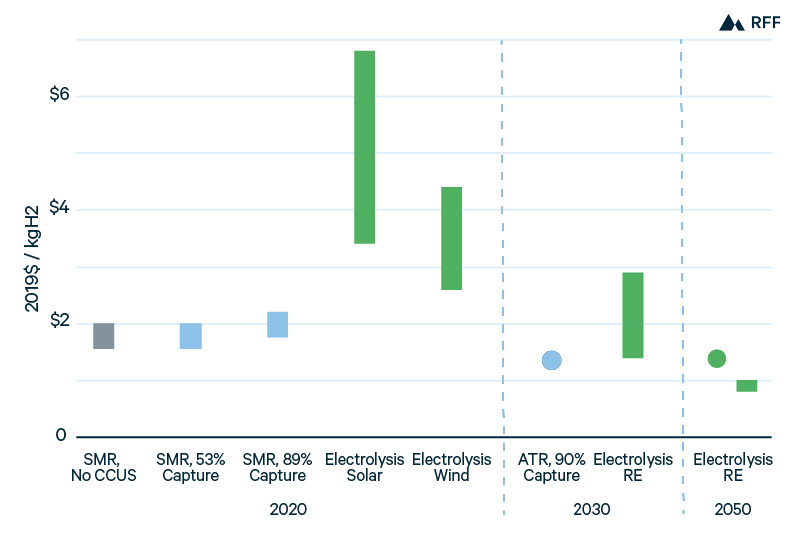

Figure 4 presents ranges for current costs of hydrogen production in the United States, along with point estimates for costs in China. Because of low US natural gas prices, SMR is the least expensive US production method, with the low end of costs approaching $1.00/kgH2. Applying CCUS to the process stream of SMR, capturing just over half of total emissions, adds between $0.25/kgH2 and $0.30/kgH2 to hydrogen production costs. Applying CCUS to combustion gases captures 35 to 40 percent of emissions from SMR but at a higher marginal cost of CO2 capture: production costs increase by $0.35/kgH2 to $0.40/kgH2 (Sandalow et al. 2019). In China, the higher cost of natural gas favors coal gasification, which has production costs similar to the low end of SMR in the United States, $1.05/kgH2. Capturing 90 percent of the emissions from coal gasification in China would increase hydrogen production costs by about 50 percent (IEA 2019). Compared with the broad range of emissions intensities for gas- and coal-based hydrogen (Figure 2), the range of brown, gray, and blue hydrogen costs is narrow (Figure 4).

Although blue hydrogen—even with 90 percent capture—entails significant emissions of CO2, current production costs of blue hydrogen are inexpensive relative to green hydrogen methods. As we further discuss later in this section, the capital and electricity costs must decline and the utilization (or capacity factor) must increase if the production costs of green hydrogen are to approach those of blue hydrogen.

Figure 4. Current Hydrogen Production Costs, by Method

In Figure 5, an illustrative carbon price of $50/tCO2 shows the near-term viability of blue hydrogen. With this carbon price, capturing emissions from the process stream would result in a production cost equal to that from SMR without CCUS. In other words, a tax credit of $50/tCO2 would make blue hydrogen (with 50 to 60 percent CO2 capture) competitive with gray hydrogen. However, applying CCUS to the combustion gases as well—to capture roughly 90 percent of total CO2 emissions—would remain more expensive because of the lower efficiency of this method. Whereas the marginal abatement cost of capturing process emissions is about $50/tCO2, the marginal cost of capturing combustion emissions exceeds $100/tCO2. For brown hydrogen in China, given its high emissions intensity, capturing 90 percent of CO2 emissions would reduce production costs by 20 percent. Although the price of $50/tCO2 is illustrative, it is consistent with the global SCC and the value of the 45Q tax credit for CCUS, both of which we discuss in Section 4.

Figure 5. Current H2 Production Costs, with $50/tCO2 Price

2.3.2. Cost Components and Opportunities for Reduction

2.3.2.1. Blue Hydrogen

For blue hydrogen, the incremental costs of adding CCUS to natural gas reforming fall into three categories: capital expenditures, operating expenses, and fuel costs. We focus on blue hydrogen from natural gas rather than coal, given the predominance of gas-based hydrogen in the United States and the lower CO2 potential for hydrogen from natural gas. For SMR, CCUS equipment for the separation of CO2 from the process stream—and, for even lower emissions, the combustion gases as well—would need to be added to the production plant. Operating expenses increase primarily because of the transportation and storage of CO2 from the plant. Lastly, carbon capture requires energy itself (often referred to as a parasitic load on the plant), increasing the amount of natural gas needed to produce a given amount of hydrogen. Of these three components, the incremental capital expenditures and operating expenses account for a large majority of the increased production costs for blue hydrogen (IEA 2019).

The production cost of blue hydrogen can be reduced in several ways. Novel technological pathways for blue hydrogen production are possible. See, for example, https://www.greentechmedia.com/articles/read/utility-global-comes-out-with-big-claims-for-hydrogen. First, technological improvements and cost reductions in carbon capture equipment would reduce the incremental capital expenditures for blue hydrogen and, to a lesser extent, the operating and fuel expenses through less material use and greater fuel efficiency. Second, increased scale of CCUS—at a regional level—would lower the costs of CO2 transportation and storage, the largest incremental operating expenses. These technological and scale effects show the benefit to blue hydrogen from the broader development of CCUS. Third, for blue hydrogen with 90 percent capture, a transition from SMR to ATR could reduce the cost of CO2 capture by one-half to two-thirds (Hydrogen Council 2020), causing overall production costs to fall. Finally, lower natural gas prices would decrease blue hydrogen costs: a decline of $1.00/MMBtu in the price of natural gas (currently selling for less than $3.00/MMBtu; EIA 2020b) would reduce the cost of blue hydrogen by $0.15/kg to $0.20/kg (IEA 2019). At the same time, lower natural gas prices would reduce the costs of gray hydrogen and also make hydrogen less competitive in applications where natural gas is an alternative fuel or feedstock. Of course, higher natural gas prices would work in the opposite direction.

2.3.2.2. Green Hydrogen

For green hydrogen to be competitive, significant improvements in its three major cost components—the capital expenditure, the electricity cost, and the electrolyzer utilization—are needed. Capital expenditures for green hydrogen include the electrolyzer stack (an assembly of cells) and the balance of the electrolysis plant, including power electronics and plant infrastructure. The cost of electrolyzer stacks would decline with increasing scale of electrolyzer manufacturing, using more automated and streamlined processes (Hydrogen Council 2020), and the development of less expensive cell materials. The balance of plant cost would decline with greater numbers of electrolyzer stacks in a plant, spreading fixed plant costs over a larger electrolysis capacity.

The cost of electricity is established in one of two ways, depending on the configuration of the green hydrogen plant. For a plant with a dedicated power source, such as a particular solar or wind project, the power cost is the levelized cost of electricity (LCOE) from that project. LCOE is the ratio of the present value of total costs to the present value of electricity generation, and thus it accounts for a project’s capital and operating costs and its utilization. Solar and onshore wind costs have declined dramatically over the past decade to about $40/MWh in average locations and $30/MWh in optimal locations (Lazard 2019). Future cost reductions for solar and wind power are expected to be more modest, with estimated 2040 costs (in 2019$) of $25/MWh to $30/MWh for solar and $26/MWh to $36/MWh for onshore wind (EIA 2020c). Cost ranges reflect optimal locations at the low end and average locations at the high end, since it is less likely that solar or wind would be installed in resource-poor locations. Nevertheless, costs reductions may be greater than those projected by EIA, with 2040 costs (in 2019$) as low as $11/MWh for solar and $16/MWh for onshore wind (NREL 2019). Costs reflect low technology costs and optimal locations from the National Renewable Energy Laboratory’s 2019 Annual Technology Baseline. Alternatively, the green hydrogen plant may be connected to the grid, so long as the power it uses is renewable or nuclear, as verified with renewable energy certificates (RECs), for example. In this case, the electricity cost would be the power price, either in the wholesale market or to an industrial consumer, plus the market premium for zero-carbon power. Average power prices for wind and solar energy (not including their renewable premium, as measured by REC prices) ranged from $16/MWh to $36/MWh for wind and from $28/MWh to $42/MWh for solar across US wholesale markets in 2018 (Wiser and Bolinger 2019; Bolinger et al. 2019). Besides REC values, wholesale power prices further exclude the value from federal tax credits and deductions and the value of providing capacity to the grid. Wholesale power prices at a particular location vary hourly and seasonally, so the grid-connected alternative allows for potentially higher utilization (as we discuss below) and lower power prices for green hydrogen. In particular, increasing renewable energy on the grid will likely lead to periods with excess power supply and a price of zero. Consequently, there is an aspiration that green hydrogen plants will be able to take advantage of this zero-priced power to achieve substantially lower production costs. However, other power consumers will also seek to make use of the power surplus, so large quantities of zero-priced electricity cannot be expected to persist. The uncertainty in the quantity of low-cost power is a significant risk for a grid-connected plant. Whereas green hydrogen with a dedicated power supply has a fixed cost of power, a grid-connected system faces uncertain power costs over the life of plant.

Electrolyzer utilization (also referred to as capacity factor or load factor), the third major cost component of green hydrogen, is affected by capital expenditures and power prices. For green hydrogen with a dedicated power source, electricity costs are fixed and the green hydrogen plant operates as much as possible. Still, the solar or wind plant itself generates electricity only a fraction of the time, and the utilization of the electrolyzer may not exceed the capacity factor of the power plant. New US solar and onshore wind plants in good locations have capacity factors of about 30 percent and 40 percent (EIA 2020c), respectively. Capacity factors for wind and solar vary significantly, because of both geographic location and project design choices (e.g., rotor lengths for wind, tracking and inverter size ratios for solar). Over the past 10 years, US capacity factors have ranged approximately between 30 and 50 percent for wind projects and between 18 and 32 percent for solar projects (Wiser et al. 2020; Bolinger et al. 2019). To achieve a higher utilization, green hydrogen plants could use nuclear or offshore wind, but both of these technologies have considerably higher generation costs along with higher capacity factors. Other options to increase electrolyzer utilization are to pair solar or wind plants with battery storage or to combine solar and wind with each other in locations where their generation is complementary (IRENA 2019).

For grid-connected green hydrogen, the trade-off between utilization and power prices occurs continually over the life of the plant. Rather than operating whenever power is available, as with a dedicated power source, the grid-connected plant would minimize its hydrogen production costs by choosing to produce when power prices are low but producing sufficiently often to amortize its fixed capital cost. At very low utilization rates (e.g., less than 20 percent), an increase in utilization has a large effect on reducing production costs, but at higher utilization rates (e.g., greater than 40 percent), the marginal benefit of increased utilization is far smaller (IEA 2019). The marginal cost of increased utilization is from higher power prices as the plant chooses to produce during periods of more expensive electricity, and its magnitude depends on the variability in power prices. Since utilization affects production costs through the amortization of fixed costs, reduced capital expenditures on electrolyzer stacks and the balance of plant would lessen the significance of utilization. Therefore, with decreased capital costs, green hydrogen plants could minimize production costs at lower rates of utilization.

Although capital expenditures, power cost, and electrolyzer utilization are the most significant drivers of hydrogen production costs, three other factors could provide incremental reductions in the cost of green hydrogen. First, electrolyzer stacks have an operating lifetime, which is currently longest for alkaline electrolyzers and shortest for SOECs. Longer stack lifetimes for each technology are possible, particularly for the less mature SOEC and PEM electrolyzers (IEA 2019); that would spread the capital cost over more hydrogen production. Second, the efficiency at which electrolyzers convert electrical energy to hydrogen may be improved for any of the electrolyzer technologies. Increased electrical efficiency would reduce effective power costs and raise the efficiency of capital investment. Third, operating and maintenance costs would be reduced with declining costs of parts and improved system operations (Hydrogen Council 2020).

2.3.3. Development of Blue and Green Hydrogen

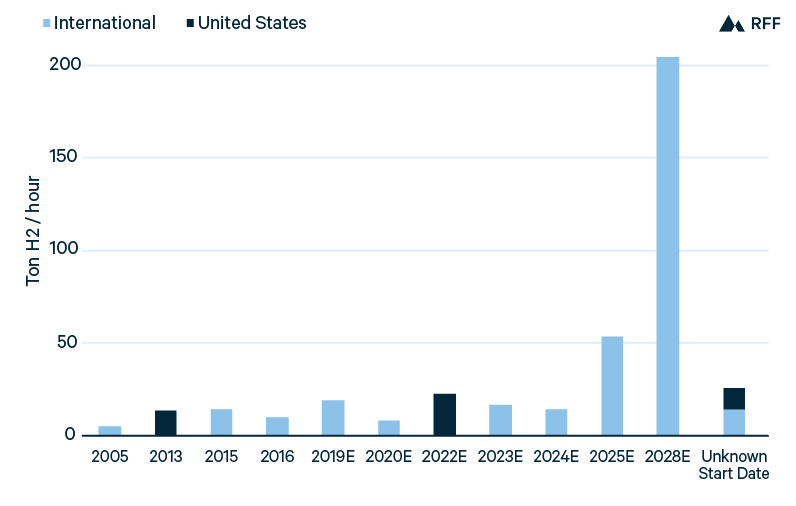

Figure 6 shows global installations of blue hydrogen, including operational projects and projects currently under development. The first blue hydrogen project came online in 2005 in the Netherlands, with the hydrogen produced at a Shell refinery and the captured CO2 sold to greenhouses in the region. Since 2013, blue hydrogen projects have come online at greater frequency, including at US ammonia and refinery operations, with the CO2 used in enhanced oil recovery (EOR). From project announcements, new blue hydrogen capacity will likely continue steadily over the next several years. Still, only one or two projects are planned to start blue hydrogen production in a given year, so added capacity is a function of the sizes of a small number of projects.

Figure 6. Blue Hydrogen Installations, Operational and Planned

The significance of project size is highlighted by the large increase in blue hydrogen capacity planned for 2028, from a single massive project. H21 North of England proposes nine production units that collectively could produce 1.8 million tons of hydrogen—equal to approximately 2.5 percent of the current global hydrogen supply—if operated at full capacity throughout the year. The H21 project illustrates two factors discussed above on how blue hydrogen costs can be reduced. First, with a very high CO2 capture rate of 94 percent, the H21 project has chosen ATR over SMR technology to lessen the costs of capture (H21 2018). Second, along with the large scale of H21 itself, widespread CCUS is planned in the region (particularly along the Humber estuary), decreasing CO2 transportation and storage costs and thus the operating costs of blue hydrogen. A cluster of CCUS facilities is also planned in Rotterdam (Parnell 2019). Such a coordinated strategy could allow for lower costs of blue hydrogen in Louisiana and Texas, for example.

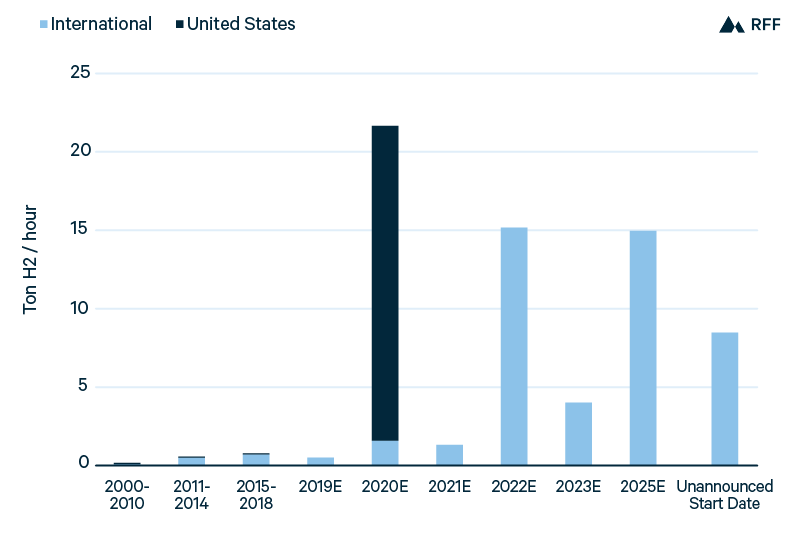

Figure 7 presents the capacity of new green hydrogen projects installed since 2000 as well as those planned for the next several years. Through 2018, the cumulative capacity was less than 2 tons of hydrogen per hour, but planned projects would increase global capacity more than 30-fold. As with blue hydrogen, total planned green hydrogen capacity mostly results from a few large projects. However, given the smaller size of green hydrogen projects, total green hydrogen capacity (both operational and planned) is about one-sixth that of blue hydrogen.

Figure 7. Green Hydrogen Installations, Operational and Planned

International development, particularly in Europe, accounts for a majority of planned green hydrogen capacity, but the largest announced project is in the United States. The Nel-Nikola project is a partnership between Nel (a Norwegian hydrogen company) and Nikola (a US designer of zero-emissions trucks) to provide 1 GW of electrolysis capacity to 30 hydrogen fueling stations across the United States (Nel 2018). As of June 2020, Nikola had ordered 85MW of electrolyzers from Nel. Whether the full 1GW project will be realized, and at what timescale, is uncertain—as is the case for all planned capacity additions. The project would decrease green hydrogen capital costs through an average electrolyzer capacity of more than 30 MW—larger than any electrolyzer installed to date and allowing for reduced balance-of-plant costs—and through the increased scale of Nel’s electrolyzer manufacturing.

Beyond the operational and planned projects shown in Figures 7 and 8, proposals for substantially larger green hydrogen projects include the Asian Renewable Energy Hub in Western Australia, which would devote up to 23 GW of onshore wind and solar for green hydrogen production, and the European Hydrogen Valley cluster, which would involve up to 10 GW of offshore wind in the North Sea to power electrolyzers in the Netherlands (Asian Renewable Energy Hub 2020; Parnell 2020). Both projects have dedicated power sources with the potential for low electricity prices and high capacity factors to reduce the production costs of green hydrogen. Alternatively, Mitsubishi’s Advanced Clean Energy Storage project in Utah is pursuing a grid-connected path to large-scale green hydrogen production. With increasing renewables penetration in the western United States, the project aims to procure large amounts of wind and solar energy at low prices, allowing for high electrolyzer utilization and low power costs (MHPS 2019).

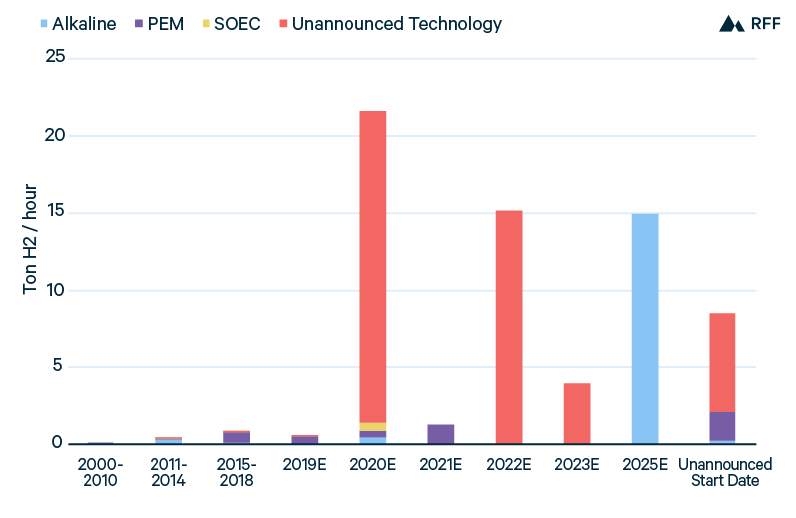

Green hydrogen projects in development highlight the importance of scale—of both hydrogen production plants and electrolyzer manufacturing—as well as power costs and utilization. Conversely, project information to date does not provide much indication of technological preference. Figure 8 shows operation and planned green hydrogen installations by technology, and with the exception of a large alkaline project set to come online in 2025 and a few smaller PEM projects, the majority of planned projects have yet to announce a technology choice. The scarcity of technological commitments suggests that the relative advantages of alkaline, PEM, and SOEC electrolyzers are unclear, at least over the near term.

Figure 8. Green Hydrogen Installations, by Technology

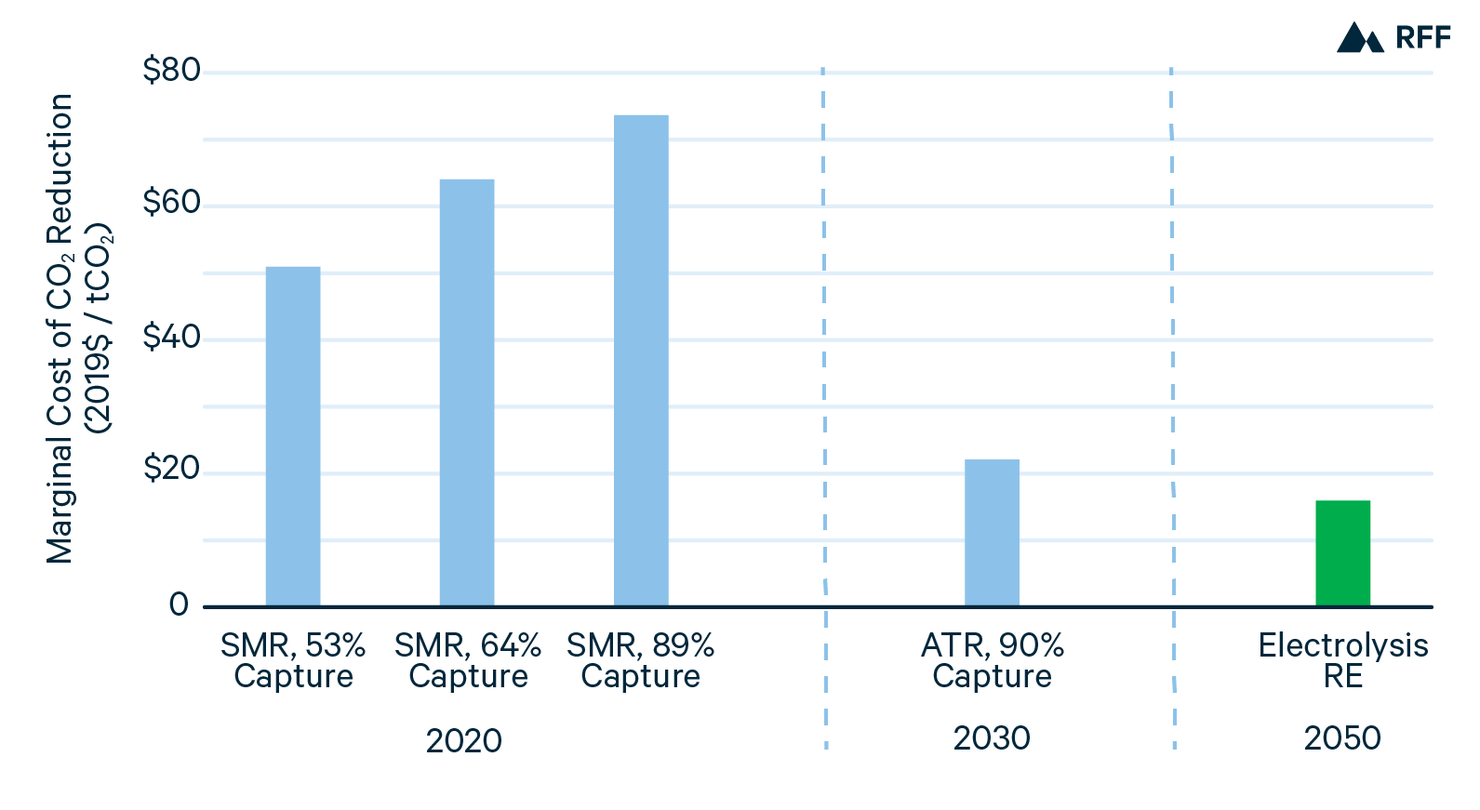

2.3.4. Future Costs of Blue and Green Hydrogen

From the present costs of gray, blue, and green hydrogen and projections of how component costs and factors might evolve, Figure 9 shows how the costs of hydrogen production technologies might compare over time. For blue hydrogen with CO2 capture from process emissions, production costs are already competitive with gray hydrogen after accounting for the global social cost of carbon or a tax credit equal to $50/tCO2. Blue hydrogen capturing CO2 from both process and combustion emissions is not yet cost effective. However, with increased scale—particularly of regional CCUS infrastructure—and a transition from SMR to ATR, blue hydrogen with 90 percent CO2 capture could be the most economic hydrogen production method by 2030, at an approximate cost of $1.30/kgH2 (Hydrogen Council 2020). Includes a cost of $0.06/kgH2 for the uncaptured CO2 emissions, based on the 2030 SCC.

Figure 9. Current and Projected Hydrogen Costs

Between 2030 and 2050, the production costs of green hydrogen may fall below those of blue hydrogen because of further reductions in electrolyzer and power costs. IRENA (2019) considers electrolyzer costs of $200/kW and power costs of $20/MWh for green hydrogen in 2050, giving a production cost of $1.38/kgH2 at the assumed 48 percent utilization. However, power costs and electrolyzer costs may decline significantly further. The Italian natural gas utility Snam expects that green hydrogen in 2050 will have a power cost of only €12/MWh, along with a capital cost of €162/kW (Snam 2019). A recent Bloomberg New Energy Finance analysis forecasts electrolyzer costs of just $80/kW in 2050. In combination with projected power costs of $15/MWh, green hydrogen production costs would decline to $0.80/kgH2 to $1.00/kgH2 in 2050 (Mathis and Thornhill 2019).

2.4. Costs of Hydrogen Transportation and Storage

The costs of hydrogen production do not include the cost of delivery to the end user, which could be an expensive process, given that hydrogen is a gas with a very low density and boiling point. Currently, transportation and storage costs are not significant concerns for hydrogen since 85 percent of hydrogen is produced and consumed on-site (IEA 2019). However, if hydrogen is to expand beyond its present usage in specific industrial applications, transportation and storage costs will rise and could present a substantial barrier to hydrogen growth. Since our scope is hydrogen use in the power and industrial sectors, we do not discuss the infrastructure costs of hydrogen fueling stations or the costs to distribute hydrogen to such dispersed locations, both of which would be important for hydrogen vehicles. Additionally, with our focus on the United States, which has low-priced natural gas for blue hydrogen and areas with abundant sunshine or wind for green hydrogen, we consider shipping costs only in limited detail. The concern about minimizing combined production and transportation costs—at an international scale (e.g., shipping green hydrogen from solar- and wind-rich Australia to Japan) or for fueling stations (e.g., decentralized versus centralized green hydrogen production with the respective distribution costs)—has received considerable attention but is less relevant for the US power and industrial sectors. See IEA (2015), IEA (2019), IRENA (2019), and Hydrogen Council (2020) for further discussion.

2.4.1. Storage of Hydrogen

For blue hydrogen operating on the site of an industrial consumer, as is currently the case for most gray hydrogen, significant hydrogen storage may not be needed. There would, however, be a need for CO2 infrastructure. If blue hydrogen is produced onsite, it would require CO2 pipelines and storage, but not hydrogen pipelines and storage. If blue hydrogen is produced at a merchant plant, economies of scale would permit more uses of blue hydrogen (e.g., at smaller end-use facilities), but it would require both CO2 and hydrogen infrastructure. Conversely, if the timing of hydrogen production and consumption is not perfectly aligned (as would likely be the case for green hydrogen powered by intermittent renewable energy), storage is a necessary component of hydrogen infrastructure.

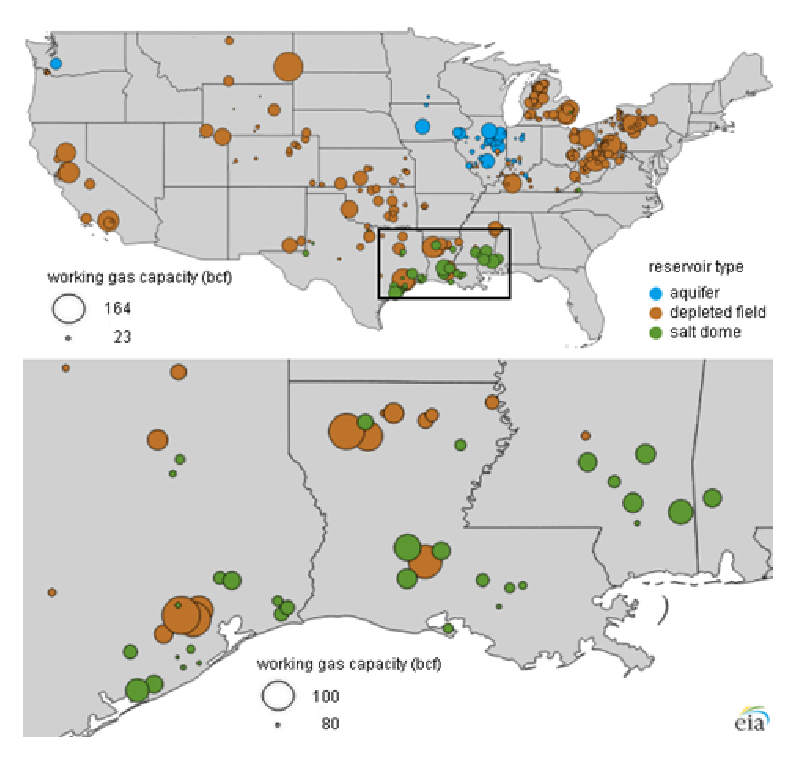

For storing large volumes of hydrogen over months, geological features are likely to provide storage at the lowest cost. Four specific geological options have been evaluated: salt caverns, depleted oil and gas fields, aquifers, and rock caverns. Salt caverns are the most mature, and likely the optimal, option for storing hydrogen. The primary advantages of salt cavern storage are its efficiency (only a small fraction of the hydrogen injected is unable to be extracted), lack of contaminants, and high operating pressure—allowing rapid discharge when hydrogen is needed (IEA 2019). In Texas, the Chevron Philips Clemens Terminal has stored hydrogen in a salt cavern since the 1980s (AIS Software 2017). More recently in Texas, Air Liquide commissioned the world’s largest hydrogen storage facility, capable of storing 30 days of production from an SMR plant (Air Liquide 2017).

The other three options—depleted reservoirs, aquifers, and rock caverns—entail likely disadvantages and greater uncertainties for storing pure hydrogen, although natural gas is stored extensively in depleted reservoirs and aquifers in the United States (EIA 2020d). Relative to salt caverns, the disadvantages of these options include more permeable formations (which reduce efficiency and operating pressure), greater contaminants (which could require costly removal on hydrogen discharge), and hydrogen reactivity with rocks, fluids, and microorganisms (which reduce efficiency and cause contamination). The motivation for exploring these options is to increase the space and range of hydrogen storage, since the availability of salt caverns is more geographically limited (BNEF 2020). Figure 10 shows US natural gas storage facilities, with salt domes concentrated in the Gulf Coast region and depleted gas fields more widespread. However, salt formations also occur in the Great Lakes, Western Plains, and Rocky Mountain regions (Casey 2009), suggesting that salt cavern storage for hydrogen could be developed beyond the Gulf Coast.

Figure 10. US Underground Natural Gas Storage Facilities, by Type

IEA (2015) evaluates the four options for geologic storage of hydrogen, finding salt caverns optimal, so long as they are geographically available. Depleted oil and gas reservoirs and aquifers are technically feasible but entail higher investment and operating costs. Rock caverns have greater technical uncertainty but with potentially lower investment and operating costs than aquifers and depleted reservoirs. BNEF (2020) finds similar cost trends, estimating benchmark storage costs of $0.23/kgH2 for salt caverns, $1.90/kgH2 for depleted gas fields, and $0.71/kgH2 for and rock caverns. Substantial cost reductions are possible, and they estimate possible future storage costs of $0.11/kgH2, $1.07/kgH2, and $0.23/kgH2 for salt caverns, depleted gas fields, and rock caverns, respectively.

2.4.2. Transportation of Hydrogen

Transporting a large quantity of hydrogen, a gas, at low cost requires pipelines, conversion to an alternative energy carrier, or liquefaction. Pipeline transport of pure hydrogen (we discuss blending with natural gas below) requires the construction of hydrogen pipelines or, potentially, the modification of existing natural gas pipelines no longer used for that purpose. Although geographically limited, hydrogen pipelines are currently in use in the United States, notably Air Liquide’s Gulf Coast Pipeline System, which connects hydrogen production and storage with industrial consumers (Air Liquide 2017).

Pipeline costs are characterized by high capital costs and low operating costs, such as for compression. Although hydrogen has a very low density, its rapid flow through pipes (almost three times faster than natural gas) lessens this disadvantage. IEA (2019) estimates hydrogen pipeline capital costs of $1.2 million/km and total transport costs of approximately $0.07/kgH2 for every 100 km. BNEF (2020) provides a similar estimate of pipeline transport costs of $0.10/kgH2 to $0.58/kgH2 for distances of 100 km to 1,000 km.

Transportation of hydrogen gas through pipelines entails costs that scale almost linearly with distance; an alternative approach is to convert hydrogen gas to a liquid carrier and transport it through pipeline or by ship at a lower cost per distance. Since this approach involves costly conversion steps, only for long distances will it be less expensive than hydrogen pipeline transmission. IEA (2019) estimates that for distances greater than 1,500 km, conversion to either ammonia or a liquid organic hydrogen carrier (LOHC), shipping, and reconversion to hydrogen would be lowest cost mode of transport. For example, given the distance between the Gulf Coast (with prime blue hydrogen resources) and the Northeast, ammonia or LOHC shipping could be most efficient. The transportation cost advantage would also shift toward the shipping of ammonia (but not LOHC) if ammonia could be used at the destination, thus eliminating the need for reconversion to hydrogen. Ammonia can also be transported in pipelines, at a lower cost per distance than hydrogen pipeline transport but a higher cost per distance than ammonia shipping. A final consideration is that the conversion and reconversion steps for ammonia or LOHCs are energy intensive, collectively consuming 20 to 40 percent of the hydrogen’s energy value (IEA 2019).

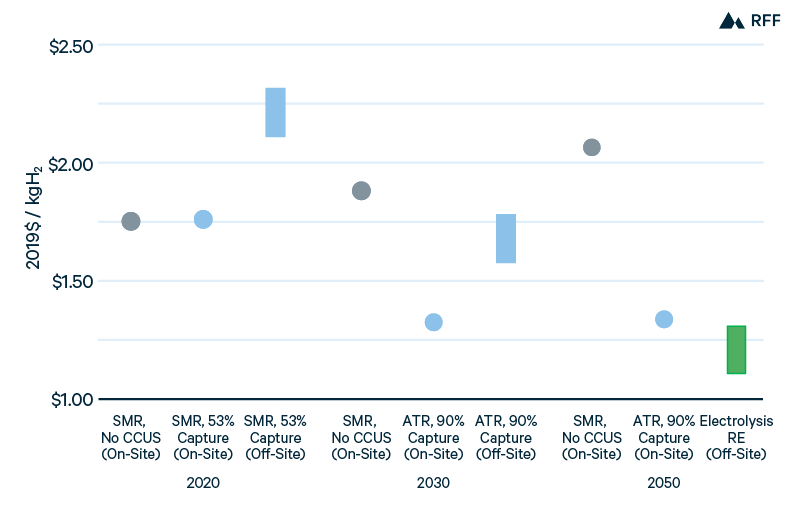

2.4.3. Total Hydrogen Supply Costs

Figure 11 takes the production costs from Figure 9 to illustrate how the costs of hydrogen storage and transportation could affect the choice of hydrogen production technology and location. The first category in each time period is SMR, produced at the end-use site (e.g., a refinery). The costs of on-site SMR increase from 2020 through 2050 as the social cost of carbon rises. The second category is the least-cost on-site decarbonized hydrogen method—SMR with 53 percent capture in 2020 and ATR with 90 percent capture in 2030 and 2050. Note that green hydrogen, produced from zero-carbon electricity that fluctuates in availability or price, would generally require storage and thus is not well suited to on-site production (unless salt cavern storage were available on site). The third category is the least-cost off-site decarbonized hydrogen method—SMR with 53 percent capture in 2020, ATR with 90 percent capture in 2030, and renewable energy electrolysis in 2050—and includes costs for salt cavern storage and pipeline transport between 100 km (low case) and 500 km (high case). Although this simple illustration makes strong assumptions (in particular, that end-use facilities have cost-effective access to CO2 pipelines necessary for on-site blue hydrogen), it shows that on-site blue hydrogen has a considerable advantage until green hydrogen production and salt cavern storage can achieve substantial cost reductions.

Figure 11. Total Costs of Hydrogen Supply

2.4.4. Reduction of Transportation and Storage Costs

Along with cost reductions in the hydrogen storage and transportation methods discussed above, two strategies have been proposed to lower the costs or reduce initial requirements of infrastructure: (i) blending hydrogen with natural gas to utilize existing natural gas infrastructure; and (ii) developing hydrogen infrastructure within a confined geographic scope.

2.4.4.1. Hydrogen Blending with Natural Gas

Blending hydrogen with natural gas has appeal because today’s extensive natural gas storage and pipeline infrastructure could allow the development of hydrogen to proceed before incurring the capital costs—and potentially lengthy timeline—of building a dedicated network. Therefore, blending with natural gas could enable the scaling up of hydrogen in various new applications before commitments to infrastructure are made for pure hydrogen. Nevertheless, there are limits to the proportion of hydrogen that may be blended with natural gas. In natural gas pipelines, blending limits can result from the lower energy density by volume of hydrogen and the potential for hydrogen to embrittle steel. On average, 10 to 20 percent hydrogen by volume is feasible without infrastructure modifications (IRENA 2019), Since the energy density by volume of hydrogen is about one-third that of natural gas, the energy share of hydrogen in a blend will be less than its volumetric share. but infrastructure components may vary widely in their tolerance for hydrogen. See IEA (2015) for a listing of transportation, storage, distribution, measurement, and appliance types and the and the percentages of hydrogen that may be blended without and with equipment modifications. A component of the natural gas network with a low tolerance for hydrogen could limit hydrogen blending throughout the network.

Industrial consumers of natural gas, for both feedstock and fuel, may have narrow specifications for the purity of the gas mixture, so hydrogen blending would be less suitable in these processes. Moreover, because the cost of separating hydrogen from a mixture with natural gas is prohibitive (IEA 2019), natural gas blending for the sake of pipeline utilization is not sensible unless the final consumer is amenable to a blend of natural gas and hydrogen. The power sector appears to be more flexible for natural gas blending, with recent gas turbines that are compatible with a sizable proportion of hydrogen. For example, modern gas turbines from Mitsubishi Hitachi Power System (MHPS) can use 30 percent hydrogen (MHPS 2019). Although outside the scope of this report, the retail natural gas sector (for commercial and residential customers) has also shown potential for hydrogen blending. For example, Hawaii Gas adds 12 percent hydrogen in its natural gas distribution on Oahu (MHPS 2019), and the Italian utility Snam is testing the blending of up to 10 percent hydrogen (Snam 2019).

2.4.4.2. Hydrogen Development Clusters

When dedicated hydrogen infrastructure is to be built, because either blending limits are exceeded or it is simply the less expensive option, transportation costs may be minimized by locating hydrogen production, demand, and storage in close proximity. In the United States, with low-cost natural gas and regions with excellent wind and solar resources, salt cavern storage may be the geographically limiting factor. As long as demand is also flexible with respect to location, clusters of hydrogen production and demand could be built around optimal storage. This is already the case for blue hydrogen in the Gulf Coast region, with access to natural gas for hydrogen production, salt cavern storage, and industrial customers. A cluster for US green hydrogen has also been proposed: the Mitsubishi project in Utah would utilize salt caverns to store the hydrogen produced, which would then provide fuel for nearby turbines and fuel cells (MHPS 2019). If the cost of power transmission is less than the cost of hydrogen transport, this type of cluster could be a model for green hydrogen in the power sector.

2.5. Conclusions about Hydrogen Supply

From the cost estimates in this chapter, blue hydrogen is a viable near-term option to replace gray hydrogen. Specifically, capturing CO2 from the process stream in SMR would be cost-effective at $50/tCO2—roughly equal to the 2020 global social cost of carbon in 2019$ (IWG 2016) and the tax credit available through 45Q—and thereby reduce the CO2 emissions footprint of hydrogen production by half. Given the expense and limited current extent of hydrogen infrastructure, either merchant blue hydrogen in an existing cluster (e.g., in the Gulf Coast region) or on-site blue hydrogen production (e.g., at a refinery or ammonia plant) would be the most feasible near-term options.

Development of CCUS technology and infrastructure would reduce both capital and operating costs of blue hydrogen, and a transition from SMR to ATR reactors could allow blue hydrogen with 90 percent capture to become the least expensive hydrogen production method (after accounting for carbon costs) for new facilities by 2030. Expanded hydrogen storage and pipelines and reduced infrastructure costs would enable more off-site hydrogen production to supply a broader set of end users. However, the high cost of transporting hydrogen over distances greater than a few hundred miles favors the use of hydrogen relatively close to its source of production.

In the longer term, from 2030 to 2050 and beyond, green hydrogen may become the most economic production process. The current planned and proposed green hydrogen plants suggest the industry’s optimism about the technology, and with increased scale, electrolyzer costs could decline rapidly, as current market research indicates (Mathis and Thornhill 2019). Moreover, further cost reductions in wind and solar power would reduce energy costs for green hydrogen, and an electricity grid dominated by intermittent renewables could have periods of low prices that grid-connected green hydrogen could make use of. Naturally, the longer term is subject to greater uncertainties in power prices, capital costs, and significant technological changes, all of which could affect the cost-effectiveness of decarbonized hydrogen supply.

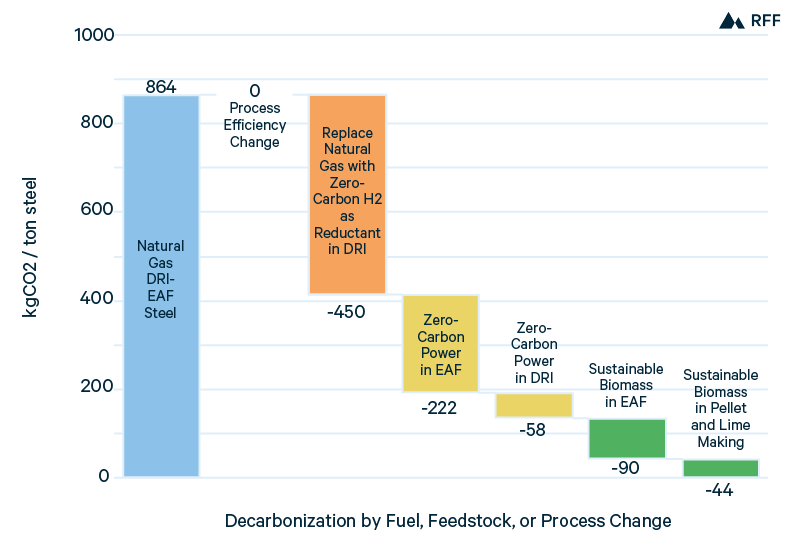

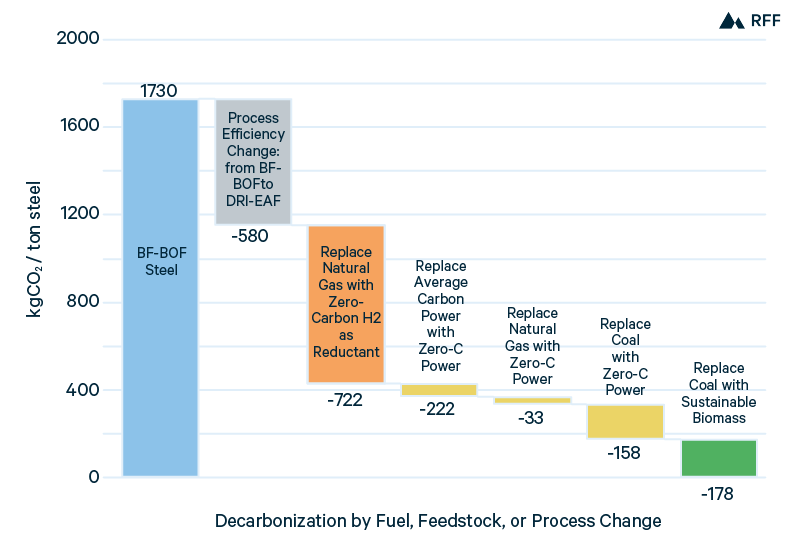

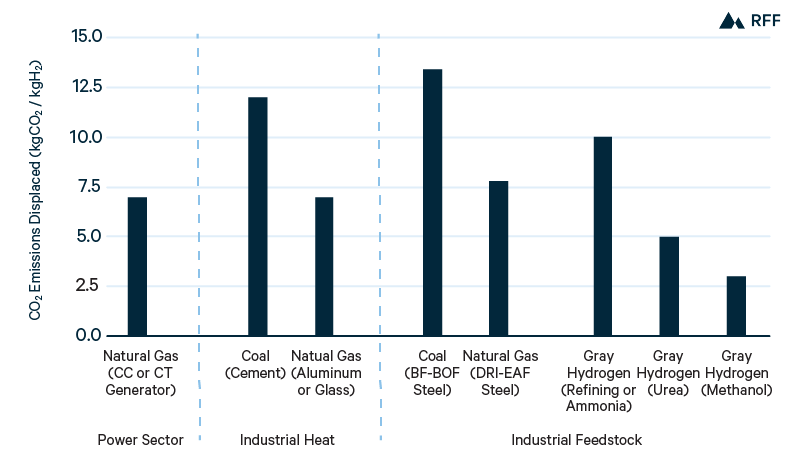

3. Uses of Decarbonized Hydrogen

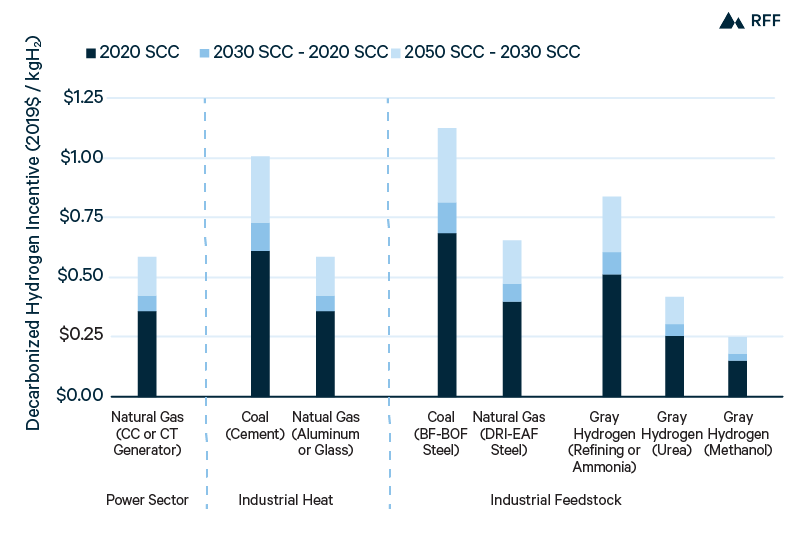

Below, in Sections 3.1, 3.2, and 3.3, we evaluate how decarbonized hydrogen may be used in the power sector and as a source of industrial heat and feedstock. Each section follows a general format. First, we provide an overview of how hydrogen could be used in the sector to reduce GHG emissions, covering important indirect benefits, such as supporting the feasibility of variable renewable energy. Second, we consider the processes (and their technical requirements) in which hydrogen could be utilized—in energy storage, industrial heat, or specific feedstock applications. This leads to a comparison of hydrogen with the high-emitting methods that currently predominate, as well as with low-emitting alternatives to hydrogen (such as CCUS or low-carbon power). We then assess the cost-effectiveness of decarbonized hydrogen from its value as a fuel or feedstock and the emissions that it would displace. Next, we gauge the prospects for blue and green hydrogen in these applications. Natural gas is often the incumbent energy source, and CCUS is a versatile method for reducing emissions, so it is important to understand how blue hydrogen compares with CCUS at the power or industrial plant. Finally, we measure the appropriate incentive for decarbonized hydrogen based on the emissions it would displace, and we offer conclusions on the timing and scale of decarbonized hydrogen usage in the sector.

3.1. Hydrogen in the Power Sector

3.1.1. Overview

The opportunity for decarbonized hydrogen in the power sector is to provide electricity that is responsive to demand (known as dispatchability) and has low carbon emissions. Of the primary sources of low-carbon power, only hydropower is dispatchable. Natural gas power with CCUS, still nascent on the US grid, is also dispatchable and with low emissions. As we discuss later, natural gas power with CCUS is the primary low-carbon alternative to hydrogen-fired power.

The other main US low-carbon technologies are either intermittent, such as wind or solar, or operate without flexibility to demand, like nuclear. Although this is the case in the United States, nuclear power plants in France operate to follow electricity demand. Such load-following nuclear power plants are necessary for a grid in which nuclear power supplies a large majority of electricity. As the share of power supply from intermittent renewable sources increases, the need for dispatchable electricity to meet demand rises. For example, the Sustainable Development Scenario of the World Energy Outlook projects that renewable sources would supply 67 percent of electricity in 2040, and wind and solar together would account for a majority of renewable power (IEA 2020a). The high proportion of intermittent power implies periods of both surplus (power supply in excess of demand) and deficit (power supply less than demand)—unless there is sufficient storage or dispatchable generation. Decarbonized hydrogen has the potential to prevent deficits with dispatchable power, and grid-connected green hydrogen, specifically, may also exploit surpluses or inexpensive carbon-free power. Therefore, grid-connected green hydrogen is a form of energy storage, in which electrical energy is converted to chemical energy and then reconverted when demanded. Because of its potential as energy storage, we focus primarily on grid-connected green hydrogen. However, at the end of this section, we consider blue hydrogen and green hydrogen from dedicated power sources, both of which can provide low-carbon dispatchable power (but not energy storage).

The extent of power surpluses and deficits, and thus the opportunity for hydrogen, clearly depends on the share of wind and solar power, but two other factors are significant. First, if wind and solar power have a low correlation with each other, a combination of wind and solar will be able to meet a greater proportion of demand. For instance, where wind is stronger at night (as in California), wind and solar power will be more complementary. Second, if the combination of wind and solar power has a high correlation with demand, there will be less need for storage or dispatchable generation. Since hydrogen is most competitive in storage over weeks and months, we do not discuss demand-side technologies and strategies that can make demand more flexible over short time periods (e.g., to be coincident with solar generation). These two factors vary considerably by geography. At the high latitudes of Europe, solar generation is 60 percent lower in winter than in summer, but electricity demand in winter is 40 percent higher (Hydrogen Council 2017). Therefore, at a high share of wind and solar generation, a large amount of green hydrogen to provide interseasonal energy storage may be optimal in a low-carbon electricity mix. Hydrogen Council (2017) surveys four studies of European power supply, which find that at variable renewable energy shares of 60 to 100 percent of electricity demand, 4 to 20 percent of power generation should be used for hydrogen production. The studies vary in their approaches (e.g., modeling the least-cost option to achieve 2°C scenario versus a specified share of renewable energy) and sectors included (e.g., economy-wide versus power sector only) but the general conclusions are consistent—a high percentage of variable renewable energy in Europe is only practical with interseasonal energy storage.

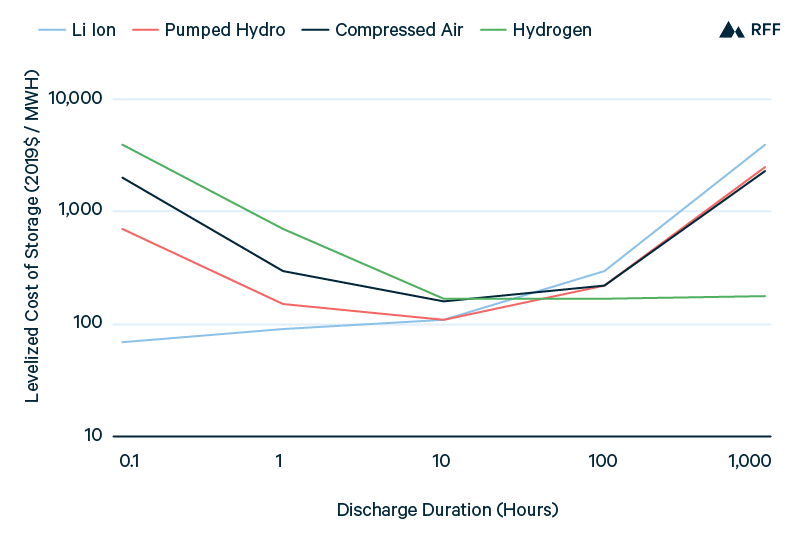

With rising shares of intermittent generation, the potential for storage arises for various durations, from voltage and frequency regulation over seconds to the interseasonal storage discussed above. The diurnal variation in solar output creates a large opportunity for storage over several hours, since midday solar energy could be stored for use during the evening or even nighttime. However, hydrogen storage is a multistep process that is not well suited to quick cycles or cost-effective for short durations. Compared with battery, pumped hydropower, and compressed air storage, a majority of the electricity used in hydrogen production is lost when it is returned as power. The round-trip energy efficiencies are >90 percent for lithium ion batteries, 70 percent for longer-duration flow batteries, 80 percent for pumped hydropower, and 60 percent for compressed air storage (IRENA 2017). In contrast, electrolysis has an efficiency of 60 to 70 percent (depending on the electrolyzer technology), 5 to 10 percent of the energy is lost in compression for storage and transportation, and combustion turbine and combined-cycle (CC) plants have respective efficiencies of 40 and 60 percent (IEA 2019, 2015). Thus, hydrogen storage has a round-trip efficiency of 20 to 40 percent, depending on technology choices and compression requirements.

At sufficiently long discharge durations, hydrogen overcomes its energy efficiency disadvantage relative to battery, pumped hydropower, and compressed air storage. Although substantial energy is lost in the conversion to hydrogen and reconversion to power, hydrogen itself can be stored over time (e.g., in salt caverns) at far less cost per unit of energy than for the other storage technologies. Figure 12 illustrates the IEA (2019) analysis of the levelized cost of storage as a function of discharge duration, finding that hydrogen is the least expensive storage option for discharge durations longer than one to two days. Whereas the costs of battery, pumped hydropower, and compressed air storage increase rapidly from day-long discharge to week-long or month-long discharge, the cost of hydrogen storage is minimally affected by these differences in discharge duration.

Figure 12. Storage Costs and Discharge Duration

3.1.2. Cost Analysis for Hydrogen in the Power Sector

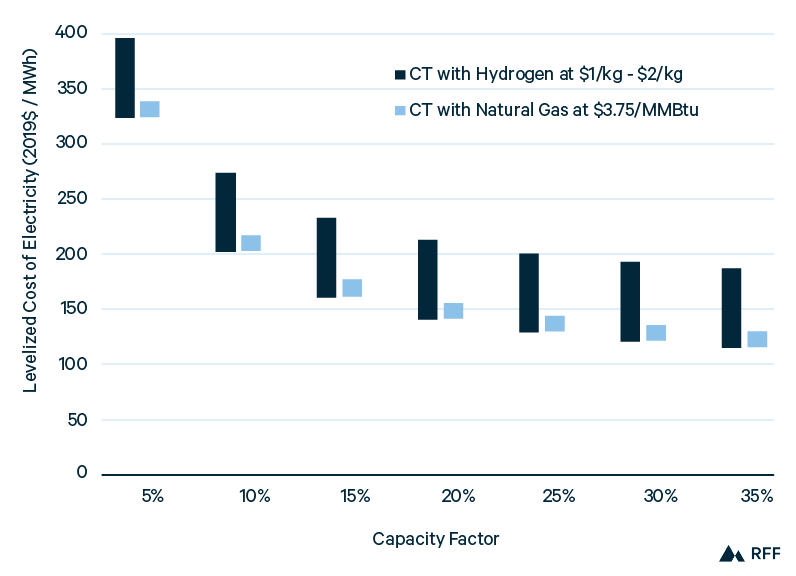

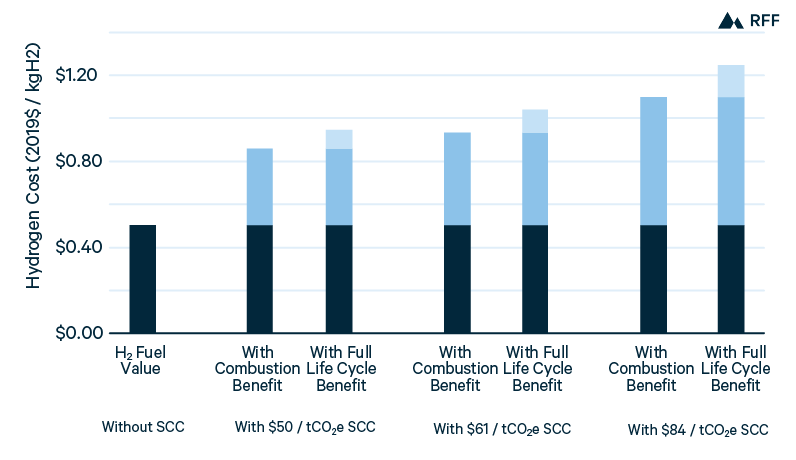

As a form of chemical energy, with its advantage of low-cost, long-duration storage, hydrogen is more comparable to natural gas than to battery, pumped hydropower, or compressed air storage. Furthermore, hydrogen—like natural gas—may be used in a combustion turbine (CT) for flexible generation or in a CC plant for longer-duration power supply. Indeed, hydrogen may also be blended with natural gas in either CT or CC power plants. In this section, we analyze the costs of hydrogen versus natural gas power in dedicated CT and CC plants, as well as the costs of hydrogen blended with natural gas. Power cost (in $/MWh) is the levelized cost of electricity (LCOE) to account for a plant’s capital and operating costs as well as its utilization. LCOE is calculated as the ratio of the present value of total costs to the present value of electricity generation. Because hydrogen does not emit CO2 on combustion, we assume that natural gas power incurs the SCC for its greenhouse gas emissions (of CO2 and methane) to provide a fair comparison of total electricity costs. However, we do not include the costs of conventional air pollutants (SO2, NOX, PM2.5, and PM10), which vary by location within the United States and are typically more modest than the costs of greenhouse emissions of natural gas (however, in areas with stringent pollution controls, such as Los Angeles, PM2.5 emissions would incur substantial costs). The combustion of hydrogen may also cause NOX emissions, but the magnitude is uncertain. In the CC case, we include the option of natural gas with 90 percent CO2 capture, which appears to be a viable choice for low-carbon natural gas power. Given the lower capacity factor of CT plants, carbon capture is not considered in that case. As shown in Figure 14, a high capacity factor is needed to amortize the increased capital costs for power plants with carbon capture. Lastly, although fuel cells are potential generators using either natural gas or hydrogen, we do not include them because high capital costs make them less competitive than CC plants (Lazard 2018).

Figure 13 shows the power costs of CT plants using hydrogen or natural gas as a function of plant capacity factor. CT power plants, though less efficient than CC plants, have the ability to ramp generation up and down quickly in response to demand, and thus provide valuable flexibility. Hydrogen, at least at the low end of its range, is competitive with natural gas power. However, the cost-effectiveness of hydrogen rests on several optimistic assumptions, which we make throughout this analysis. First, the range of hydrogen costs considered is $1.00/kgH2 to $2.00/kgH2; even the high end of this range (which is uncompetitive with natural gas) is below the midpoint projection of $2.15/kgH2 for green hydrogen production in 2030 (Figure 9). For hydrogen power costs to equal the high end of natural gas power costs in Figure 13, the cost of hydrogen would have to be about $1.25/kgH2. Furthermore, the fuel cost to the power plant is the delivered cost of natural gas or hydrogen and thus is inclusive of storage and transportation costs. With its mature infrastructure and greater volumetric energy density, natural gas storage and transportation costs are relatively inexpensive—about $0.50/MMBtu. Calculated as the approximate difference between the natural gas electric power price (see https://www.eia.gov/dnav/ng/ng_pri_sum_a_EPG0_PEU_DMcf_a.htm) and the Henry Hub natural gas price (EIA 2020b) since 2016. For hydrogen (from Figure 11), even with salt cavern storage and a pipeline distance of just 100 km, storage and transportation would cost approximately $0.33/kgH2 in 2020 and $0.21 in 2050 (equal to $2.50/MMBtu and $1.50/MMBtu, respectively). Therefore, to be competitive with natural gas in CT plants, hydrogen production costs would need to decline below $1.00/kg, an optimistic scenario even in 2050.

Figure 13. Combustion Turbine Power Costs for Hydrogen and Natural Gas, without CO2 Capture

The second key assumption is a comprehensive climate policy for natural gas power, with all greenhouse gas emissions priced at the global SCC. Emissions include the CO2 from natural gas combustion as well as noncombustion emissions from both the natural gas fuel cycle (energy consumed in natural gas production, processing, and transmission) and methane leaks in the supply chain (NREL 2012; Rhodes et al. 2016). For LCOE calculations, we assume that methane has a GWP of 30. Over a 100-year period, the GWP for methane is between 28 and 36 (EPA 2020). With an SCC of $61/tonCO2-eq in 2030 (the low case) and $84/tonCO2-eq in 2050 (the high case), From IWG (2016), inflated from 2007$ to 2019$. greenhouse gas emissions add $39/MWh to $54/MWh to power costs for CT with natural gas. Noncombustion emissions account for about $8/MWh to $11/MWh, so without a price on these emissions, hydrogen costs would need to decline by an additional $0.11/kgH2 to $0.15/kgH2 to be competitive. Conversely, we assume that hydrogen-based CT power incurs no greenhouse gas charges at the plant level, Blue hydrogen, of course, would be charged for uncaptured emissions. which may be too optimistic an assumption. Although hydrogen combustion has no climate impact, hydrogen itself is an indirect greenhouse gas with a GWP of 5 (Derwent et al. 2020). Therefore, leaks in hydrogen infrastructure would cause an external cost, albeit a much smaller one per MMBtu of hydrogen than per MMBtu of methane. Compared with methane, H2 has not only a lower GWP (5 versus 30) but also a higher energy density by mass (142MJ/kg versus 56MJ/kg), so a lower mass of hydrogen is needed for the same energy content. Given the limited scale of dedicated hydrogen infrastructure, the leakage rate for hydrogen is unclear, so we do not estimate a leakage cost for hydrogen power.

Other assumptions include equivalent heating efficiencies and equivalent turbine costs and performances for hydrogen and natural gas. Hydrogen may incur a slightly greater loss in heating efficiency compared with natural gas. Hydrogen has a 15 percent difference between its lower heating value (LHV) and higher heating value (HHV), compared with 10 percent for natural gas, because a greater mass of water is produced per kgH2 than per kgCH4. The difference between HHV and LHV reflects the heat required to vaporize water, which may not be recovered. As for turbines, MHPS (2019) asserts that modern turbines could be upgraded from natural gas to hydrogen with modest modifications, but validation of a turbine using 100 percent hydrogen is not planned until 2025, so there may be some differences in cost and performance.

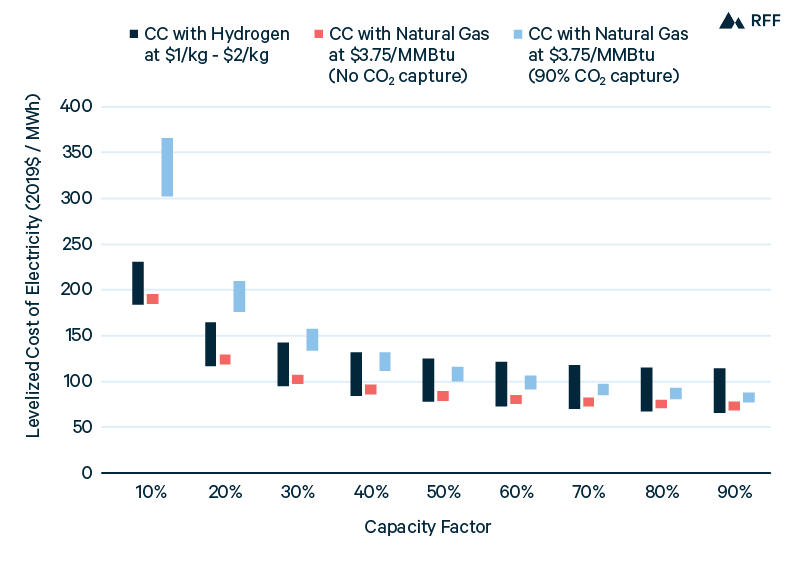

Figure 14 presents the power costs from using hydrogen or natural gas in a CC power plant. Although CC plants lack the fast ramping ability of CT plants, power costs are significantly lower: the addition of the steam turbine increases fuel efficiency by about 50 percent with a comparatively small percentage increase in the capital cost per MW (NREL 2019). Therefore, CC plants are utilized more consistently to supply power. For example, in 2019, the average capacity factors for CCNG and CTNG power plants were 57 percent and 11 percent, respectively (see https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_6_07_a). Comparing CC using hydrogen (CCH2) with CC using natural gas (CCNG) without CO2 capture, CCH2 is competitive only with hydrogen costs below $1.25/kgH2. This result is almost identical to what is shown for CT plants in Figure 13. The relative benefit to hydrogen of a lower fuel cost per MWh is offset by the lower emissions costs per MWh for natural gas in CC versus CT power plants. Significantly, the assumptions discussed above—the low delivered costs of hydrogen, comprehensive carbon pricing, and equivalent cost and efficiency of power plants using hydrogen versus natural gas—apply to this analysis as well.

Figure 14. Combined-Cycle Power Costs for Hydrogen and Natural Gas, with and without CO2 Capture

The important difference between Figures 13 and 14 is the potential for CCNG with 90 percent CO2 capture. The cost of CCNG with carbon capture is expected to decline over time, so we model a high-end capital cost of $2,200/kW (the 2020 cost from NREL 2019) and a low-end capital cost of $1,700/kW (the 2050 cost from NREL 2019). Having higher capital costs than CC plants without capture and lower variable costs—through lower fuel costs than CCH2 and lower emissions costs than CCNG without capture—the capacity factor has a greater effect on the power costs of CCNG with CO2 capture. From Figure 14, only at a 90 percent capacity factor is the inclusion of carbon capture potentially cost-effective for CCNG power plants.

A significant reason for the less favorable economics of CCNG with capture is that these plants still incur between $11/MWh and $15/MWh in greenhouse gas costs, respectively assuming either the 2030 SCC or the 2050 SCC. Although 90 percent of CO2 from combustion is captured, noncombustion emissions from the natural gas fuel cycle and methane leakage are not reduced. Indeed, noncombustion emissions are slightly higher for CCNG plants with CO2 capture than without capture because of their increased natural gas consumption. NREL (2012) and Rhodes et al. (2016) assume national averages for fuel cycle emissions and leakage rates; more efficient production, processing, and transmission of natural gas and reduced methane leaks would improve the cost-effectiveness of CO2 capture for CCNG plants. Additionally, the cost of CCNG plants with CO2 capture may decline more than anticipated, and new technologies, such as the Allam Cycle currently under demonstration in a 50MW power plant in Texas, offer alternative pathways to natural gas power with carbon capture (NET Power 2020). Without reduced methane emissions or CCUS costs, CCNG without capture—using either low-cost hydrogen (less than $1.25/kgH2) or natural gas—will be the most economic option for dispatchable power through 2050.

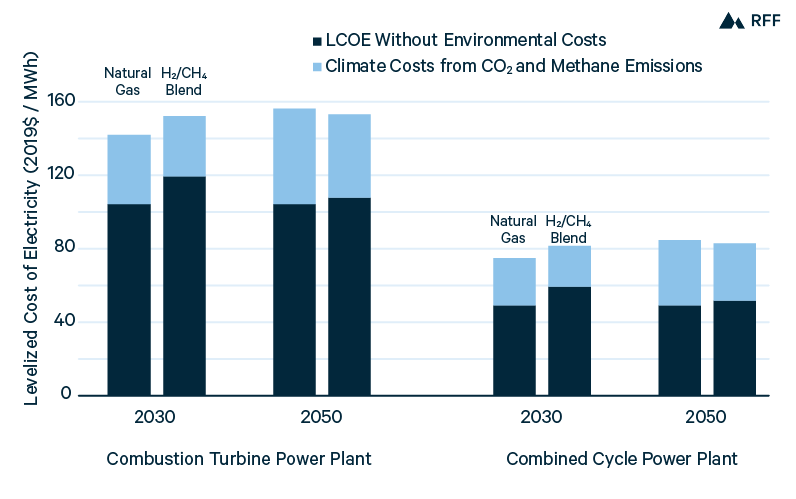

As we discussed in Section 2.4, blending hydrogen with natural gas is feasible in the power sector and could allow hydrogen to gradually scale before dedicated infrastructure is built. Figure 15 compares the power costs from a hydrogen and natural gas blend with the power costs from natural gas alone, in both CT and CC plants. We assume a blend of 30 percent hydrogen by volume—consistent with the tolerance of modern gas turbines (MHPS 2019)—which is equal to 12.5 percent hydrogen by energy content, given the lower volumetric energy density of H2. Figure 15 presents costs with an illustrative capacity factor for CT and CC plants of 20 and 60 percent, respectively, but since plant costs and efficiencies are assumed to be equal for hydrogen blend and natural gas generators, the capacity factor does not affect differences in power costs.

Figure 15. Combustion Turbine and Combined-Cycle Power Costs with Natural Gas and H2–CH4 Blend

Assumes capital costs and capacity factors of $800/kW and 20 percent, respectively, for CT plants, and $900/kW and 60 percent, respectively, for CC plants. Fixed and variable operation and maintenance costs are from NREL (2019). 2030 and 2050 hydrogen costs of $2.15/kg and $0.90/kg, respectively, are converted with an energy density of 0.134MMBtu/kg. Natural gas cost of $3.75/MMBtu is based on an average Henry Hub price from 2020 to 2050 of $3.25/MMBtu, from EIA (2020a), and a transportation cost of $0.50/MMBtu. Assumes no environmental costs other than from CO2 and CH4.